American Express Membership Rewards Credit Card, or Amex MRCC, is an entry-level offering from Amex India. For referral applications, the first year is free and the annual fee is reduced to Rs 1500. However, don’t let the entry-level tag mislead you. Amex MRCC can be more rewarding than some premium credit cards if used properly. Spending Rs 20000 in a calendar month can earn us 2000 bonus MR points, making it one of the easiest ways to earn MR points. As part of the Amex MRCC, we also get access to the Gold Collection for redemption, where we can get Amazon Pay vouchers and Tanishq gift cards.

Eligibility

Unlike other credit card issuers, Amex has some of the simplest eligibility criteria for its credit cards. To apply for Amex MRCC we need:

- CIBIL Score: 750+

- Annual Income: Rs 6 Lakh+

Fees

| Joining Fee | Zero (FYF with referral) |

| Welcome Benefit | 4000 Membership Reward(MR) points |

| Annual Fee | Rs 1500+GST (with referral) |

| Annual Fee Waiver | Fully waived if annual spending > Rs 1.5 Lakh 50% waived if annual spending > Rs 90K and < Rs 1.5 Lakh |

| Renewal Benefit | 5000 MR points if annual fee is charged |

Regular Rewards

| Spend Category | Rewards |

|---|---|

| Retail Spends | 1 MR point/Rs 50 ~0.8% to 1.2% |

| Fuel, Utilities, Insurance & EMI | No Rewards |

Spending in excluded categories like fuel and insurance counts for bonus MR points and annual spend waivers. Amex is one of the last few credit card issuers to provide rewards for digital wallets. We can load Paytm/Mobikwik wallet and use it for fuel, insurance and utility transactions. This way we can earn regular rewards for these transactions.

Bonus Membership Rewards

The base reward rate might seem low for Amex MRCC but we have milestone rewards like other Amex cards. These are what we have to target to get a high reward rate.

| Milestone | Bonus MR Points | Enrollment |

|---|---|---|

| Rs 1500 X 4 transactions in calendar month | 1000 | Not Required |

| Spend Rs 20,000 in a calendar month | 1000 | Required |

Amex MRCC gets 2X on Reward Multiplier

- Standard Reward Rate: 1 MR point/Rs 50 ~0.8% to 1.2%

- 2X Reward Rate: 2 MR points/Rs 50 ~1.6% to 2.4%

Maximizing the American Express Membership Rewards Credit Card

The bonus membership rewards are what make the MRCC a good rewarding card. We need to spend Rs 1.5 Lakhs in a year to get the annual fee waiver. Below is how we can plan our spending to get maximum rewards.

- We use the 1000 bonus MR points on 4 X Rs 1500 transactions every month for 12 months

- We use the 1000 Bonus MR points on spending Rs 20000 in a month for 6 months in a year

| Transactions | Bonus MR Points/Month | Regular MR Points/Month | Total Spend/Year | Total MR Points/Year |

|---|---|---|---|---|

| Make 4 X Rs 1500 transactions every month | 1000 | 120 | Rs 72000 | 13440 |

| Spend Rs 14000 every month for 6 months | 1000 | 280 | Rs 84000 | 7680 |

- Total Spend: Rs 1.56 Lakhs

- Total MR Points: 21120

- If we value each MR point at 40 paise, this is a return of Rs 8448 ~5.4%!

- Spend on Amex Reward Multiplier, use RM offers and you will have an even higher return. Not many entry-level cards will give you a return of 5.4% on just Rs 1.56 Lakhs spend!

No Airport Lounge Access

There is no complimentary airport lounge access on the American Express Membership Rewards credit card.

- Domestic Airport Lounge Access: Not Available

- International Airport Lounge Access: Not Available

Fuel Surcharge Waiver

Amex MRCC gets a 0% convenience fee for HPCL fuel pumps. This is valid for all transactions of value less than Rs 5000. So, you can potentially use your Amex MRCC at HPCL fuel pumps to hit the milestone. You will not get regular MR points but you will get the milestone bonus MR points.

Other Benefits & Charges

- Fuel Surcharge Waiver: Not available except at HP fuel pumps

- Foreign Currency Markup: 3.5%+GST ~4.13%

18 and 24 Carat Gold Collection for Amex MRCC

For the American Express Membership Rewards credit card, one of the best options is to redeem for the 18/24 Carat Gold Collection rewards. These offer you a good value for your membership reward points if you do not want to do a points transfer.

