The Club Vistara SBI Card PRIME is one of the best Vistara credit cards in the market today. Between all the rewards, miles, and cashback an airline credit card can be a better fit for domestic travelers who don’t want complete Airmiles redemptions. While we have co-branded cards for most airlines, Vistara cards are much better in rewards. As of now, Vistara has co-branded cards with Axis Bank and SBI Card. In this article, we review one of the Vistara co-branded cards – the Club Vistara SBI Card PRIME. This is a higher variant of the base Club Vistara SBI Card.

Fees and Charges

| Joining Fee | Rs 2999+GST |

| Welcome Benefit | 1 Complimentary Premium Economy Ticket 3000 CV points on spending Rs 75000 within 90 days |

| Annual Fee | Rs 2999+GST |

| Annual Fee Waiver | None |

| Renewal Benefit | 1 Complimentary Premium Economy Ticket |

| Complimentary Club Vistara Status | Silver (Renews every year) |

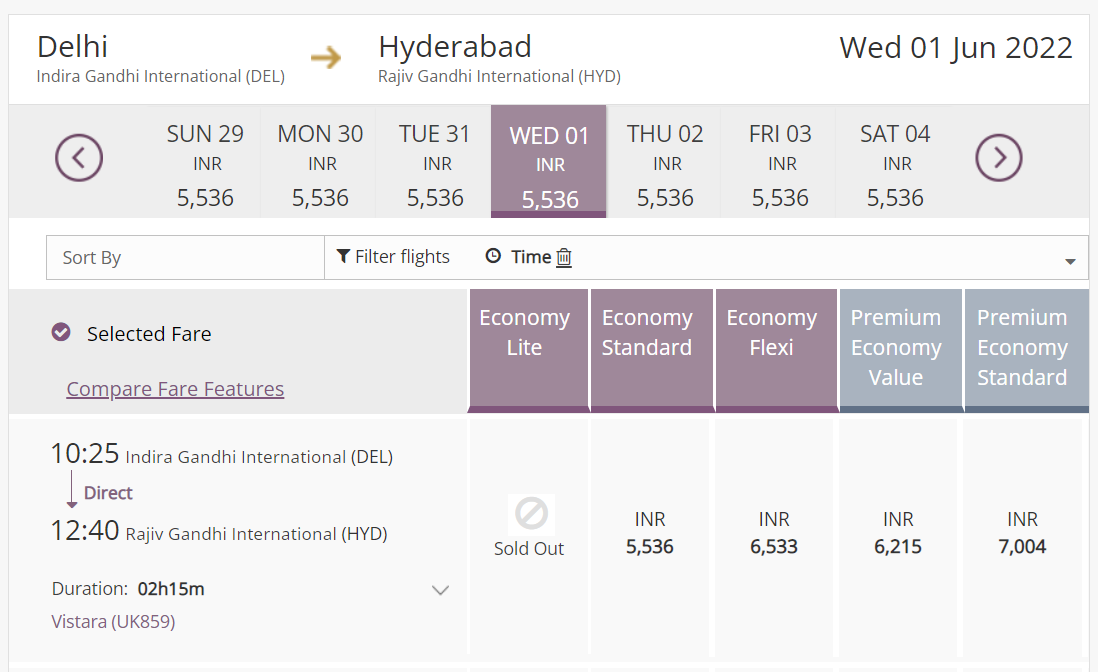

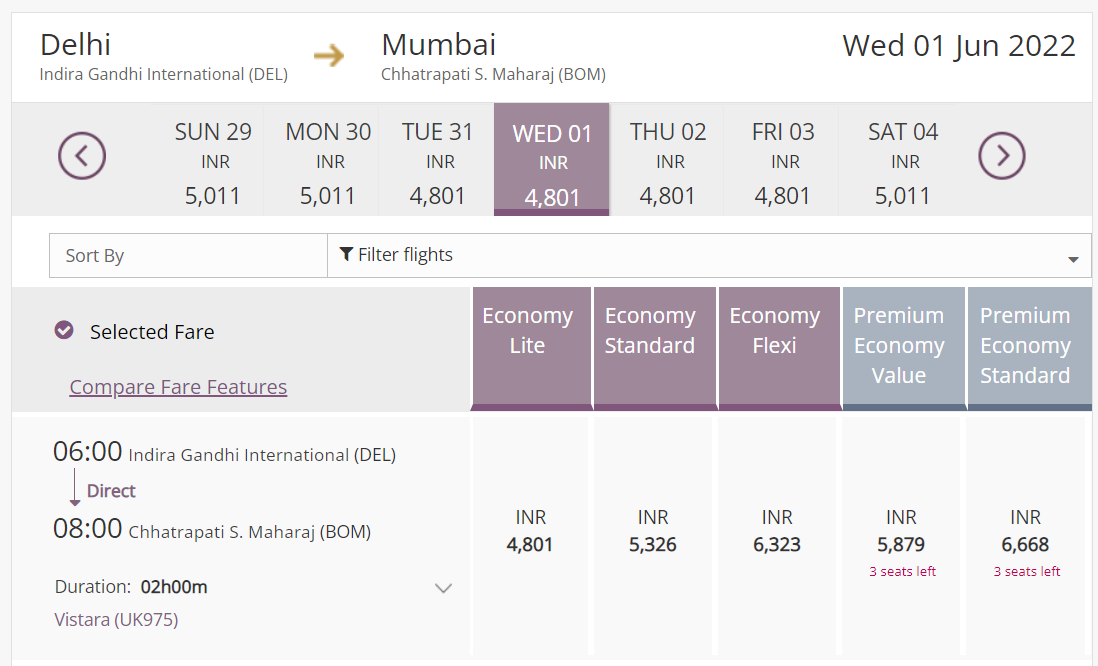

The complimentary premium economy ticket is worth more than the joining fee. We are valuing the complimentary premium economy ticket for at least Rs 5500. It can of course be even higher depending on the route and time of booking.

Considering the welcome and renewal benefit, the Club Vistara SBI Card PRIME card pays us to hold it even if we do not make any spending on it. Effectively, we get more benefits than the fee we pay.

Rewards

- All Spends: 4 Club Vistara(CV) points per Rs 200 ~ 1.6% Return

- 9 CV points per Rs 100 spent on Vistara flights (with the complimentary Club Vistara Silver membership)

