Metal credit cards are often associated with luxury and premium features.Meanwhile, we have simple plastic entry-level cashback credit cards. How would it be if we combined both? This is where OneCard comes in. A sleek app and Simple Rewards make this Lifetime Free Metal credit card stand out. Check out this OneCard review to find if this card is worth your while.

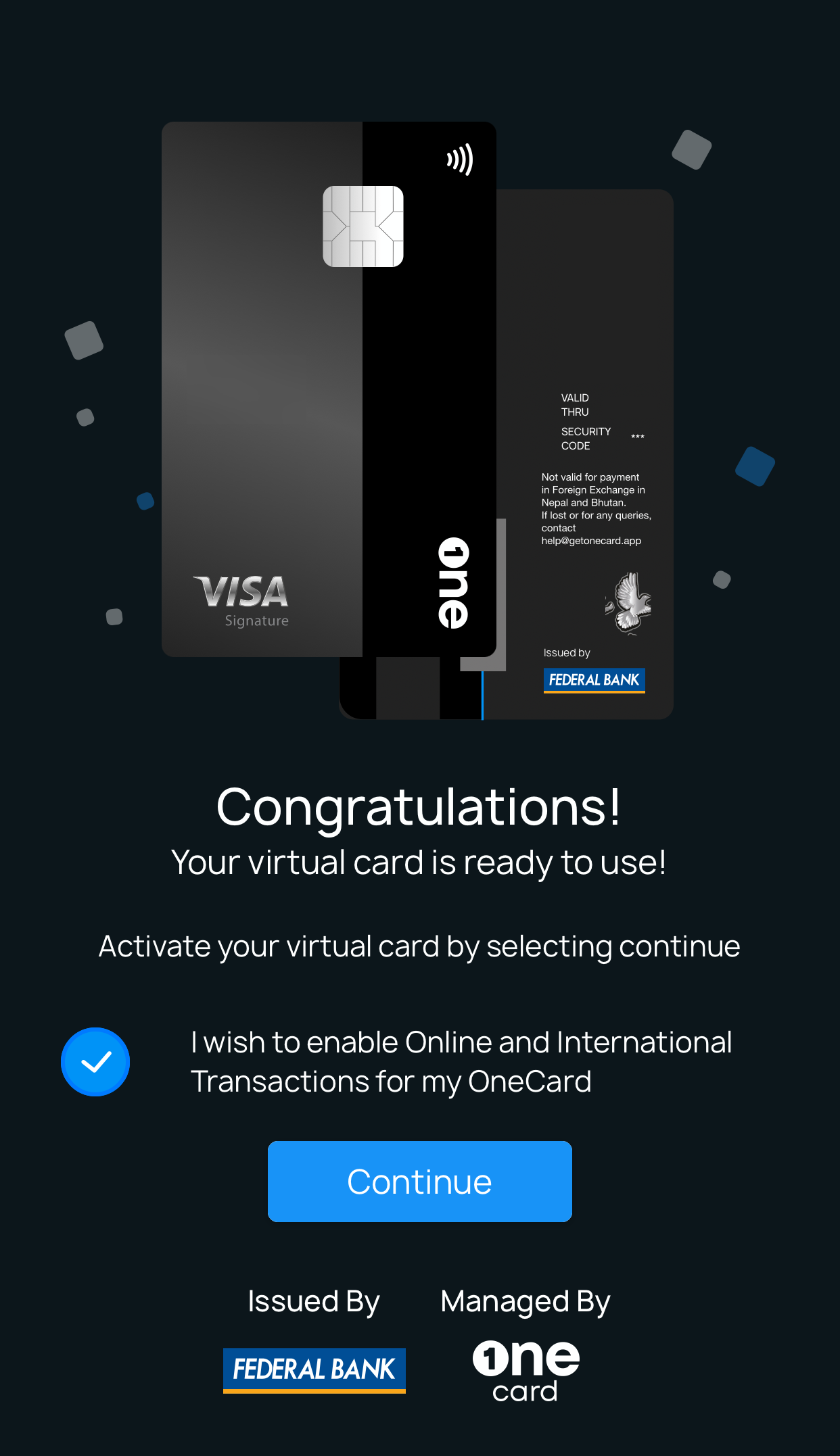

OneCard Banking Partners

OneCard does not have a license to issue credit cards. So, it issues cards in partnership with several commercial banks. To put it simply, this is like a co-branded credit card. The current banking partners of OneCard are:

