The IndianOil Axis Bank credit card used to be one of the best budget options for IOCL fuel credit cards. At Rs 500 annual fee and 4% rewards on fuel, it was an easy choice to get this one. But, how does it fare now after the latest devaluation from Axis Bank. Here is a look at the updated offering.

Fees

| Joining Fee | Rs 500+GST |

| Annual Fee | Rs 500+GST |

| Welcome Benefit | 100% value back up to Rs 250 as EDGE RP on 1st fuel transaction within 30 days of card issuance |

| Annual Fee Waiver | On spends of Rs 3.5 Lakh in a membership year except rent, wallet and insurance transactions |

The welcome benefit on this card used to be a flat 100% cashback up to Rs 250 but it has now changed to an EDGE RP benefit. The annual fee waiver at Rs 50000 means we need to spend only Rs 4200/month on fuel spends to make the card LTF. All new issuances of the IndianOil Axis Bank credit card are on the RuPay payment network.

Rewards

The IndianOil Axis Bank card earns EDGE Reward points for transactions.

| Category | EDGE Rewards | Value |

|---|---|---|

| IndianOil Fuel | 20 RP/Rs 100 | 4% |

| Online Purchases | 5 RP/Rs 100 | 1% |

| All other purchases | 1 RP/Rs 100 | 0.2% |

| Insurance, Gold/Jewellery, Wallet, Rent, Utilities, Govt. Transactions | No Rewards | NIL |

- 4% rewards will only be valid for fuel purchases between Rs 400 and Rs 4000.

- Accelerated EDGE RP for fuel is capped at 1000 RP per month. This caps the maximum fuel for 4% return at Rs 5000 per calendar month. With the current fuel prices, it will be enough for just one refuel for cars.

- 1% fuel surcharge waiver for transactions between Rs 400 and Rs 4000. Maximum waiver of Rs 50 per statement. This caps the fuel surcharge waiver at Rs 5000 worth of fuel spent in a statement cycle. Fuel surcharge waiver is not available for UPI transactions.

We get the 4% EDGE Rewards benefit for using any fuel pump and any POS. No restrictions. You just have to use an IOCL fuel pump. This is where the IOCL Axis credit card is better than the IOCL Citibank card.