We are valuing 1 CV point at 80 paise in this case. But in extreme cases, we can get a value higher than Rs 1 as well or a value of 60 paise too.

Milestone Rewards

The main feature of all Vistara co-branded cards is the milestone benefit. We get 4 premium economy tickets and a hotel stay gift voucher for spending Rs 8 Lakhs in a year. The value of these premium economy tickets increases when we are booking closer to the travel date.

| Spend Milestone | Reward |

|---|---|

| Rs 1.5 Lakh | 1 Premium Economy Ticket |

| Rs 3 Lakh | 1 Premium Economy Ticket |

| Rs 4.5 Lakh | 1 Premium Economy Ticket |

| Rs 8 Lakh | 1 Premium Economy Ticket Rs 10000 Yatra Hotels Gift Voucher |

Club Vistara SBI Card PRIME offers a 5.6% return on spends

- Approximate value of one premium economy ticket: Rs 5500 as we need to pay approximately Rs 1000 as redemption charges towards fuel and surcharges.

- Total value of 4 premium economy tickets: Rs 22000

- Value of Yatra Hotel Gift Vouchers: Rs 10000

- CV Points on Rs 8 Lakhs spend: 16000 (excluding Vistara spends)

- Total Return: 16000 CV points ~Rs 12800 + Rs 22000 as Economy Tickets + Rs 10000 Yatra Hotels GV = Rs 44800 ~5.6% Return on Rs 8 Lakh spending

The 16000 CV points alone can get you a Bengaluru to New Delhi Premium Economy ticket. Check the Vistara award chart for many other options. The challenge here will be booking the award ticket as Vistara cards are a bit too popular.

Club Vistara Silver Privileges and Benefits

The Club Vistara SBI Card PRIME offers Silver status for as long as we hold the card. This status comes with its own set of benefits that we can use when flying on Vistara.

