The Tata Neu Infinity HDFC Bank credit card is the higher variant of the two co-branded credit cards from HDFC Bank and Tata Neu. The Infinity variant is offered first year free without any joining fee. From the second year onwards, the annual fee is Rs 1499+GST which is waived with spends of Rs 3 Lakh in a membership year. Tata Neu Infinity HDFC Bank credit card offers a reward rate of 1.5% to 5% and is the best credit cards for UPI spends and Tata Neu partner brands. With benefits like complimentary airport lounge access and fuel surcharge waiver, we are recommending this card as a must-have card for your spends.

Fees and Charges

| Joining Fee | Zero (First Year Free) |

| Welcome Benefit | None |

| Annual Fee | Rs 1499+GST or LTF |

| Renewal Benefit | 1499 NeuCoins if fee is charged |

| Annual Fee Waiver | Spend Rs 3 Lakh in a membership year |

The Tata Neu Infinity HDFC Bank Credit Card is issued on both Visa and RuPay platforms. But, we recommend getting the RuPay variant when applying for the card as we can use it for UPI spends.

The Tata Neu credit cards are being offered LTF to a lot of customers on the Tata Neu app. So, do check if you are eligible for it.

Tata Neu Infinity HDFC Bank Credit Card Rewards

| Purchase Category | Rewards (NeuCoins) |

|---|---|

| Tata Neu and partner brands on app | 5% |

| Air India mobile and app bookings | 5% |

| Utility Bill Payments and Recharges with Tata Pay | 5% |

| Retail Spends | 1.5% |

| UPI Spends | 1.5% |

| Wallet, Gift Vouchers, Fuel, Rent, and Government Transactions | 0% |

- Partner brands include 1MG, Big Basket, Croma, Air Asia, Tata CLiQ, IHCL, Westside, Qmin, Tata Play, Titan, Tanishq and Cult

- Rewards for Grocery transactions capped at 2000 NeuCoins per calendar month

- Rewards for Insurance spending capped at 2000 NeuCoins per day

- Rewards for UPI spends capped at 500 NeuCoins per calendar month ~Rs 33300 spend per calendar month

5% on utility bills and partner brands is the USP of the Tata Neu Infinity HDFC Bank credit card. The RuPay variant is the most popular option thanks to the ability to use it for UPI spends.

Fair Usage Policy: Caps on Tata Brand Merchants Rewards

One of the things that the Tata Neu Infinity credit card has done is impose a fair usage policy cap on its rewards. This ensures that commercial spending on this card is limited. The caps apply on the spends that earn 5% NeuCoins on Tata Partner brands and transactions.

| Brand | Max Monthly Spends eligible for 5% NeuCoins | Max Annual Spends eligible for 5% NeuCoins |

|---|---|---|

| Croma | Rs 6 Lakh | Rs 18 Lakh |

| Tata CLiQ, Westside | Rs 3 Lakh | Rs 18 Lakh |

| IHCL, Qmin, Air Asia | Rs 8 Lakh | Rs 30 Lakh |

| 1MG, Cult, Tata Play | Rs 2 Lakh | Rs 15 Lakh |

| Bill Payments – Tata Pay | Rs 50000 | Rs 6 Lakh |

| Big Basket | Rs 1 Lakh | Rs 12 Lakh |

| Titan, Tanishq | Rs 6 Lakh | Rs 18 Lakh |

HDFC Bank SmartBuy Offers for Tata Neu Infinity Credit Card

The Tata Neu Infinity HDFC Bank credit card does not get the 5% cashback or 5X rewards benefits on SmartBuy like other HDFC Bank credit cards. Instead, we get bonus NeuCoins for SmartBuy transactions at a much lower rate. We can earn a maximum of 1000 bonus NeuCoins per calendar month through SmartBuy.

