Easy is one of the basic entry-level credit cards from the Bank of Baroda. It is available in both Visa and Rupay variants. While the rewards are not that great, you can get the Easy credit card to avail of merchant offers from BoB. Here is a review of the BoB Easy credit card.

Fees and Charges

| Joining Fee | |

| Joining Fee Waiver | Spend Rs 6000 within 60 days for fee reversal |

| Annual Fee | |

| Annual Fee Waiver | Spend Rs 35000 in a year |

Rewards

BoB Easy offers reward points as per the spend category. Departmental stores and movie spending get an accelerated earning rate.

- Departmental Stores and Movie Spends: 5 RP/Rs 100 ~1.25% return

- Special MCCs: 0.5 RP/Rs 100 ~0.125% return

- All other spends except Fuel: 1 RP/Rs 100 ~0.25% return

The accelerated rewards for departmental stores and movie spending are capped at 1000 RP per calendar month. The reward points can be redeemed for a statement credit at 1 RP = 25 paise. So, this card is as good as a cashback card. There are no redemption charges as well.

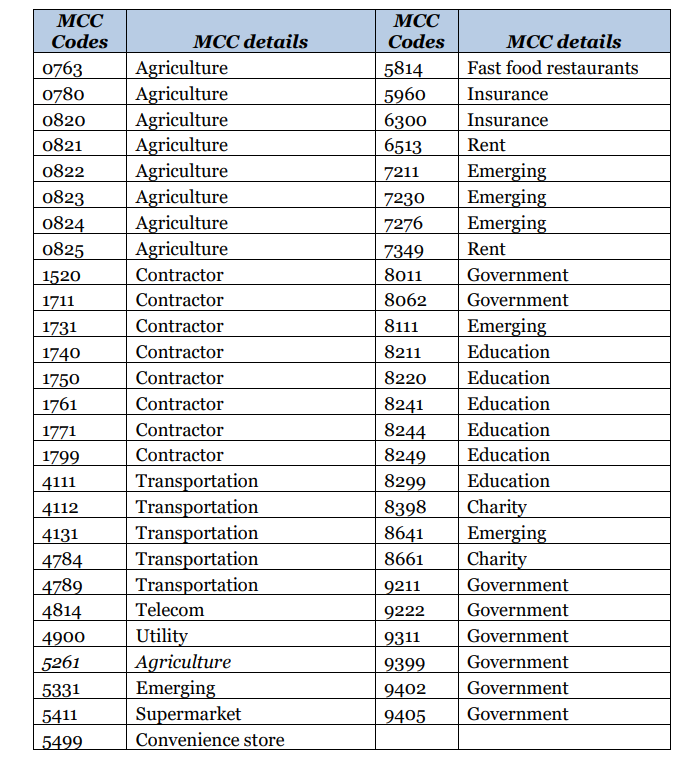

The special MCCs where we get lesser reward points include some high-spending categories like Rent, Insurance, Utilities, and Government Transactions. The below screenshot has the complete list.

Other Relevant Points

- Foreign Currency Transactions Markup: 3.5% plus GST

- Charges on Rent Payment: 1% of the amount plus GST

- Fuel Surcharge Waiver: 1% on transactions between Rs 400 and Rs 5,000 (Max. Rs. 250 per statement cycle)

Should you get the BoB Easy credit card?

The 0.25% reward rate on online spending is a little too less with all the amazing credit cards on the market today. BoB regularly brings 10% discount offers on Amazon, Cred, etc. So, you can get this, Select or Premier to take advantage of these offers.

There are many credit cards that offer better cashback rewards today. Some of them are SBI Cashback, Axis Ace, and HDFC Millennia.