SBI SimplyCLICK and Amazon Pay ICICI Bank are two good entry-level credit cards. Both offer reasonable rewards in their respective segments. Here is a detailed comparison of SBI SimplyCLICK vs Amazon Pay ICICI Bank credit card and their rewards & benefits.

Fees and Charges

| SBI SimplyCLICK Credit Card | Amazon Pay ICICI Bank Credit Card | |

|---|---|---|

| Joining Fee | Rs 499+GST | Lifetime Free (LTF) |

| Annual Fee | Rs 499+GST | Lifetime Free (LTF) |

| Welcome Benefit | Rs 500 Amazon Gift Card | Rs 750 Amazon Gift Card for Prime members Rs 600 Amazon Gift Card for non-Prime members |

| Annual Fee Waiver | Rs 1 Lakh spend in a membership year | Lifetime Free (LTF) |

Like most offerings from SBI Card, SimplyCLICK is not offered LTF. But, the low annual fees and renewal fee waiver amount make it easy to retain the card for the rewards it offers.

Rewards

The USP of the Amazon Pay ICICI Bank credit card is its 5% unlimited rewards for Amazon India purchases. For someone who spends a lot at Amazon, this can add up to a lot of savings. Amazon Pay is available on most websites which gives us 2% rewards for Amazon Pay ICICI Bank credit cards.

SBI SimplyCLICK card also offers similar rewards for Amazon India. With both base and milestone rewards, it offers 4.5% rewards for Amazon purchases. We also gain on SimplyCLICK with the 10% instant discount offers on SBI Cards during Amazon sales.

| Category | SBI SimplyCLICK Credit Card | Amazon Pay ICICI Bank Credit Card |

|---|---|---|

| Amazon Spends | 10 RP per Rs 100 spent ~2.5% | 5% Rewards |

| Apollo 24X7, BookMyShow, Cleartrip, EazyDiner, Netmeds, Myntra, Dominos, Yatra | 10 RP per Rs 100 spent ~2.5% | 2% Rewards if Amazon Pay gateway is available else 1% Rewards |

| Other Online Spends | 5 RP per Rs 100 spent ~1.25% | 2% Rewards for merchants supporting Amazon Pay 1% Rewards for other merchants |

| Offline Spends | 1 RP per Rs 100 spent ~0.25% | 1% Rewards |

| Milestone Rewards | Rs 2000 Cleartrip voucher for Rs 1 lakh and 2 Lakh spends in a membership year | Not Available |

| Wallet Loads | No Rewards | 1% Rewards |

| Return on spends | 0.25% to 4.5% | 1% to 5% |

Redemption Options

Amazon Pay ICICI Bank credit card automatically redeems the earned rewards at the end of the billing cycle. The rewards get added as an Amazon gift card to the respective account. There is no minimum threshold for reward redemption.

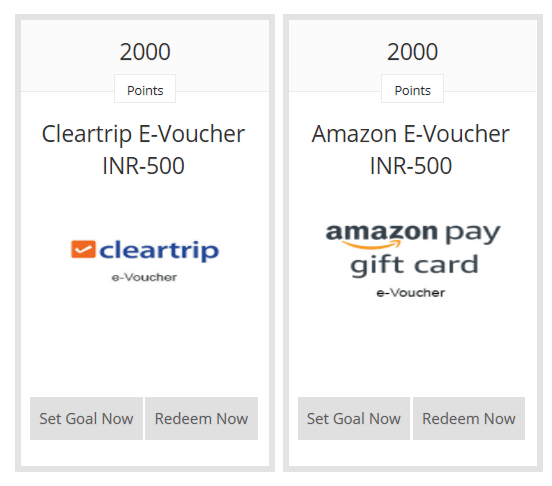

SBI SimplyCLICK offers two options for reward redemption – Amazon or ClearTrip vouchers. The minimum reward points needed for redemption are 2000. Each reward point is equivalent to 25p. and redemptions can be in blocks of Rs 500 Amazon or ClearTrip e-gift vouchers. SBI Card does not charge a redemption fee for SimplyCLICK.

Which card is better – SBI SimplyCLICK vs Amazon Pay ICICI?

Amazon Pay ICICI Bank card is a good all-rounder which gives at least 1% cashback on all spends. SBI SimplyCLICK is useful only for online purchases. The 0.25% on offline spending is too low! Considering that Amazon Pay ICICI Bank is LTF, it is the better credit card. Unless you are shopping during an instant discount sale, the Amazon Pay card provides you with 5% unlimited rewards any time of the year.