- Federal Bank

- SBM Bank

- South Indian Bank

- BoB Financial

Fees and Charges

OneCard is a lifetime free card and comes with zero joining and annual fee. But. there are a few others like card replacement fees which are on the higher side.

| Joining Fee | Zero – LTF |

| Annual Fee | Zero – LTF |

| Forex Markup | 1%+GST ~1.18% |

| Card Replacement Fee | Rs 3000 |

Sign Up Process

Like other FinTech’s, OneCard too has a simple and quick sign-up process. We need to apply from the OneCard app and the entire process including KYC takes less than 2 mins.

If you need an invite to apply for the OneCard, just start using the OneScore app. You will get an invite to apply for the card from the OneScore app with a pre-qualified credit limit. The virtual card is generated instantly after KYC and is available for online usage. The Metal card is delivered in 3-5 working days.

Rewards

| Spend Category | Rewards | Return |

|---|---|---|

| Retail Spends | 1 RP/Rs 50 | 0.2% |

| Top 2 Category Spends | 5 RP/Rs 50 | 1% |

| Fuel and Wallet Spends | No Rewards | Zero |

The points for each transaction reflect instantly in the app which is good. We need to spend in at least three categories (by MCC) to be eligible for 5X Rewards in the top two categories. The base reward rate is quite low. But OneCard takes up ICICI Bank’s approach and has pretty decent merchant offers round the year. We even get multiple spend offers in the app depending on our spends.

