Flipkart Axis Bank credit card is the Flipkart equivalent of the Amazon Pay ICICI card. It comes with a joining and annual fee of Rs 500 and offers 5% cashback on Flipkart spends. Other spends get 1% cashback. Among the benefits are complimentary domestic airport lounge access and a fuel surcharge waiver.

Fees

Flipkart Axis Bank credit card comes with a joining and annual fee of Rs 500 plus GST. The welcome benefits include a Flipkart GV of Rs 500 and 15% cashback up to Rs 500 on Myntra. From the 2nd year onwards, the annual fees are waived on spends of Rs 2 Lakh.

| Joining Fee | Rs 500+GST |

| Welcome Benefit | Rs 500 Flipkart Gift Voucher on 1st transaction |

| Annual Fee | Rs 500+GST |

| Annual Fee Waiver | Spend Rs 3.5 Lakh in a membership year excluding rent and wallet load transactions |

Flipkart Axis Bank Credit Card Cashback

Flipkart Axis Bank is a cashback credit card. The earned cashback in a statement period is automatically credited in the next statement period. There is no max cap on cashback that can be earned on spends. This is in line with what the Amazon Pay ICICI Bank credit card offers as well.

But, unlike the Amazon Pay card we get direct cashback over here. Cashback is always better than reward points that get added as a gift card. The 1% cashback on other spends make this card suitable for offline spends too.

| Category | Cashback |

|---|---|

| Flipkart | 5% |

| Myntra | 1% |

| Bill Payments, Travel, and Add Money | 1% for transacting through Smart Store – Bills and Recharges |

| Flights and Hotel Payments on Flipkart | 1% |

| Spends at Cleartrip, Swiggy, Uber, PVR, Cure.fit, and Tata Play | 4% |

| Other Spends | 1% |

Excluded Transactions for Cashback

Below transactions will not get any cashback on the Flipkart Axis Bank credit card:

- Fuel Spends

- Gift Card purchases on Flipkart, Myntra

- EMI transactions or purchases converted to EMI

- Wallet loading transactions

- Jewelry Purchases

- Rent Payments

- Government Services

- Utilities

Fuel Surcharge Waiver

The Flipkart Axis Bank credit card provides a 1% surcharge waiver for fuel purchases. The transaction amount needs to be between Rs 400 and Rs 4000 and the maximum surcharge waiver is Rs 400 per statement.

Complimentary Airport Lounge Access

- Domestic Airport Lounge Access: 4 visits/year

- International Airport Lounge Access: Not Available

Flipkart Axis Bank credit card offers 4 complimentary domestic lounge visits in India per calendar year. So, if you are an occasional domestic traveller this card can help you with lounge access. The list of participating lounges is limited to a few cities – Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, and Pune. The details are available over here.

Flipkart Axis Bank credit card has a minimum spends requirement to get complimentary airport lounge access. We now need spends of Rs 50,000 over a rolling period of last 3 calendar months to get complimentary airport lounge access. For example, if you need to access the airport lounge on 10th of March, then you should have spent Rs 50,000 in the period from 1st of December to 28th of February.

Pros and Cons

Pros

- 5% cashback for Flipkart purchases with no cap

- Minimum 1% cashback for transactions

Cons

- Cashback on other spends has reduced from 1.5 to 1%

- No cashback for wallet, fuel and a lot of other categories

- Lounge access now needs significant spends

- Limited lounge access valid only for metro cities

Other Benefits and Charges

- Fuel Surcharge Waiver: 1% waiver on transactions between Rs 400 and Rs 4000. Maximum fuel surcharge waiver of Rs 400 per statement cycle.

- Foreign Currency Transaction Charges: 3.5%+GST ~4.13%

- Finance Charges: 3.6% per month

Flipkart Axis Bank vs Amazon Pay ICICI Bank credit card

The Flipkart Axis Bank credit card is a notch above the Amazon Pay ICICI Bank credit card:

- Cashback vs Rewards: The Flipkart Axis Bank credit card is a cash back card. This is always preferable as that is adjusted against the statement outstanding. For Amazon Pay card, it gets added to the Amazon Pay balance which needs to be used for the next purchases.

- Lounge Access: Flipkart Axis card is the only one to offer complimentary lounge access but provided you meet the spends criteria.

But, the Amazon Pay ICICI Bank credit card is better in two aspects. It is a LTF card and also offers rewards on most spends including government services. Also, see – Flipkart Axis Bank vs Amazon Pay ICICI credit card

