ICICI Bank’s Gemstone collection has five credit cards – Coral, Rubyx, Sapphiro, Emeralde and Diamant. Coral is the entry-level card with Diamant(invite only) being the highest in the order. In this post, we review the ICICI Bank Rubyx credit card. Rubyx is a dual variant card issued on both American Express and Visa/Mastercard. This is a review of the Visa/Mastercard variant as it is the one that gets issued in most cases.

Fees and Charges

Rubyx is issued LTF in most cases for existing ICICI Bank savings account customers. So, do check with the bank on this.

While the welcome benefit is decent enough, I would prefer a statement credit or Amazon vouchers instead. It gives more flexibility on the spend instead of moving around different merchants.

| Joining Fee | Rs 3000+GST |

| Welcome Benefit | Rs 5000+ worth Gift Vouchers – Tata CLiQ (Rs 2000), Ease my Trip (Rs 1000 X 2), Uber (Rs 250), Central (Rs 500 X 2), Croma (Rs 1000) |

| Annual Fee | Rs 2000+GST |

| Annual Fee Waiver | Rs 3 Lakhs Spend |

Rewards

ICICI Bank credit cards have one of the lowest reward rates in the industry. While they do have many merchant offers, their cards do not offer much for regular transactions. The reward rate is quite low for a card that charges a fee. Even LTF cards offer better rewards now.

- Domestic Spends: 2 RP per Rs 100 ~0.5% return

- International Spends: 4 RP per Rs 100 ~1% return

- Utilities and Insurance Spends: 1 RP per Rs 100 ~0.25% return

- Fuel Spends: No rewards

Milestone Rewards

- 3000 PAYBACK points on spending Rs 3 Lakhs in a membership year

- 1500 PAYBACK points on every Rs 1 lakh spend after crossing Rs 3 lakhs milestone above

- Max 15000 PAYBACK points in a year

Rewards Redemption

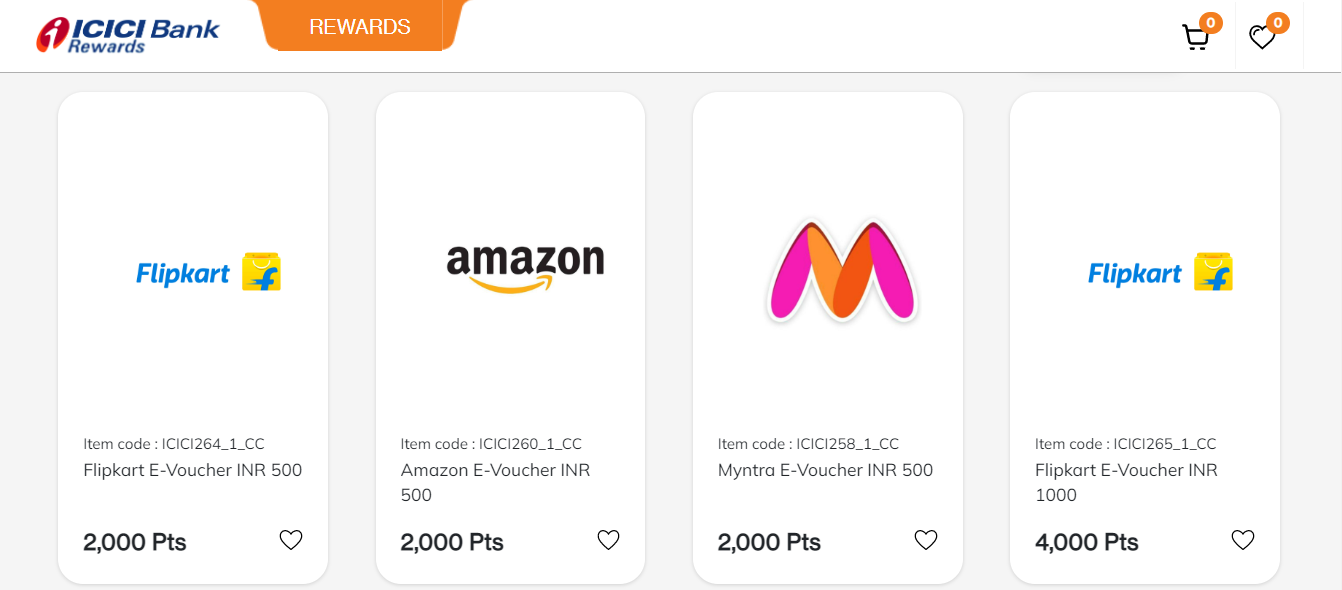

We get multiple categories for redeeming the reward points.

- Fashion and Lifestyle catalog

- Electronics products

- Travel and Luggage catalog

- E-Vouchers

- Home and Kitchen products

The value of each reward point stays at 25 paise. Given the reward value, e-vouchers are the only good choice. Tanishq, Kalyan Jewellers, Jockey, Marriott and Croma are some of the good options in e-vouchers. We also have e-commerce GVs like Amazon, Flipkart, and Tata CliQ.

Benefits

- Airport Lounge Access: 2 complimentary access per quarter to select airport lounges in India on spending Rs 5,000 in the previous quarter. Check here for list of lounges.

- Railway Lounge Access: 2 complimentary access per quarter to railway lounges listed here.

- Book My Show: 25% discount up to Rs.150 on purchase of minimum 2 movie tickets per transaction on BookMyShow and Inox. The offer can be availed twice a month on BookMyShow and Inox each.

Drawbacks

I usually evaluate the Pros and Cons of a credit card in a review. Considering the card features in this case, I will focus more on the drawbacks.

- High Annual Fee Waiver – The fee waiver is set too high at Rs 3 Lakhs for this card.

- Rewards System – The low earning rate of rewards along with Payback does not make this card lucrative at all.

- Conditional Airport Lounge Access – Even entry-level credit cards have started offering complimentary airport lounge access now. Rubyx should do a lot better.

Final Thoughts

ICICI Bank is the second-largest private bank in India. But it continues to lag in the credit cards market. It is not surprising seeing their credit card offerings. Even the co-branded Amazon Pay credit card offers better rewards than Rubyx card.

If you are planning to get the Rubyx card by paying a fee, avoid it. We have far better cards in the market. If you are getting this LTF, then take it to avail of the cashback offers that come on Flipkart/Amazon during sales.

ICICI Bank Rubyx Credit Card

CardMaven

1 thought on “ICICI Bank Rubyx Credit Card”

ICICI has now started their own reward portal and since April 2022, is no longer tied up with Payback. The new ICICI reward portal isn’t that great either in terms of choices.