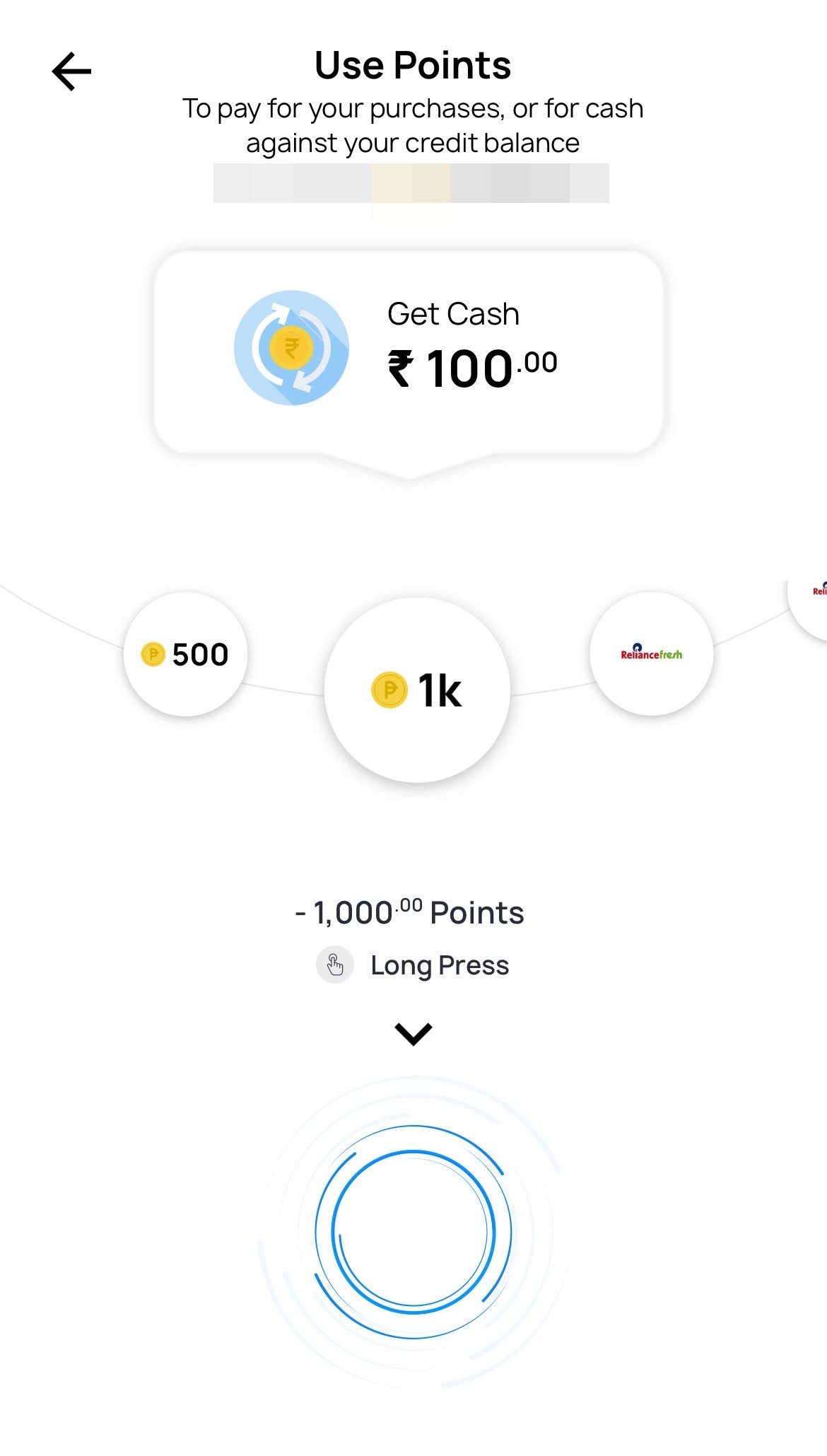

Rewards Redemption

OneCard does not charge any redemption fee and there is no expiry for the reward points too.

The reward points can be instantly redeemed from the OneCard app for statement credit or to pay against a purchase. In both cases, the value of each reward point equals 10 paise. So, we get Rs 50 statement credit for 500 reward points.

