Do you often book flights on domestic routes that Vistara operates on? Then, Vistara co-branded credit cards can be a quicker way to earn miles and free tickets. Axis and Vistara have three credit cards that offer complimentary tickets and CV points. The Axis Bank Vistara Infinite credit card is the top variant with a joining and annual fee of Rs 10000. We get a business class ticket in lieu of both the joining and annual fee.

Fees

| Joining Fee | Rs 10,000+GST ~Rs 11,800 |

| Welcome Benefit | 1 Complimentary Business Class Ticket |

| Activation Benefit | 10,000 CV points for Rs 1 Lakh spend in the first 90 days |

| Annual Fee | Rs 10,000+GST ~Rs 11,800 |

| Annual Fee Waiver | None |

| Renewal Benefit | 1 Complimentary Premium Economy Ticket |

| Club Vistara Status | Gold (only for the first year) |

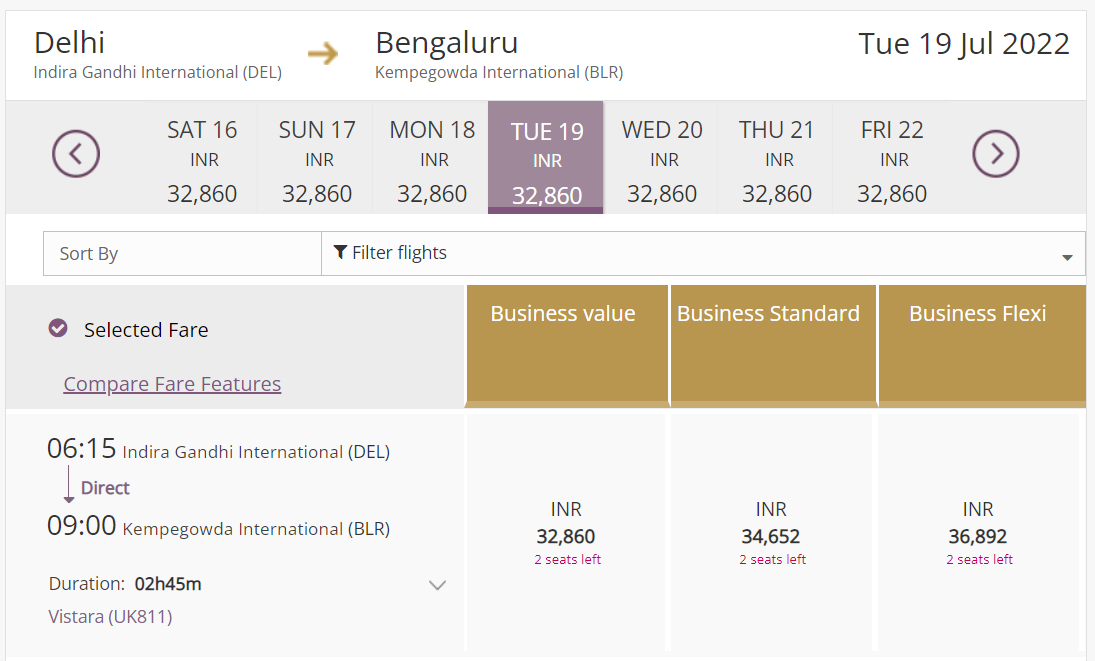

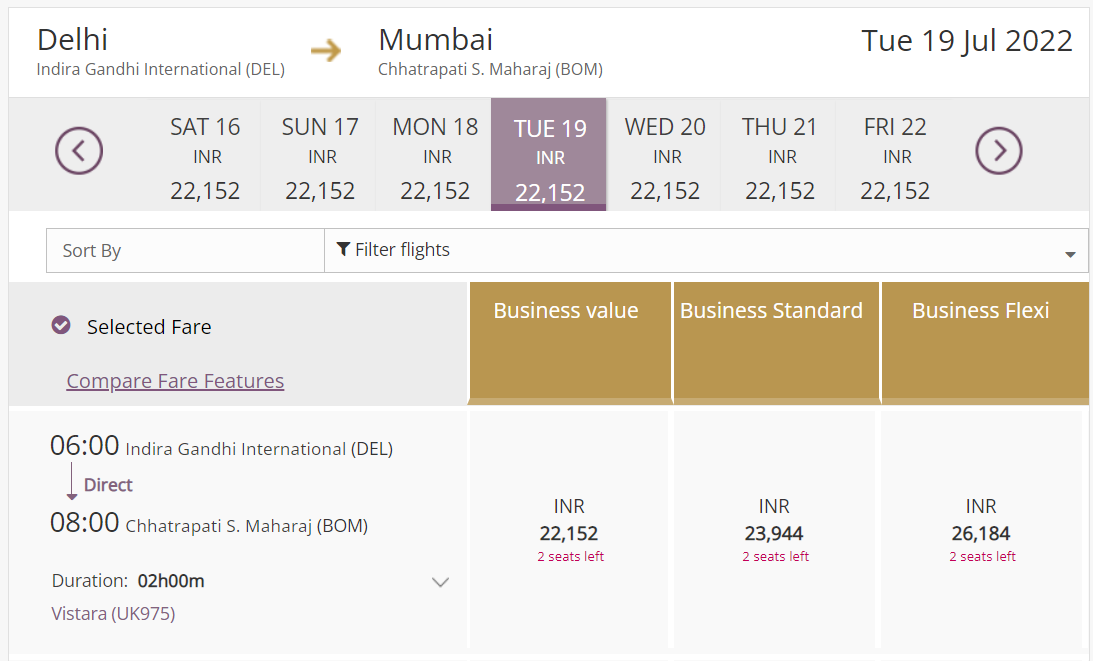

A business class ticket on Vistara is priced in the range of 25K – 35K for routes like DEL-BLR or DEL-BOM. It can be in the range of 15K-20K for shorter routes like DEL-IXC. So, the value of the complimentary business class ticket is more than the joining/annual fee. If we can use it for a busy route, we can even get 3 times the fee we pay.

Rewards

| Spend Type | Rewards |

|---|---|

| Retail Spends | 6 CV points/Rs 200 ~2.4% Return |

| Fuel, Wallet, Rental, Insurance, Gold/Jewellery, Govt. Services, Utilities | No CV points |

| Vistara Spends (Gold Status Benefit) | 10 CV points/Rs 100 |

We have valued each CV point at 80 paise. The actual value may be more or less than that depending on the availability of award tickets and corresponding revenue prices. The list of spends where the Axis Vistara Infinite credit card does not get CV points keeps growing with utilities, insurance and government payments being the latest exclusions.