- Earn 9 Club Vistara Points for every Rs 100 spent on Vistara flights base fare

- Extra 5 Kg baggage allowance

- 1 class upgrade voucher on Tier Renewal

Complimentary Airport Lounge Access

- Domestic Airport Lounge Access in India: 2 complimentary visits per quarter with Mastercard

- International Airport Lounge Access outside India: 4 complimentary visits per calendar year (maximum 2 per quarter) with Priority Pass.

Free Cancellation on Vistara Flights

Club Vistara SBI Card PRIME offers free cancellation on Vistara tickets booked with it

- In case of a refundable ticket, the insurance company will be paying the difference amount up to Rs 3500 whichever is less i.e. entire ticket amount minus taxes and convenience fees

- In case of a non-refundable ticket, the insurance company will be paying the ticket fare (excluding tax and convenience fee) or Rs 3000 per cancellation whichever is less

You can check the complete T&C here.

Insurance Benefits

- Air Accident Cover: Up to Rs 1 Cr

- Loss of check-in baggage: Up to Rs 72000

- Delay of check-in baggage: Rs 7500

- Loss of travel documents: Up to Rs 12500

- Baggage Damage Cover: Up to Rs 5000

Final Thoughts

As expected, the Club Vistara SBI Card PRIME is one level above the base variant Club Vistara SBI Card. We get better rewards and benefits from this. The good thing is getting the PRIME variant is better even with the higher annual fee. If we opt for this card, we get 3 Premium Economy tickets on reaching Rs 4.5 Lakhs spend. The base variant gives us 3 Economy tickets at a higher milestone spend of Rs 5 Lakhs. So, even if you are planning to spend the same amount get the Club Vistara SBI Card PRIME.

Frequently Asked Questions

Yes, we get both domestic and international airport lounge access with this card.

Yes, we get a premium economy ticket as a welcome and renewal benefit every year.

Yes, we get Club Vistara Silver status as a welcome benefit. From the second year onwards, the Club Vistara status will be as per the eligibility criteria of the program.

Club Vistara SBI Card PRIME

Card Maven

56 thoughts on “Club Vistara SBI Card PRIME”

I have an Infinia and some other premium cards. I have some SBI elite card which I seldom use. How difficult is it to get this card?

It is not that difficult to get. For easier approval, apply from an airport kiosk.

Hi,

So despite the Renewal fees being paid

vistara have downgraded my Silver status

Is the silver status renewal not part of the renewal for the SBI Vistara Prime card or is it a one time only thing?

It is only for the first year. Also, updated the post to make it clear.

Is it same case with Axis vistara infinite and signature cards as well?

No, Axis provides it on renewal too.

I don’t see the updated post. Am I missing something?

The Club Vistara SBI Card PRIME offers Silver status for as long as we hold the card. This status comes with its own set of benefits that we can use when flying on Vistara.

It is valid even after the first year. We updated it based on the feedback after this comment.

Is 75000 spend milestone applicable post renewal?

No, that is only for the first year.

redgirraffe.com does not have SBI credit cards as a bank option in the drop down when we try and register

Use PayZapp and pay with SBI Card

Does SBI allow upgrading existing card to CV prime card or allow possessing 2 cards at a time? I’ve tried applying through their website but they aren’t accepting my application, not sure why. Please suggest me a way forward, I’m looking to pay rent through this card.

They do allow multiple cards. Apply offline at one of the SBI Card kiosks.

Do we receive any cv points on spendings that are less than rs 200? Are cv points calculated on the total amount billed during the billing cycle or individual amounts?

No, it is in multiples of Rs 200. It is calculated for each transaction.

Can we use ticket voucher to book tickets for others? Or these specific to card owner?

You can add nominees in your CV account and use it for them.

Does rent payment count as milestone benefit?

Yes, it does for now.

I am using SBI Club Vistara Prime. SBI claims that the charges on rent payment is 199+GST but when I tried using phonepe/paytm, it is adding 1000Rs convenience charges. Which app should I use to pay the rent?

Paytm and PhonePe also have their own charges

do you still get CV points for rent payments ?

Please confirm

HI, I am planning to Apply it and close my SBI Cashback after the devaluation announcement.

I already have an Axis Vistara Infinite, so need clarification regarding the Vistara FFP.