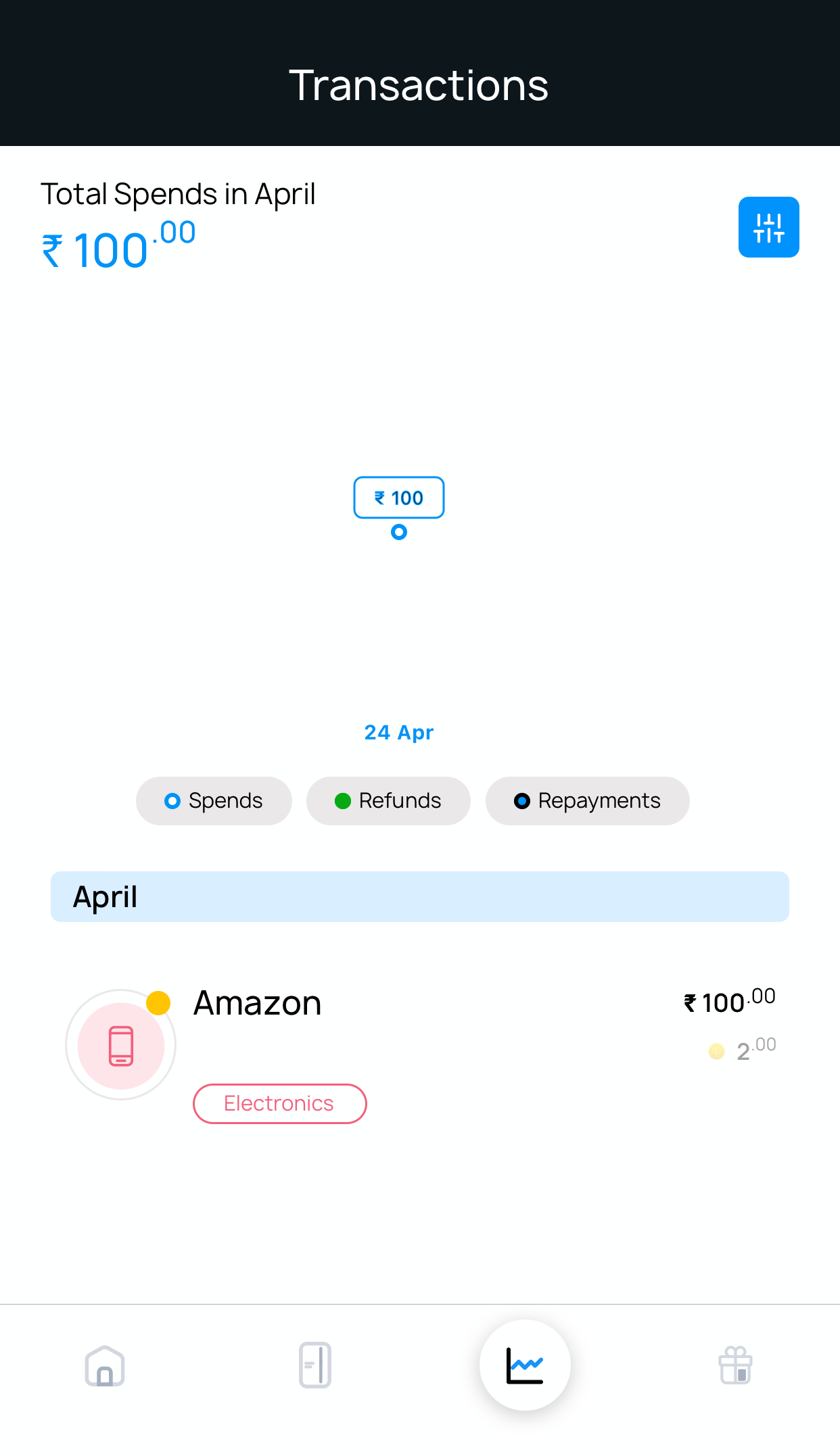

We can also track transaction wise reward points including any bonus rewards on the app.