Milestone Rewards

The main feature of all Vistara co-branded cards is the milestone benefit. We get 4 business class tickets on spending Rs 12 Lakh in a year. The value of these premium economy tickets increases when we are booking closer to the travel date.

Spends Excluded from Milestone Benefits for Axis Bank Vistara Infinite Credit Card

| Milestone | Target Spend | Benefit |

|---|---|---|

| 1 | Rs 2.5 Lakh | 1 Business Class Ticket |

| 2 | Rs 5 Lakh | 1 Business Class Ticket |

| 3 | Rs 7.5 Lakh | 1 Business Class Ticket |

| 4 | Rs 12 Lakh | 1 Business Class Ticket |

Return on Spend

The price at which we can value the complimentary business class tickets depends on the route. We searched for two routes DEL-BLR and DEL-BOM to arrive at an approximate value.

- Average cost of business class ticket: Rs 25000

- Average cost of redemption for taxes and surcharges: Rs 3500

- Value of each complimentary business class ticket: Rs 21500

It is always possible to get a better value for the business class tickets. So we get CV points worth Rs 28,800 and 4 Business Class tickets worth Rs 86,000. This is a return of Rs 1,14,800 or 9.5% on Rs 12 Lakh spend. That is pretty good for a travel card but the question to ask here is are you really going to fly in business class on a domestic route. If yes, then this is a good card.

Complimentary Airport Lounge Access

- Airport Lounge Access in India: 8 visits/year

- Airport Lounge Access outside India: Not Available

Axis Bank Vistara Infinite credit card offers 8 complimentary airport lounge visits in India per calendar year. So, if you are an occasional domestic traveller this card can help you with lounge access. The list of participating lounges is limited to a few cities – Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, and Pune. The details are available over here.

