In 2020, the Axis Bank Ace credit card set a new standard for cashback credit cards in India. With it, you could earn 2% cashback on any offline/online purchases and 5% cashback on utility bills. Four years later, Axis Bank’s latest devaluation has changed its core benefit – 2% cashback. Are the rewards and benefits still worth it for the Axis Bank Ace credit card? Let’s find out.

Fees

| Joining Fee | Rs 499+GST |

| Joining Fee Waiver | Spend Rs 10,000 within 45 days |

| Annual Fee | Rs 499+GST |

| Annual Fee Waiver | Spend Rs 2 Lakh in a membership year |

Unlike other Axis Bank credit cards, there is no restriction on spends eligible for annual fee waiver on Ace.

Axis Bank Ace Credit Card Cashback

| Type of Spend | Cashback |

|---|---|

| Bill Payments on Google Pay Electricity, Internet, Gas, DTH, and Mobile Recharges | 5% |

| Swiggy, Zomato, and Ola | 4% |

| All other spends* | 1.5% |

| EMI, Fuel, Wallet, Rent, Gold/Jewellery, Insurance, Education, Govt. Services | No Cashback |

| Utility spends outside Google Pay | No Cashback |

The 5% and 4% cashback are now capped at Rs 500 per statement cycle. This has a major for many who were paying utility bills on Google Pay. So, Ace will now give you 5% cashback on only Rs 10000 worth of bill payments with Google Pay. This is still good enough for a small family but would make it not so useful for someone with higher utility bills as electricity bills tend to climb in summers.

Most other offline and online spends get 1.5% cashback. There is no cap on this as of now but there is a growing list of spends where we do not get cashback. These categories are listed above.

Rewards Redemption

The good thing about Axis Ace is there is no action required for rewards redemption. Cashback earned during a billing cycle is credited 3 days before the next statement generation date. A 1.5% monthly cashback credit is always better than accumulating rewards for bulk redemption.

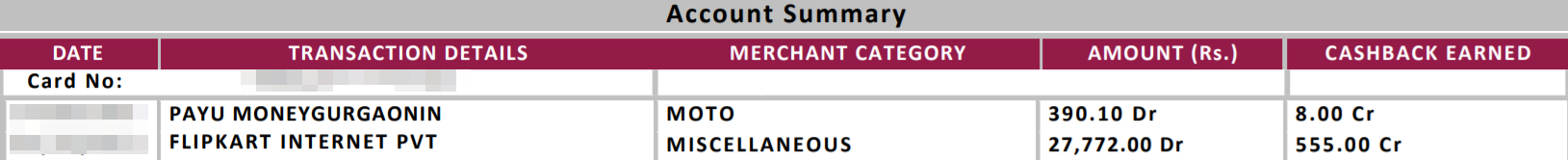

Axis Ace statement shows the merchant category and cashback for each transaction. This is something we like. We do hope every card issuer starts doing the same. It saves so much effort in the manual calculation and you know where to spend/where not to spend to get 1.5% cashback.

Complimentary Airport Lounge Access

- Airport Lounge Access in India: 4 visits/year

- Airport Lounge Access outside India: Not Available

Axis Bank Ace credit card offers 4 complimentary airport lounge visits in India per calendar year. So, if you are an occasional domestic traveller this card can help you with lounge access. The list of participating lounges is limited to a few cities – Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, and Pune. The details are available over here.

Axis Bank Ace credit card now has a minimum spends requirement to get complimentary airport lounge access. We now need spends of Rs 50,000 over a rolling period of last 3 calendar months to get complimentary airport lounge access. For example, if you need to access the airport lounge on 10th of March, then you should have spent Rs 50,000 in the period from 1st of December to 28th of February.

Other Key Benefits and Charges

- Foreign Currency Markup: 3.5%+GST ~4.13%

- Cashback Redemption Fee: None

- Finance Charges: 3.6% per month or 52.86% per annum

- Fuel Surcharge Waiver: 1% waiver for transactions between Rs 400 to Rs 4000. Maximum surcharge waiver of Rs 500 per statement cycle.

Pros and Cons

Pros

- 1.5% cashback on daily spends

- 5% cashback on Google Pay bill payments

- Automatic cashback redemption

- Complimentary domestic airport lounge access

Cons

- 4% and 5% cashback have a very low cap of Rs 500 per statement cycle

- iOS users miss out on 5% cashback with Google Pay

- No cashback on common spends like fuel, insurance, and wallet spend

Final Thoughts

Any credit card that offers benefits worth more than the fee it charges is always a good addition to the wallet. Axis Ace credit card ticks several of the boxes with low fees, good cashback, and an easy fee waiver criteria. The latest devaluation has brought down the cashback for offline spends to 1.5%. But, if you are planning to use the Ace credit card for both bill payments and offline spends then it is still a good option.

Some other good cashback credit cards that you can explore are the Freecharge Axis Bank credit card, SBI Cashback and Airtel Axis Bank credit card.

Axis Bank Ace Credit Card

Card Maven

Frequently Asked Questions

Currently, the Axis Bank credit card is being issued only by Google Pay on an invite-only basis. You can also apply it on the Axis Bank mobile app if you have a pre-qualified offer.

We have compared both the cards and their rewards/benefits in this article. This will help you decide which card is better for your requirements.

Yes, we get 4 complimentary visits to airport lounges in India every calendar year. Access is by Visa to this list of lounges.

The forex mark-up is 3.5%. So, the card is not suitable for international transactions even with the 2% cashback.

Yes, we have a 1% surcharge waiver for transactions between Rs 400 and Rs 4000. The maximum benefit is Rs 500 per statement cycle.

19 thoughts on “Axis Bank Ace Credit Card”

Is this card still being issued? Tried applying for it online and on the app but there is no option to select this card. All other cards are available

Yes, but only if you have a pre-approved offer in your Google Pay app.

For the reversals of joining fee they are asking to spend atleast 10,000rs with in 45days. Does this mean it includes rent payments as well. I couldn’t find a concrete statement to support this. Do give me information if anyone has done it.

No T&C as of now excluding rent payments as eligible spends for joining fee reversal

Does this card offers cash back on paying school fees and Govt Property taxes? MCC Codes – 9399 & 8299

Yes, these categories are not excluded as of now.

Hello! If i make annual payments for a savings and investment plan, Kotak Fortune Maximiser to be specific, is the cashback applicable?

That will be difficult to know but my guess is no. They should be using a MCC that will fall under 1% category.

I am planning to use this card for business. If I make a payment to a merchant and pay the credit card in the same day will I get the 2% cashback?

Yes, but too much usage will get tagged as business usage. THey block the card in such cases.

but, you have mentioned in the Rewards Redemption section that the cashback will be credited 3 days before the next statement generation date, How will I get the cashback if I pay the credit card back in the same day, Can you please explain?

Cashback will get credited based on transactions(net of refunds). Payments don’t have an impact.

Can you recommend some good business credit cards

Sorry, not much idea about business credit cards

Cashback is based on the transaction

Has Axis Bank stopped issuing ACE credit card? Card application link on Axis Bank’s website offers several other cards apart from AXE. How does one apply for Axis Bank ACE credit card?

Yes, Axis Ace credit card is not being issued for now.

Which is the best card between Axis Bank Ace vs HDFC Bank Infinia Credit Card

Rahul – It depends on how you want to redeem your rewards. Are you looking to redeem rewards only for cashback/statement credit/Amazon vouchers or you will redeem them for travel as well?