Will it remain the same or SBI will issue a fresh Vistara CV ID ?

You can give them the CV number during application.

Am looking for rent payment through RedGirraffe portal with SBI credit card, with good rewards. Am not able to find out if this is possible. Do u have any suggestions?

Add your SBI Card on Payzapp and pay through that to RedGirraffe

Thanks. There is processing fee both from RedGirraffe and also from payzapp right? Also do i get cashback from using SBI cashback card?

It will get into rent/insurance MCC. So, it may be 0% or 1% cashback.

RedGirraffe will charge 0.39%+GST.

Thanks.

1. Then i guess SBI vistara credit card is good for rental payments of around 50k? To earn CV points

2. It’s restricted to domestic flights right?

3. Payzapp doesn’t have processing fee i hope

1. Yes

2. No, we can use CV points for international flights as well

3. PayZapp does not have a processing fee

What is the price of the complimentary ticket offered?

No cap on price. You can book any flight based on availability.

How to claim the welcome benefit of flight ticket? Is there a code we have to use while buying tickets

It will be added to your Vistara account.

Is e-wallet such as paytm loading eligible for the CV points?

Yes, all spends including fuel is considered.

Thanks for the response,

No card is not getting blocked, it just says Transaction Failed and SBI email response and call center seemed stumped about it…

Great website,

Do utility bill payments and insurance spends count towards CV points and milestone benefits,

I previously had Axis Vistara infinite card but discontinued it during Lockdown since Vistara at the time was non supportive ..

Need an SBI card , do you recommend any other apart from SBI vistara? Need it primarily for the online sales

I currently have Diners Black, Amex Plat charge and Icici saphiro, RBL Zomato, Yes first exclusive..most spends are done on the first 2

Any input would be appreciated thanks

Yes, bill payments and insurance spending count towards CV points and milestone benefits for the SBI Vistara cards.

You can use it for sale discount, no need to get another card.

Hi thanks for the response,

Is there any other SBI card that you would recommend..i dont have this one thinking of applying as i see a lot of value in its annual fees comapred to the remaining SBI portfolio.

Unless you would suggest otherwise

The Vistara card is a good one if you travel on the routes they fly. There are not many useful cards in the SBI portfolio compared to the ones you already hold. 🙂

Got the card, SBI did the expected “sbi giri” , they never asked me for my exisitng vistara FFP , i had to tell them not to issue a new one ,

Suprisingly got a very low credit limit, [is that normal with SBI?]

Also, tried purchasing gyftr vouchers through SBI yono website, keeps telling me transaction..have any of you faced similar issues?

Is there any other website where we can purchase gyftr or vouchers through SBI vistara card?

Yes, SBI Card does issue a low limit sometimes. If you have another SBI Card, then you can transfer some limit from that. Else, wait for 6 months and try for LE.

For vouchers issue, is the card getting blocked? If yes, unblock the card and retry after 24 hrs. It should work.

Is it easy to get award flight if Vistara is operating in your route. I heard mostl of the tickets are expired due to this

Yes, we do have the same issue in some cases.

Hello Maven, hope SBI Vistara still counts insurance payments towards milestone rewards?

I don’t have any credit cards and am searching for one since I have a sizeable insurance spend – could you kindly recommend any other suitable card for insurance payments? Thanks!

Yes, it is still counted.

Can we use the points for economy class tickets for higher realisation of points?

Yes, CV points can be used as per your requirement.

Can you please tell me if we can claim premium economy ticket on 1 stop over flight ?

What I mean if there is no direct floght from point A to Point B but it is via c, can we book the same layover ticket using premium economy ticket? or we would require two premium econony voucher to book the same.

eg. BLR-DEL-LKO — this connecting flight will consume one premium ticket or two ?

Two tickets as these are two flights.

Is all kind of spend including rent payment qualify for spend based milestone benefits for free premium economy ticket ?

Yes. All retail spends including fuel and rent are eligible for CV points and milestone benefits.

Not able to apply online.. using SBI portal

https://www.sbicard.com/en/personal/credit-cards/travel/club-vistara-sbi-card-prime.page

what is way forward ? any other process to apply

You can apply through any of the SBI Card agents.