Vistara has a new partner for its co-branded credit cards – IndusInd Bank. For a frequent traveler, Vistara co-branded cards can be a great way to earn CV points and free flights. This is why one should have at least one Vistara co-branded card if you prefer Vistara airlines. But is the new Vistara IndusInd Explorer credit card better than the other ones from Axis/SBI? Here is a review of the Club Vistara IndusInd Bank Explorer credit card with its rewards and benefits.

Fees and Charges

IndusInd Bank always charges a high joining fee for its super-premium cards. The good thing is it provides good welcome benefits against the fee. The Club Vistara Explorer card also follows the same.

| Joining Fee | Rs 40000 plus taxes ~ Rs 47200 |

| Welcome Benefit | 1 Business Class Ticket Voucher PLUS 1 Oberoi Hotels Voucher OR 25K Vouchagram Vouchers |

| Club Vistara Membership | Complimentary Club Vistara Gold Tier membership only for the first year. |

| Annual Fee | Rs 10000 plus taxes ~Rs 11800 |

| Renewal Benefit | 1 Business Class Ticket Voucher |

The credit card looks very expensive from a fee perspective. More so, for a Visa Signature variant. The 1-night stay at Oberoi hotels will be of a higher value than 25K for some locations. 🙂 The options include the Vanyavilas Ranthambore which goes for more than Rs 45000. Another option is Amarvilas Agra, which is marked for Rs 30000.

Rewards

| Spend Category | Rewards |

|---|---|

| Vistara Spends | 8 CV Points / Rs 200 |

| Hotels/Airline/Travel | 6 CV Points / 200 |

| Utility, Insurance, Government Payment, Fuel | 1 CV Point / Rs 200 |

| Club Vistara Points on all other spends | 2 CV Points / Rs 200 |

The CV points earn rate is too low for the utilities and other spending categories. This limits the ability to accumulate CV points. For the same spend on the Axis Vistara Infinite card, we get 6 CV points per Rs 200. This is also a category where most will have high spending.

Milestone Rewards

We get a business class ticket voucher for every 3 Lakhs spent on this card. This goes on until a total spend of Rs 15 Lakhs. So, we get a total of 5 business class ticket vouchers on spending Rs 15 Lakhs.