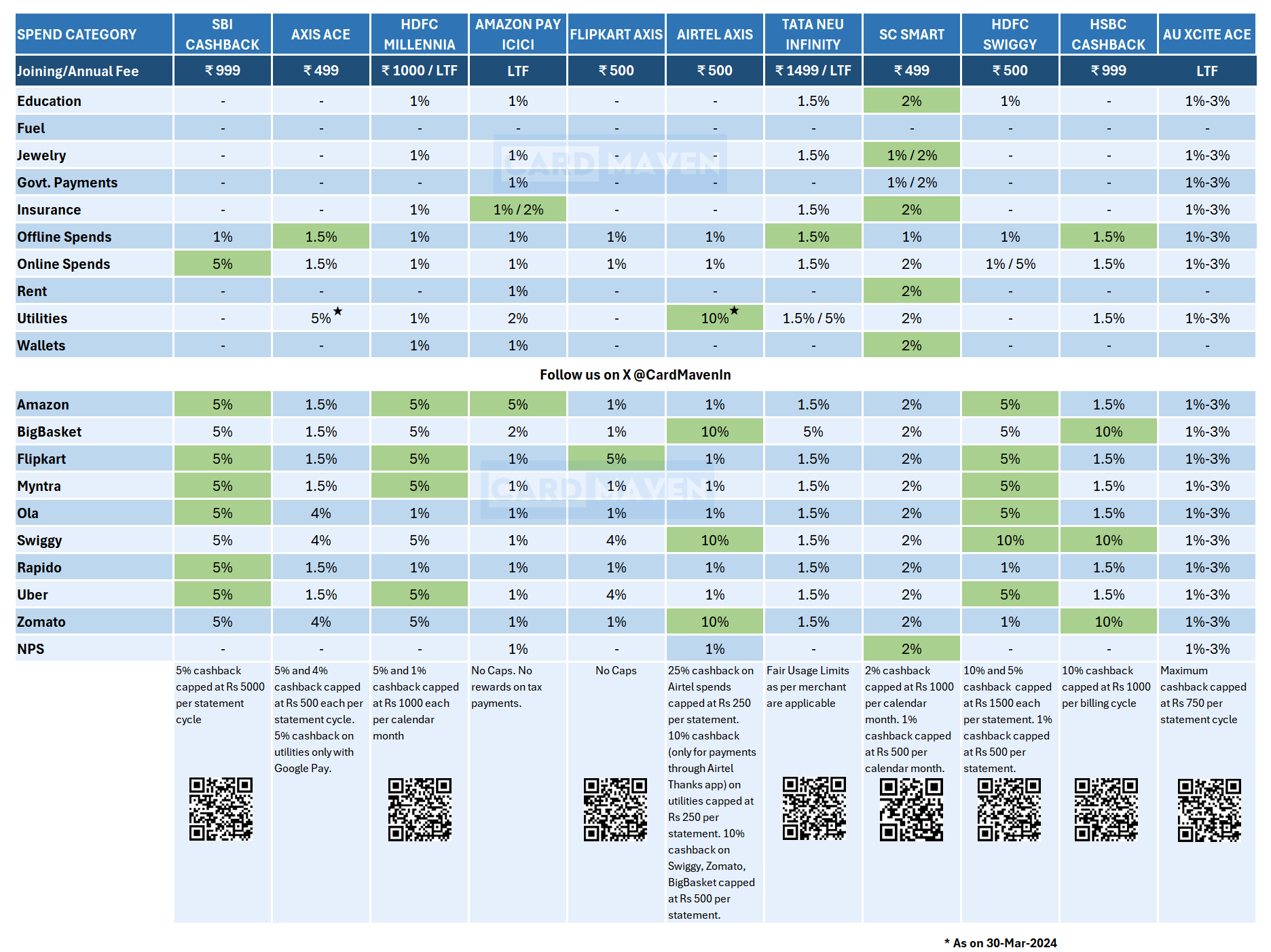

Flipkart Axis Bank Credit Card vs Other Cashback Credit Cards

If you have multiple cashback credit cards and want to know which is the best one for your spends, refer to our handy chart below. It has cashback percentage comparisons across multiple cashback credit cards to find the best one for your spends.

Final Thoughts

Flipkart Axis Bank credit card is a good option for someone who prefers direct cashback. If you use Flipkart for shopping, the 5% unlimited cashback can provide great savings. Add in the least 1% cashback and this can be an everyday credit card that can be used for all transactions. Axis Bank allows multiple credit cards for one account, so you can hold other Axis credit cards as well.

SBI Cashback is another alternative for getting 5% cashback on online shopping. It works everywhere including Flipkart.

Frequently Asked Questions

Yes, we get 4 visits per year but with a spends requirement. We need to have spends of Rs 50,000 in the last 3 months for complimentary airport lounge access.

Myntra gets 1% cashback with this card.

Flipkart Axis Bank Credit Card

Card Maven

17 thoughts on “Flipkart Axis Bank Credit Card”

Can add-on card holders share the lounge access or are they ineligible

Yes, they can

Devalued updates kar do har card k review mai

Yep. Done for this one. The other ones will follow soon.

fee waiver is at 3.5 lacs and does this card still deserve 3.8 rating. when there is millenia, sbi cashback, swiggy hdfc, tata neu infinity

Why cant they make the card lifetime free like ICICI?

They do have LTF offers on this card from time to time.

How do i know the partner restaurants that are eligible for cashbacks with this card ? If i buy something of 16k worth and convert it into EMI , merchant gives me no cost emi, will AXIS still charges me 15% interest ?

FK card now offers 1.5% cashback for EMI also

I still see the exclusion on the website at https://www.axisbank.com/docs/default-source/default-document-library/cashback-tncs—final.pdf

Did you recently receive cashback for an EMI transaction?

Hey Manas, LTF offer is over now. You can update this article.

Hey. Yes, I tweeted yesterday but did not get time to update the article. Removed reference to LTF offer from relevant articles. Thanks!

Minimum transaction amount for fuel surcharge waiver is 400₹. Please modify the article. I learnt it the hard way.

Also, GSTs are not reversed. This is a subtle T&C. You can add this too if you want.

Thanks! I have fixed it now. The Axis Flipkart card product page mentions the same as well.

Is there any clause on insurance purchase in terms of cashback from this card ?

No cashback exclusion clause for insurance transactions in the case of Flipkart Axis Bank credit card. Do check this link for the cashback T&C for the card and keep it for reference in case of any issue. Also, try to pay directly using the card instead of using any wallet gateway like Paytm/Mobikwik. Payments through wallet gateways mostly don’t get cashback as they are tagged as wallet transactions.