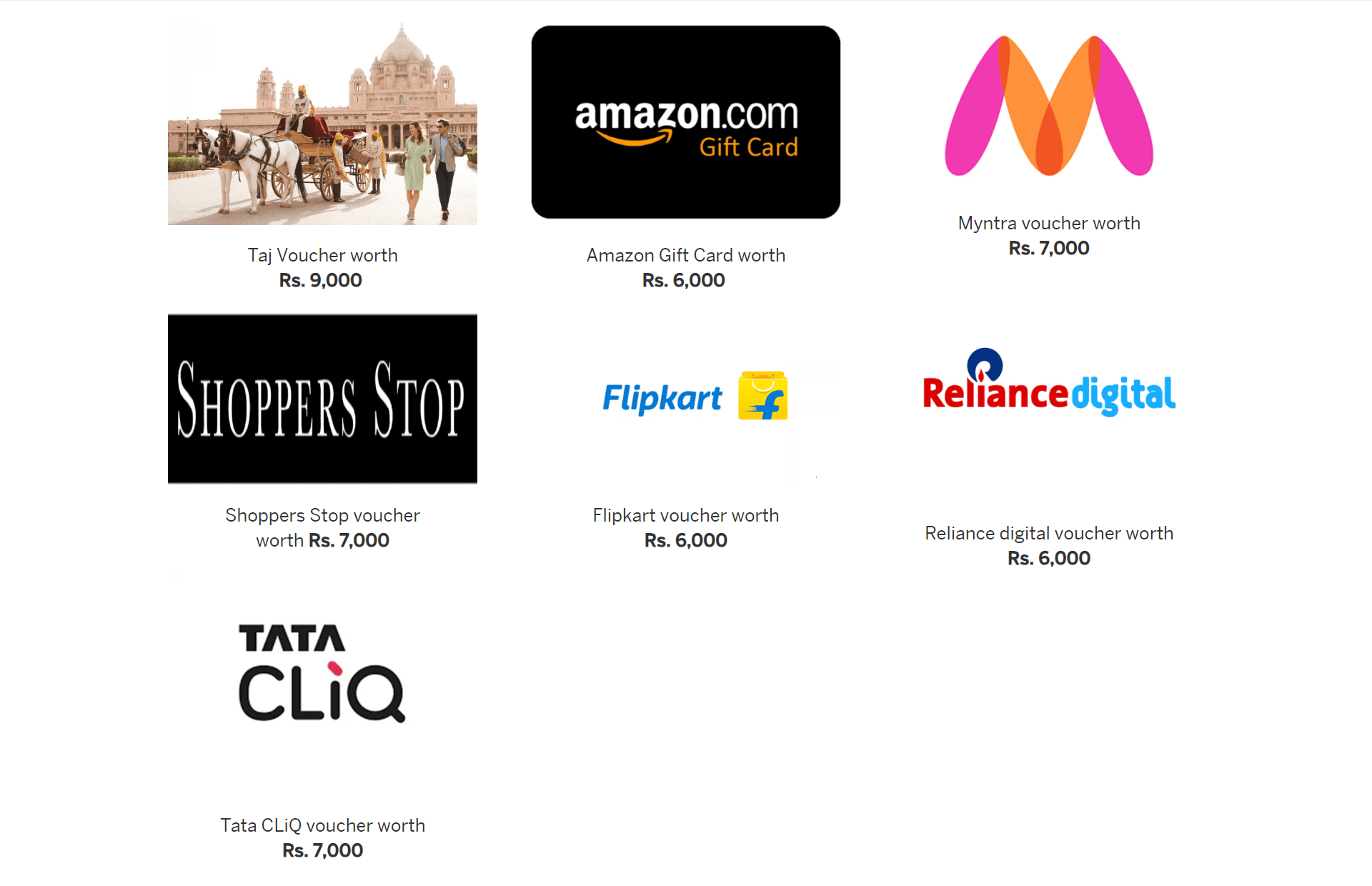

American Express Gold Collection: 18K MR points

The 18K Gold collection offers you access to Amazon Pay, Flipkart, Myntra, Shoppers Stop, Reliance Digital, Tata CLiQ and Taj Hotels stay vouchers. If we go purely by value per MR point, then Taj Hotels is your best bet. But, you also have multiple options if you do not want to do a travel redemption.