| Category | Tata Neu Infinity HDFC Bank Credit Card (NeuCoins) |

|---|---|

| IGP.com | 6% |

| Flights | 1.5% |

| Hotels | 6% |

| IRCTC | 1.5% |

| RedBus | 1.5% |

| Instant Vouchers | 1.5% |

| Apple Imagine Tresor | 1.5% |

| Flipkart | 1.5% |

Rewards Redemption

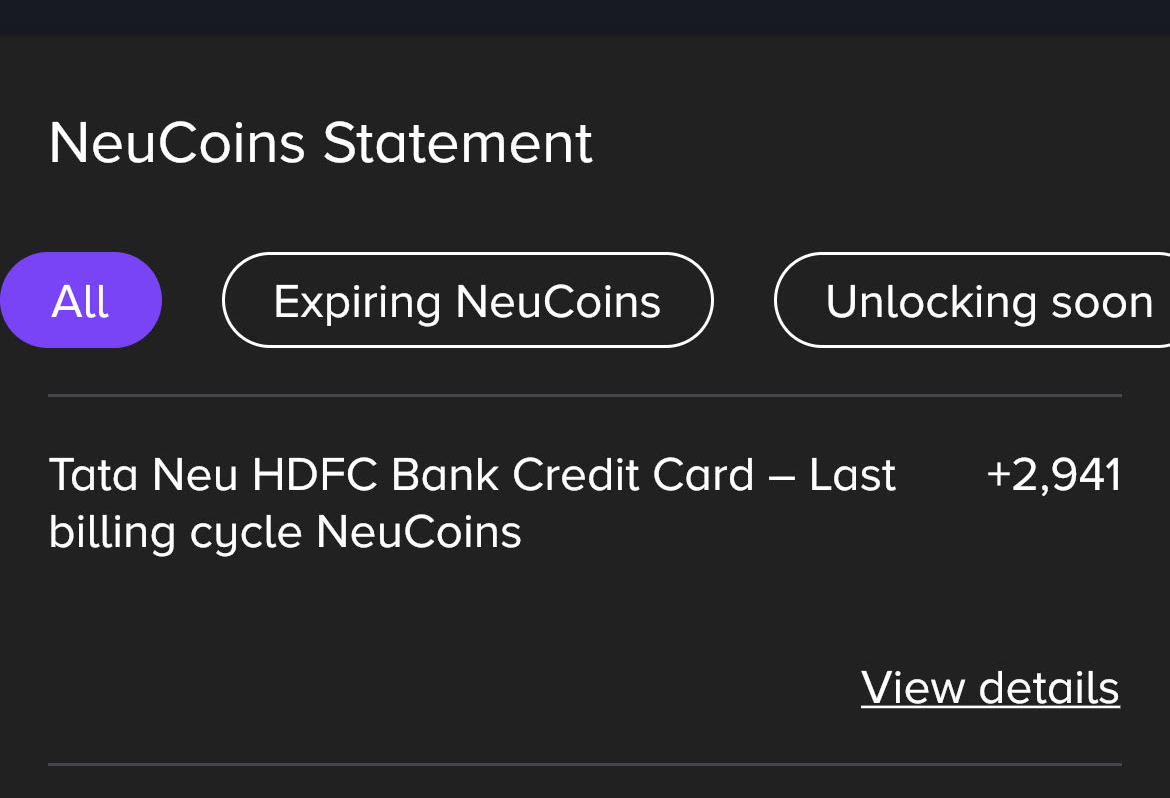

The Tata Neu Infinity HDFC Bank credit card statements show the NeuCoins earned per transaction. Earned NeuCoins are automatically transferred to the Tata Neu app within 7 days of statement generation. They can be used on any of the partner brands for purchases. 1 NeuCoin = Rs 1 for all brands.

Complimentary Airport Lounge Access

| Airport Lounge Access in India | 2 visits/quarter |

| Airport Lounge Access outside India | 1 visit/quarter |

- Airport lounge access in India will be with Visa or Rupay based on card variant. The service is provided by DreamFolks.

- Check this link for the list of eligible airport lounges in India for Tata Neu HDFC Bank credit cards

- Check this link for the list of eligible airport lounges outside India for Tata Neu Infinity HDFC Bank Rupay credit card

Key Benefits

- Fuel Surcharge Waiver: 1% waiver for transactions between Rs 400 and Rs 5000. Maximum waiver of Rs 500 per statement.

- Foreign Currency Markup: 2%+GST ~2.36%

Final Thoughts

The Tata Neu Infinity credit card is a good option. 5% rewards on Tata Neu and partner brands and 1.5% elsewhere are pretty good for a co-branded card. We also get international airport lounge access on both Visa and Rupay variants.

While we do have the SBI Cashback card now for 5% cashback on online transactions, the Tata Neu Infinity is a good backup if the former gets devalued. Plus, we also get the Tata Neu Infinity credit card as LTF on the Tata Neu app for many customers.

The 1.5% NeuCoins on UPI spends is another good benefit for the Rupay variant. We get rewards on daily spending that we used to pay with UPI from our bank account. Just add your Tata Neu credit card to BHIM and you are good to pay right from your credit card.

Frequently Asked Questions

NeuCoins expire 365 days after the last transaction where you earned or redeemed NeuCoins.