Return on Spend

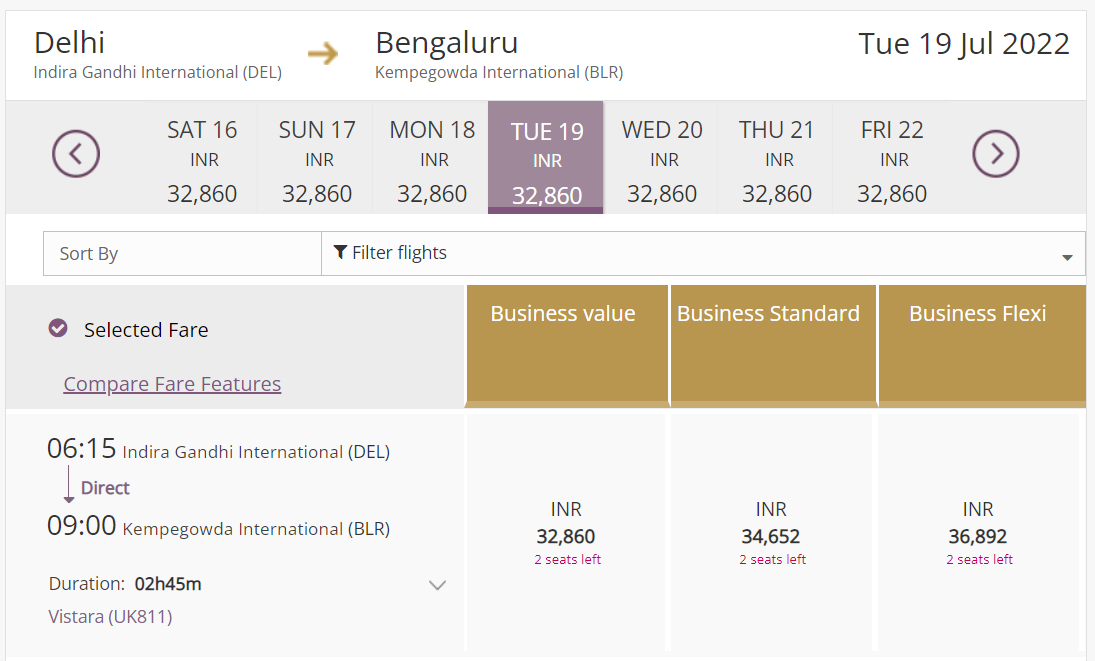

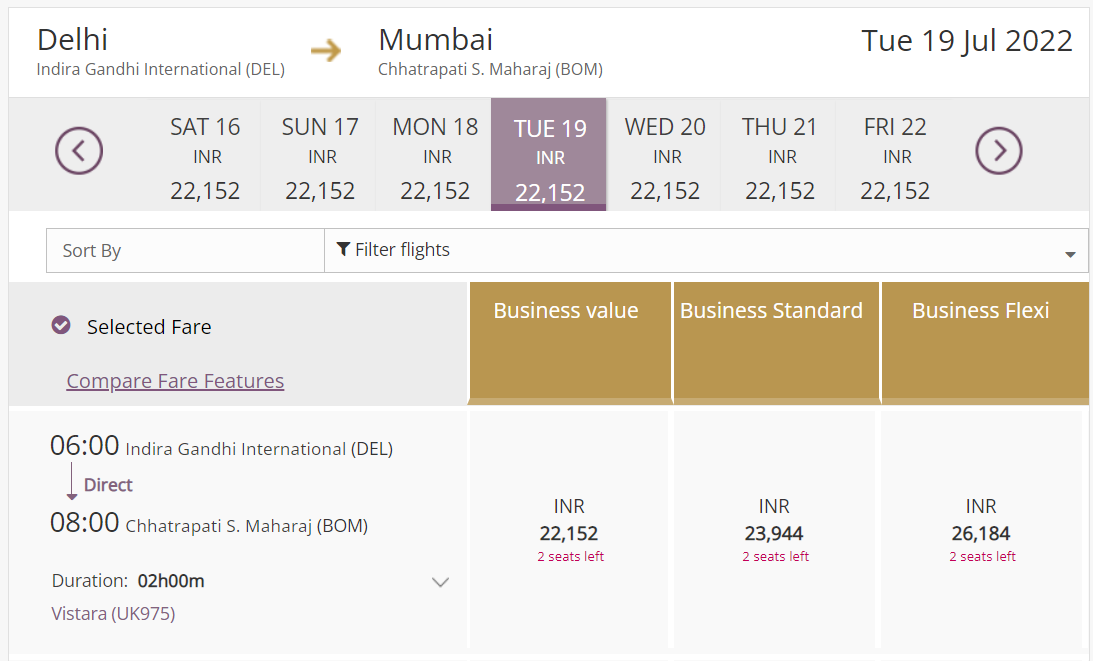

The price at which we can value the complimentary business class tickets depends on the route. I searched for two routes DEL-BLR and DEL-BOM to arrive at an approximate value.

- Approximate Cost of Business Class Ticket: Rs 25000

- Approximate Cost of Redemption for Taxes and Surcharges: Rs 3500

- Value of each Complimentary Business Class ticket: Rs 21500

It is always possible to get a better value for the business class tickets. So we get 5 Business Class tickets worth Rs 1,07,500. This is a return of Rs 7% without including the CV points.

Key Benefits

- Airport Lounge Access: 1 domestic airport lounge and 4 airport international lounge visits per year. International lounge access is through priority pass membership.

- BookMyShow: Buy one and get the second one free. The free ticket discount is capped at Rs 700 and can be availed twice a month.

- Foreign Currency Markup: Zero foreign currency markup charges. This is a big one.

Drawbacks

- High joining fee: The joining fee is quite high at Rs 40000 + GST = Rs 47200. Yes, we do get equal benefits but we are anyways ‘spending’ for it. 🙂

- Low CV Points Earn Rate: The CV points earn rate is good only for Travel and Vistara spending. Spends in other categories do not earn much, restricting usage of the card as the daily driver. In contrast, Axis Vistara cards offer a consistent CV earn rate on all spending.

- Club Vistara Gold Tier membership is only valid for the first year. After that, we need to maintain it as per Club Vistara qualification rules.

Final Thoughts

When compared with the Axis Vistara credit cards, the rewards on this card do not look exciting. On the features front, the zero foreign currency exchange is a good value addition. This will entice a lot of foreign travelers as this is on the Visa platform.

The joining fee for the Vistara IndusInd Explorer is too high for an airline credit card. Yes, we do not get good welcome benefits but again we pay for it. Plus, the ability to earn CV rates on all spending is limited.

But, if you are looking for a Vistara card that offers business travel then the Axis Vistara Infinite credit card is a much better choice. For a joining/annual fee of Rs 10K, it has more value.

Club Vistara IndusInd Bank Explorer Credit Card

Card Maven

4 thoughts on “Club Vistara IndusInd Bank Explorer Credit Card”

Vistara having partnered with Indusind bank should advise Indusind bank not to sell this highly priced credit card to persons not travelling abroad often or persons not using Vistara airlines for travel. Why sell a product to a customer by deceit when he cannot use it . Indusind bank by selling this credit card to its existing customers by deceit is trying to make revenue through joining fees which is really exhorbitant

how is sbi vistara prime- in relation to axis and this ? I believe for vistara co-branded cc , SBI VISTARA Prime is best value propostion

Yes, it is.

Vistara having partnered with Indusind bank should advise Indusind bank not to sell this highly priced credit card to persons not travelling abroad often or persons not using Vistara airlines for travel. Why sell a product to a customer by deceit when he cannot use it . Indusind bank by selling this credit card to its existing customers by deceit is trying to make revenue through joining fees which is really exhorbitant