Other Benefits

- 10% instant discount on BookMyShow

- Up to 20% discount with Axis Bank Dining Delights

Rewards Redemption

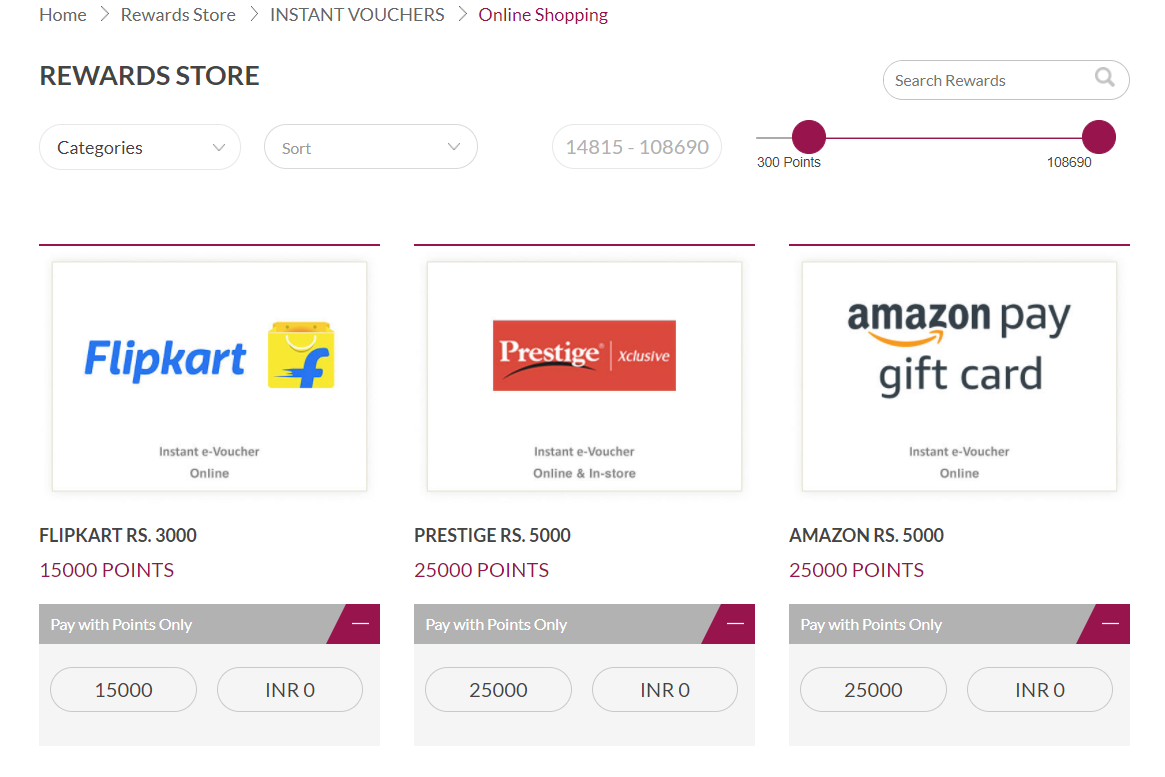

The rewards can be redeemed from the Axis Bank EDGE Rewards Portal. Each EDGE Reward Point is worth Rs 20 paise for all redemption options. We have Amazon and Flipkart gift vouchers for redemption as well.

Pros and Cons

Pros

- 4% return on IOCL fuel spends

- Fuel rewards for valid for all IOCL outlets

Cons

- Low cap for fuel rewards considering spends required for annual fee waiver

- Low reward rate for offline spends

- Difficult to get the annual fee waiver with excluded spend categories

Should you get the IndianOil Axis Bank credit card?

The latest round of devaluations has hit almost all Axis Bank credit cards. The IOCL Axis card is not spared either. The required spends to get annual fee waiver have moved up from Rs 50,000 to Rs 3.5 Lakh while excluding multiple spends. So, it does not make any sense to try for that with the low rewards on this card. For IOCL fuel credit cards, have a look at the IOCL Kotak credit card now.

Axis Bank also runs LTF offers on this card regularly. You can wait for those offers to get the IOCL Axis credit card without any spend conditions and use it only for the IOCL fuel spends. If you are looking for other fuel credit cards, do check out the list of the best fuel credit cards in India. For a higher spending on fuel close to Rs 10000 per month, also check out the BPCL SBI Card – Octane.

Frequently Asked Questions

Yes, we have used the card at multiple IOCL pumps and have got 4% rewards on those spends.

At the moment, the IOCL Kotak card is a better choice.

Yes, we get 15% off up to Rs 500 once per month on EazyDiner. The minimum bill value should be Rs 1500.

IndianOil Axis Bank Credit Card

CardMaven

16 thoughts on “IndianOil Axis Bank Credit Card”

Will edge points be rewarded if we are using it in fuel pumps via UPI apps like gpay

Yes

So, I have to buy vouchers? Or can I convert to cash? Vouchers are costly

No cash redemption. We need to redeem for vouchers.

what are charges for points redemption

Rs 49+GST for 300-10K EDGE RP

Rs 99+GST for >10K EDGE RP

Can these edge points be combined with the points from Magnus?

Yes, everything is visible as one EDGE Rewards balance when we go for points transfer.

@CardMaven bro, how will transfer work if I have both cards, do I get 5:4 ratio or 10:1 ? The 5:4 transfer ratio on this card would be really amazing … please clarify ?

Yes, it will be 5:4 ratio if you have a HNI card.

What happens to the transfer ratio when we have ATLAS?

Atlas earns EDGE Miles not EDGE RP.

Is this card eligible for Axis Gift Edge and Travel Edge accelerated reward points?

Gyftr – Probably yes as this is an EDGE Rewards card

Travel EDGE – No

HI, If the IndianOil Axis Bank credit card will not earn any EDGE Rewards for fuel spends then what is the benefit.

It does earn EDGE reward points on fuel as of today.