The Reserve credit card is a unique offering from Axis Bank. While it has decent rewards and benefits, it is also the card having the highest annual fee. At Rs 50000 plus taxes, it is close to the annual fee of the Amex Platinum Charge Card. But is it worth paying such a high charge for the Reserve? Here is a review of the Axis Bank Reserve credit card to help you decide.

Fees and Charges

| Joining/Renewal Fee | Rs 50000 plus taxes ~Rs 59000 |

| Welcome/Renewal Benefit | 50000 EDGE Reward Points ~Rs 10000 |

| Renewal Fee Waiver | Spend Rs 25 Lakhs in a membership year |

The welcome/renewal benefit of 50K EDGE RP is less for a card that charges Rs 59000 as an annual fee including taxes. This should be raised to at least 1 Lakh EDGE RP which will give a value of Rs 20000. Or, Axis Bank can also opt to reduce the annual fee.

Rewards

- Domestic Spends: 15 EDGE Reward Points/Rs 200 ~1.5% Return

- International Spends: 30 EDGE Reward Points/Rs 200 ~3% Return

With the 1.77% markup(including GST), the effective return on international transactions is 1.23%. This is a good value if someone has high international spending.

Travel Benefits

While the rewards are on the lower side for a card with such a high annual fee, we do get good travel benefits. The luxury airport transfer services are the USP of this card. We can get the rest of the features with Magnus and Infinia.

- Airport Concierge Services: 8 complimentary VIP assistance services/year

- Luxury Airport Transfers: 4 complimentary airport pickups/drops every year

- Airport Lounge Access: Unlimited complimentary visits to domestic and international airport lounges for both primary and add-on cardholders. We get 12 complimentary visits for guests as well. Domestic access is via Visa/Mastercard and international access is with Priority Pass.

Lifestyle and Dining Benefits

These benefits are renewed every year as long as the Reserve is active. If you want to extract maximum benefit out of Reserve, these need to add value for you in your current lifestyle.

- Club ITC Culinaire Membership with 1 third night free stay, 1 room upgrade, 2 certificates for 20% savings on F&B bills, and some more certificates.

- Accor Plus Membership and associated benefits

- Club Marriott Asia Pacific Membership with F&B and accommodation certificates.

- Oberoi Hotels and Resorts offer to get 15% off best rates, 50% off on suites, and complimentary room upgrade

- 15% savings at Postcard hotels on best available rates.

- EazyDiner Prime membership

- Buy one and get one free till Rs 500 on BookMyShow up to 5 times/month

- This is the USP of this card if you missed the card image. 🙂 We get 50 complimentary golf rounds/year.

Rewards Redemption

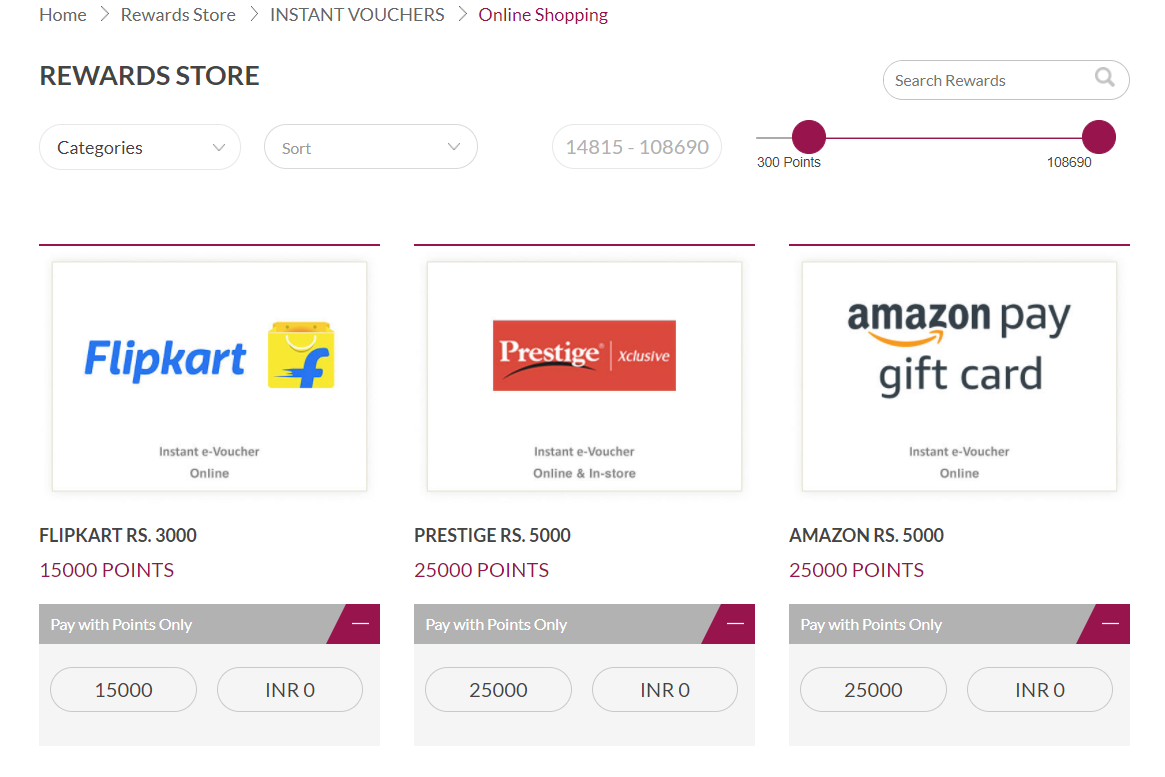

The rewards can be redeemed from the Axis Bank EDGE Rewards Portal. Each EDGE Reward Point is worth Rs 20 paise for all redemption options. We have Amazon and Flipkart gift vouchers for redemption as well.

My View

You will have a hard time extracting value out of the Reserve card even if you are able to maximize all the benefits. For Reserve, it is almost like we have to use up all benefits to get value for the fees we pay.

Leaving the above statements aside, do consider the Reserve in one case. If all the benefits and features complement your current lifestyle, then take it. Check the card for the first year and take a call after that. Do a value check for the Rs 59000 in total that you will have to pay for the joining fees.

Frequently Asked Questions

No, rent and wallet spends will not count as eligible spends for annual fee waiver calculation.

Axis Bank Reserve Credit Card

CardMaven