Standard Chartered Platinum Rewards credit card is an entry-level offering that is now LTF with spend conditions. The card offers accelerated reward points on hotels, restaurants, and fuel spending without any cap. There is no cap on the reward points. This is the only credit card that Standard Chartered offers as Lifetime Free today although with spend conditions. So, do check the details and apply for it to take advantage of bank offers from Standard Chartered India.

Eligibility

- Applicant Age: 18 to 62 years

- Minimum Gross Monthly Income: Rs 25000

Fees and Charges

| Joining Fee | Rs 250+GST or LTF* |

| Welcome Benefit | 100% Cashback up to Rs 500 on restaurant transactions within 90 days Not valid for LTF SC Platinum Rewards credit cards |

| Annual Fee | Rs 250+GST or LTF* |

| Annual Fee Waiver | Rs 60000 spends in a membership year |

The Standard Chartered Platinum Rewards credit card is now offered LTF with a one-time spend condition. We need to spend Rs 500 or more within 30 days from card issuance to make it lifetime free. This offer is not valid if you already hold other Standard Chartered Bank credit cards. You need to apply online at the below link for it to be LTF with the above conditions.

Rewards

| Category | Cashback |

|---|---|

| Fuel and Dining | 5 RP / Rs 150 ~0.8% |

| Other Spends | 1 RP / Rs 150 ~0.16% |

The reward rates are extremely low and are not even comparable to other entry-level credit cards. This is the reason we mentioned that you should get the Platinum Rewards credit card as LTF only for bank offers.

Rewards Redemption

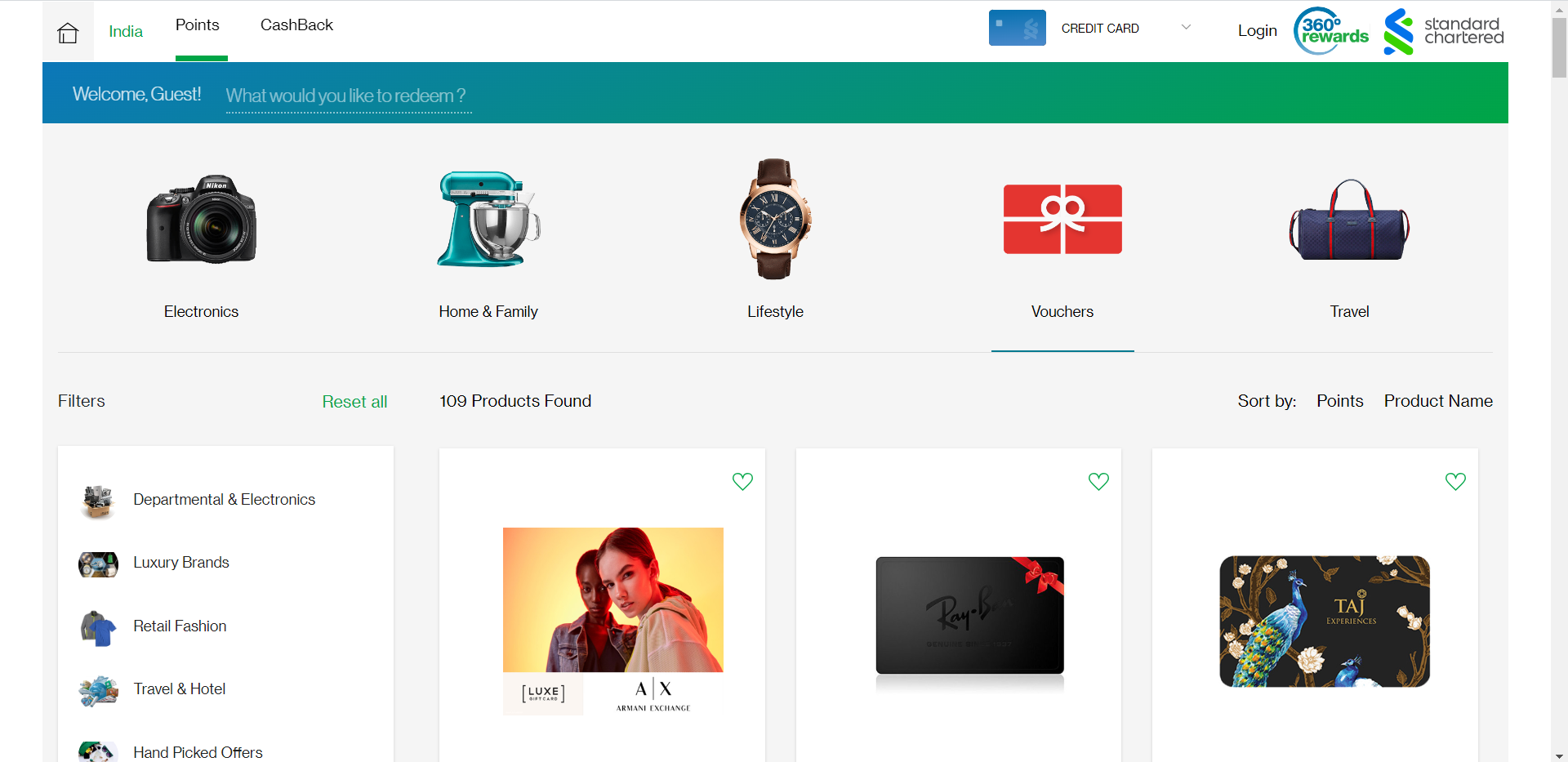

The cashback and reward points can be redeemed from Standard Chartered 360 rewards portal. Each reward point is worth 25 paise. While there are products for redemption, the best option is to redeem from the available gift vouchers.

There is a charge of Rs 99+GST per redemption request for the Standard Chartered Platinum Rewards credit card. This is not justified for an entry-level credit card that has an annual fee.

Pros

- Conditional LTF Offer

- LTF Platinum Rewards credit card can be used for bank offers

Cons

- Very low reward rate

- No other benefits

- No complimentary airport lounge access

Frequently Asked Questions

Yes, there is an offer to get this LTF based on a one-time spend of Rs 500 or more within 30 days from card issuance.

No, there is no complimentary airport lounge access on this card.

Standard Chartered Platinum Rewards Credit Card

Card Maven