We also have a minimum spends requirement to get complimentary airport lounge access. We now need spends of Rs 50,000 over a rolling period of last 3 calendar months to get complimentary airport lounge access. For example, if you need to access the airport lounge on 10th of March, then you should have spent Rs 50,000 in the period from 1st of December to 28th of February.

Club Vistara Gold Membership and Benefits

The Axis Bank Vistara Infinite credit card comes with complimentary Gold status for Club Vistara. Here are some of the benefits that come with Gold Tier. The statis is valid only for the first year and will be re-evaluated in the second year as per the status criteria from Vistara.

- Earn 10 CV points/Rs 100 on Vistara spends

- Guaranteed Reservation in Economy Class if requested 48 priors to departure

- Extra 10 kg check-in baggage

- 3 class upgrade vouchers on Tier Renewal

EazyDiner Offer on Axis Bank Vistara Infinite Credit Card

The Axis Bank Vistara Infinite credit card also gets access to the Dining Delights offers with EazyDiner.

- Get 40% off up to Rs 1000 at EazyDiner partner restaurants

- Valid once per card per month

Other Benefits & Charges

- Fuel Surcharge Waiver: 1% waiver up to Rs 400 per statement cycle for transactions of value Rs 400 to Rs 4000

- Foreign Currency Markup: 3.5%+GST ~4.13%

- Interest Charges: 3.6% per month or 52.86% annually

- Golf Benefits: 6 complimentary rounds per year

Final Thoughts

Vistara flies very limited routes in India. So, the Vistara co-branded cards make sense only if you reside in one of those cities. If you reside in one of the hub cities like Delhi, this card can offer good value with all those milestone benefits. The 9.5% return on the card sounds great but only if you are interested in flying business class. You pay Rs 10000 and also get a business class ticket even on renewal. So, you are still getting a benefit without the need to make any spends.

If you are interested in a Vistara credit card, also have a look at the Club Vistara IDFC First credit card. It does not have any exclusions on the milestone benefits and that makes it easy to get the milestone benefits.

Frequently Asked Questions

Fuel, Wallet, Rental, Government, Insurance, Gold/Jewellery and Utilities are not considered as eligible spends for CV points. Wallet, Rental, Government and Utility are not considered as eligible spends for milestone benefits.

Yes, we get 2 complimentary visits per quarter to airport lounges in India.

No, there is no limit on that.

Axis Bank Vistara Infinite Credit Card

Card Maven

16 thoughts on “Axis Bank Vistara Infinite Credit Card”

Once the spend milestone is hit, how long does it take for the vouchers to be issued?

2-3 days

when do you get the business class voucher, after joining, is the upgrade voucher avialable on getting the gold membership or after 1 year of renewal?

You get it after you pay the joining fee. The upgrade voucher will also be available when you get the Gold membership.

Does this card qualify for the grabdeals or edge gyftr or travel edge accelerated points.

No, as this does not get EDGE Rewards. But, few did try and got GrabDeals cashback even though it is excluded as per T&C. Not sure if the bug is fixed now.

The Rewards are great but the Axis Bank customer service is exceptionally pathetic if you are used to American Express, SBI and HDFC. Please beware that there are multiple followups needed with this product and customer care is not very supportive.

Is the voucher applicable for the full trip including connecting flights? Eg. Delhi to Port Blair (via Kolkata)

If it is two different flights, then you need two vouchers.

Vistara Axis cards currently have a first-year free offer. Do rental payments qualify for the milestone spend?

Yes, they are eligible.

if i spend 2.5L every year, i get 2 Business class ticket worth 45000 + 6000 Rs (from 7500 CV).

Its a great deal even if we pay 11.8k as renewal fee.

Return is ~14.8%

Yes, the renewal fee is also well compensated with the complimentary ticket.

Can ticket be booked for any passenger? For example 2 business class ticket booking 1 for self and 1 for father ?

Yes, you can add nominees and book tickets for them.

Looks like fuel transactions do not qualify for CV points. From Axis Vistara Infinite T&Cs: “No CV Points are credited for fuel transactions on Axis Bank Vistara Infinite Credit Card.”