OneCard Review: Rewards Redemption

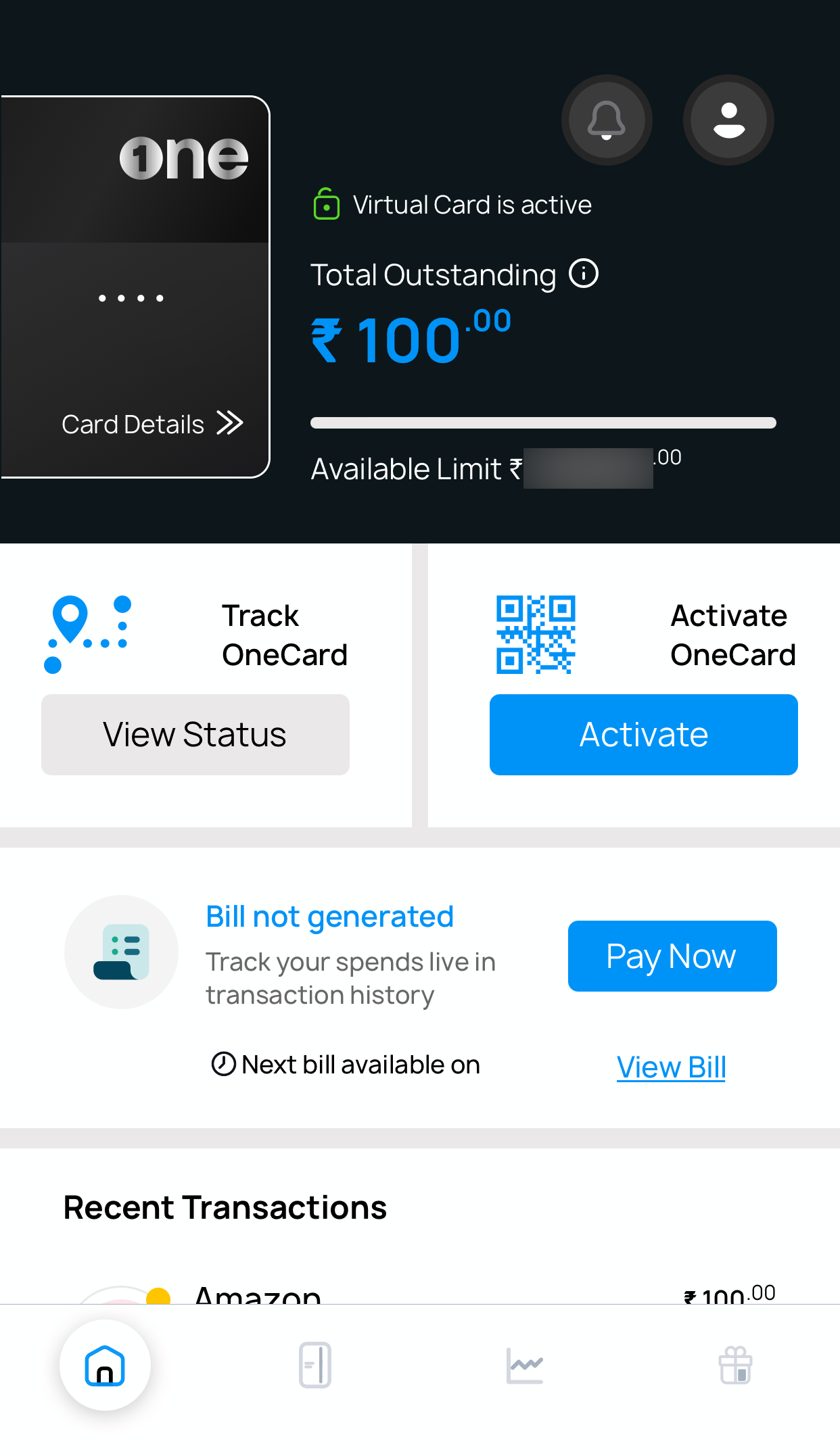

OneCard app for card management

OneCard has a sleek app that serves as a way to control and view everything related to the card. We can set transaction controls, view card transactions, and do much more. The experience is smooth and good. Wish, there was such a super-premium card with a great app experience.

Pros and Cons

Pros

- Quick and easy sign up from the app

- Card management is easy thanks to the sleek app

- Lifetime Free Metal credit card

- Low Forex Markup at 1%+GST

- Merchant Offers

Cons

- Low standard reward rate

- No extra benefits on spends like airport lounge access

Final Thoughts

In spite of its low reward rate, getting the OneCard is still worth it especially if you want to have a metal credit card. While the reward rate is low, there are decent merchant offers on Amazon, Flipkart and others during sale season. There are also targeted spend offers to get up to 10% value back on spends.

All things considered, we would have liked to see a standard reward rate of at least 1% on this card. The metal form factor is good but a higher reward rate would have helped more if we consider the competition. The forex markup fee of 1% is a nice feature and can be useful if you don’t have any other card that provides a better value.

If you are looking for entry-level cards with good cashback, do have a look at the Best Credit Cards article.

OneCard

Card Maven

3 thoughts on “OneCard Review: LTF Metal Credit Card in India”

Good review. I was about to apply after seeing some other reviews. Since, the offers and other benefits are just average, I think my decision was right. Thanks for the detailed review. Others missed some important info such as the charges for renewal. Thanks again.

Pothi.

HI,

Just signed up and got the one card. Here are some things to note.

1. I din’t get 0.2% reward for transfer which is also paytm and other wallet loads.

2. I did foreign transactions and found that the markup is more like 1.2% with the GST and you get 0.2% reward on it.

3. I have to create a fixed deposit to get the card. Maybe in 2021 the process changed.? Any way to get without FD?

Bro, the process still requires you to create FD in 2023.

Had to pay rent so applied 🙂