| E-Voucher | Value | 1 MR Point Value |

|---|---|---|

| Amazon | ₹ 6000 | 33p |

| Flipkart | ₹ 6000 | 33p |

| Reliance Digital | ₹ 6000 | 33p |

| Myntra | ₹ 7000 | 39p |

| Shoppers Stop | ₹ 7000 | 39p |

| Tata CLiQ | ₹ 7000 | 39p |

| Taj | ₹ 9000 | 50p |

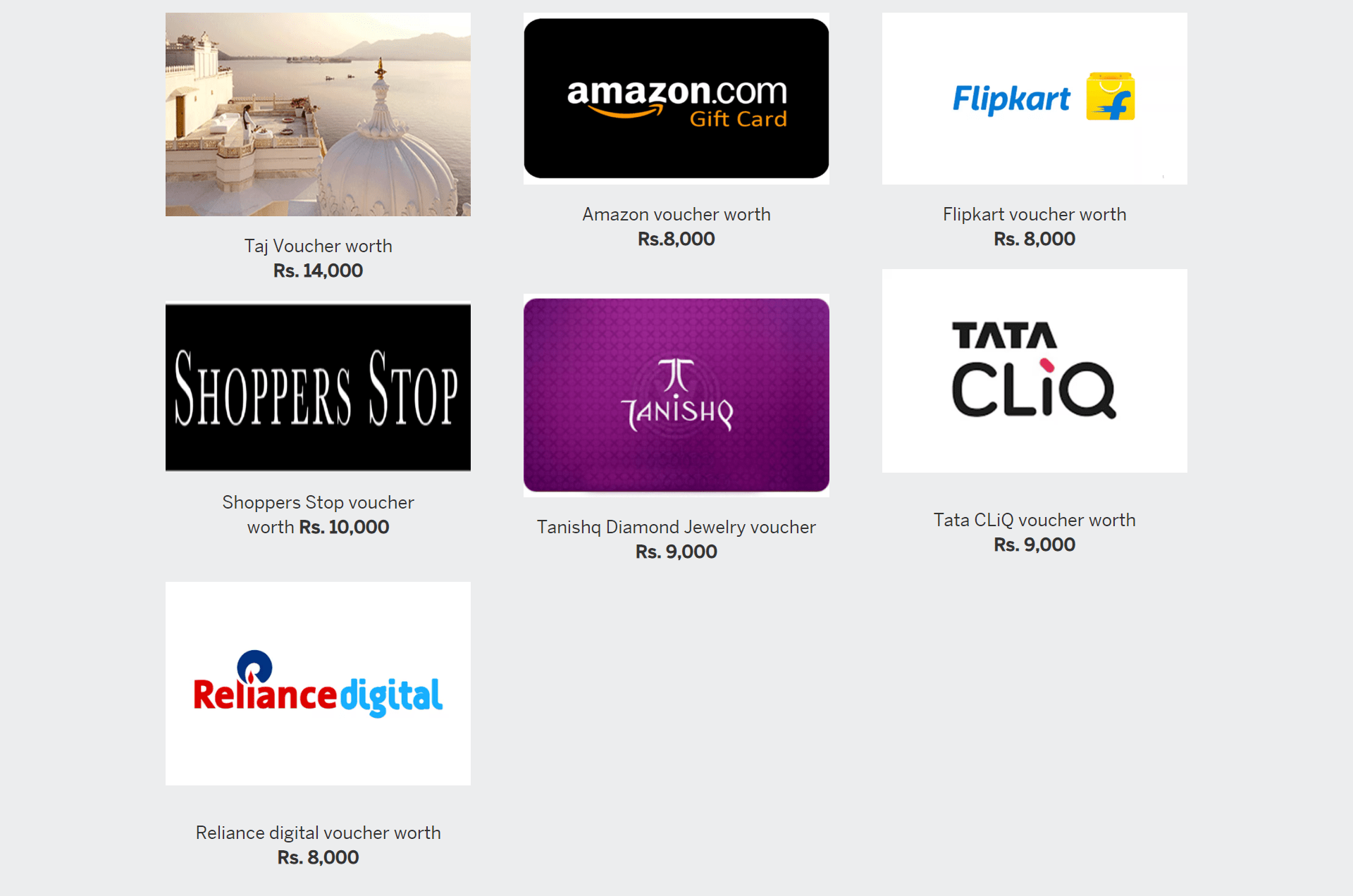

American Express Gold Collection: 24K MR points

The 24K Gold collection offers you access to Amazon Pay, Flipkart, Shoppers Stop, Taj Hotels and Tanishq Diamond Jewellery gift vouchers. If we go purely by value per MR point, then again Taj Hotels is your best bet. The 24K Gold collection gives you access to few more non-travel redemptions. Tanishq Diamond Jewellery stands out in this with a marginally higher value per MR point.

| E-Voucher | Value | MR Point Value |

|---|---|---|

| Amazon | ₹ 8000 | 33p |

| Flipkart | ₹ 8000 | 33p |

| Reliance Digital | ₹ 8000 | 33p |

| Tanishq Diamond Jewellery | ₹ 9000 | 38p |

| Tata CLiQ | ₹ 9000 | 38p |

| Shoppers Stop | ₹ 10000 | 42p |

| Taj | ₹ 14000 | 58p |

Catalog Redemption Options – Better to Avoid

The Gold Collection is delayed gratification for rewards redemption as it requires accumulating MR points over several months. There are multiple other options for redeeming the MR points on Amex MRCC on the go. These include electronics, luxury and lifestyle products, fashion accessories, and instant gift vouchers for various brands. We can even pay for transactions using MR points. The MR point value in these options is around 25p per point. But, better to avoid all these options.