Tata Neu Infinity HDFC Bank credit card is the better option for rewards and benefits.

Tata Neu Infinity HDFC Bank Credit Card

Card Maven

26 thoughts on “Tata Neu Infinity HDFC Bank Credit Card”

I have a question regarding Tata Neu Infinity 1.5% on education payments. What is the limit on Neu coins? Does it come under UPI limit or it comes under Retail spends? Is SBI collect education payment eligible for 1.5 Neu coins?

SBI Collect education payments will come under UPI limit. So, max 500 NC.

I have Infinity as an ltf card.

And Axs Ace (paid).

(After considering the recent devaluation in Axs Ace from 2% to 1.5% cb for offline, now both are at 1.5%)

Hence, comparing these two wrt Billpay benefit of 5% in each case, which one do you suggest ?

(as I’m thinking to close ace)

Your suggestion would be appreciated.

Just for Billpay, if Tata Neu Infinity suffices your requirements then don’t see any need for Ace. But, check once by paying all your bills with Tata Neu for a month. Sometimes, the Tata Neu app will not show the credit card option after exceeding bill pay transactions limits. This limit is user-specific.

Hi,

For insurnce payment, do we get 1.5% or 5% ?

5% if paid through Tata Neu app, else 1.5%

I hold the infinia card for the past 3 years but am getting this card only FYF. Is there a way I ask for this to be made LTF?

You can request Tata Neu on X to make it LTF as you have more than Rs 1.5 Lakh limit on existing credit card. But no assurances.

If one takes the LTF offer, will it effect chances of upgrading to another hdfc card in the future or its completely arbitrary

Hold the DCB card

This is a co-branded card. Not sure if upgrades will work on it. This is supposed to be a floater card.

Sorry to not be clear,

If I continue to hold the DCB and take the infinity, will it effect my chances in the future to upgrad the DCB ?

No, there is no impact of that.

Does this card earn rewards for fuel transaction via UPI ?

No, it is excluded

Applied for my father and my wife.. Kvc for my wife was completed.. it was principally approved today.. Still digital card is not generated.

2) My father is 78 years and he already holds Infinia Card.. When I applied with his DOB it did not allow me above 65 age.. So had to change the dob to 65 and got principally approved with Infinia Limit.. We had a kyc call but could not go through due to his age and they confirmed me that they would send a person to my place for the same.. Will both be approved..

The first one is done. Doing the second one is not advisable.

I applied this card yesterday and completed KYC. Today status is shown as rejected in Tata nue app. Also there is an email from hdfc bank to enhance limit of my existing card (I have regalia). They could not process my application due to internal policy.

It’s so frustrating behavior from HDFC Bank. Now I am so angry that I will close my regalia card also as they are not converting it to rupay also.

It’s not applicable for all UPI transactions. The merchant should hold the transactional account in merchandise name. Some of the merchants give their own account as UPI which will not work. However still beneficial for genuine merchants. There is a limit of 2000 per transaction if you pay by scan from image option which is a little annoying

Idk why the Tata Neu app shows that I’m not eligible for this card.

I even have a salaried account in HDFC and pass all the eligibilities required for this.

The card was initially offered FYF and I didn’t take it. Then got an LTF offer, and after lots of notifications and messages from Tata Neu, eventually applied for the card. Already have HDFC Millenia for more than 3 years. But As I happen to be visually impaired, the executive refused to process the KYC online and instead arranged offline KYC. Took 3 days for that to happen. Been more than 3 weeks after that, yesterday I had an executive verification visit at home and he promised the card will be processed soon. HDFC behaving like a typical PSB!! They should learn from ICICI, the AmazonPay card, for those who have an existing relationship with the bank, is processed within a minute with absolutely no fuss or drama.

Finally received the physical card today. The digital card was generated a couple of days ago. Now waiting for the limit to be set at par with my Millania as at the outset, HDFC would issue the card with a limit of only 5000. The card is a decent product, but HDFC really needs to sort their processes out…

thanks for prompt response.

but in the app,there is a message that we are sorry we could not take your application ahead.

so please help.

That message means you are not eligible for the Tata Neu credit card. So, you need to wait to see if it works in the future.

i am already having diners card so i am not getting this card.

please guide how can i get this card?

thanks

Existing HDFC Bank credit card customers are eligible to get this as a second card. Check your Tata Neu app to apply.

I also have Diners Club Privilege card. I got a LTF offer in the Tata Neu app, applied and had the card within a weeks time.