Transfer to Airlines/Hotel Loyalty Programs

Amex MR points are also one of the most versatile ones when it comes to using them for airline and hotel loyalty programs. We get multiple transfer partners.

| Partner | Conversion Rate |

|---|---|

| Asia Miles | 800 Points = 400 Asia Miles |

| Club Vistara | 900 Points = 300 Club Vistara Points |

| Emirates Skywards | 800 Points = 400 Emirates Skywards Miles |

| Etihad Guest | 1600 Points = 800 Etihad Guest Miles |

| Hilton Honors | 1000 Points = 900 Hilton Honors Points |

| Marriott Bonvoy | 100 Points = 100 Marriott Bonvoy Points |

| Qatar Privilege Club | 500 Points = 250 Avios |

| Singapore KrisFlyer | 800 Points = 400 KrisFlyer Miles |

| Virgin Atlantic Flying Club | 800 Points = 400 Virgin Points |

Round-the-Year Annual Offers

The rewards above are not all the American Express Membership Rewards Credit Card offers. Around the year, Amex also runs various promotional offers which end up giving a higher reward rate.

For example, since I got this card I got a Flipkart shopping offer that gave me 10% cashback up to Rs 2500, and an Amazon shopping offer that gave 10% cashback up to Rs 2000. These offers also help in meeting the annual spending required for this card.

American Express Membership Rewards Credit Card

Card Maven

21 thoughts on “American Express Membership Rewards Credit Card”

If I load Amazon pay four times, each more than 1500, will it count for 4x transactions for monthly bonus of 1000 MR points?

Yes, it will

Can rent payments be included in Milestones or for bonus RP.? Can this be LFT after using it for few months? If yes then this is good or PLATINUM travel

1. All transactions are eligible for milestone/bonus RP.

2. No, LTF is not possible.

3. Platinum Travel is also good if you can spend 4L in a year.

I am very much interested in getting this card but two things are stopping me and would like your inputs on them –

1. I heard most places do not accept Amex due to high fee. How bad is this?

2. I read at few places that recently wallet loads have been restricted (due to regulations? ) which makes it impossible to use the wallet load route as well. Is this true?

I do not want to end up with a card which I can’t use. (I currently use Amazon Pay ICICI card as most of my online purchases ate on Amazon)

1. It depends on where you purchase. But yes, offline acceptability is an issue in local stores. It works fine in branded chain retail outlets.

2. Most wallets will now charge you around 2.5% convenience fee for using Amex.

You can still get MRCC and buy Amazon Pay GV from Reward Multiplier to get bonus MR points.

Got rejected for Amex MRCC

Axis ace – 4 lakhs limit

HDFC regalia – 8 lakhs limit

Sbi cashback – 2 lakhs limit

Cibil is 797

Any reason why?

If you are in a serviceable area with valid address proof, then email them and ask for the reason.

If we can then how much in ₹ can we load in payzapp wallet in a month and year if any limit?

Is there any other wallet like Mobikwik, for Amex transaction?

No such limit. You can use any of the wallets like Freecharge, Mobikwik, Paytm etc.

No such limit. You can use any of the wallets like Freecharge, Mobikwik, Paytm, etc.

Your calculation for Tanishq is incorrect. MR point value comes out to be 0.41. Big basket voucher offers a better return than Tanishq

Thank you for highlighting this. Fixed it now.

BB has a lot more card offers than Tanishq. So, we can still consider Tanishq to provide a better value.

can this card be used for rent payment on cred and do we get points /rewards for same ? since same is not possible for utility/insurance as per restriction on this card

Amex cards cannot be used for rent payment on CRED.

If we can then how much in ₹ can we load in payzapp wallet in a month and year if any limit, kindly let me know.

Worth it for 4500? just incase no referrals.

– If waived off, no issues. But just incase if we have to pay the fee (worst case).

I would suggest to wait for the referrals to start.

MR points got any validity? Do they expire after an year or so?

Amex membership points doesn’t expire. They have lifetime validity

Hello I want Amex mrcc credit card but my itr is 4.90 lakh only last but credit history and score is good enough in one score app my cibil is 778 I never missed any payment in last 5 years all my credit cards how to get it plz help….