The Tata Neu Plus HDFC Bank credit card is the lower variant of the two co-branded Tata Neu HDFC Bank credit cards. It is offered Lifetime Free to most users and offers a reward rate of 1% to 2% like other entry-level credit cards. But, is it worth taking the Tata Neu Plus HDFC Bank credit card for Tata Neu and other spending? Here is a detailed review of the Tata Neu Plus HDFC Bank credit card.

Fees and Charges

| Joining Fee | Rs 499+GST or FYF |

| Welcome Benefit | 499 NeuCoins |

| Annual Fee | Rs 499+GST or NIL |

| Annual Fee Waiver | Spend Rs 1 Lakh in a membership year |

The welcome benefit is applicable only if the joining fee is paid. It will not be available for FYF and LTF cards. We have to do a transaction within 30 days of card issuance to avail of the welcome benefit.

The card is issued on both Visa and Rupay platforms. But, we recommend getting the Rupay variant when applying for the card as we can use it for UPI spends.

The Tata Neu credit cards are being offered LTF to a lot of customers on the Tata Neu app. So, do check if you are eligible for it.

Rewards

| Purchase Category | Tata Neu Plus HDFC Bank Credit Card |

|---|---|

| Tata Neu and partner brands on app | 2% |

| Air India mobile and app bookings | 2% |

| Utility Bill Payments and Recharges with Tata Pay | 2% |

| All other spends (including merchant EMI and UPI) | 1% |

| Wallet, Gift Vouchers, Fuel, Rent, and Government Transactions | 0% |

- Partner brands include 1MG, Big Basket, Croma, Air Asia, Tata CLiQ, IHCL, Westside, Qmin, Tata Play, and Cult

- Rewards for Grocery transactions capped at 1000 NeuCoins per calendar month

- Rewards for Insurance spending capped at 2000 NeuCoins per day

- Rewards for UPI spends capped at 500 NeuCoins per calendar month

The Tata Neu Plus variant gets just 2% on partner spending which is not great when we see other entry-level credit cards. Wish it were at least 1.5% for other spending and 3% for Tata Neu spending. It would have made it a little more attractive. We have credit cards offering better rewards at the same annual fee.

Fair Usage Policy: Caps on Tata Brand Merchants Rewards

One of the things that the Tata Neu Plus credit card has done is impose a fair usage policy cap on its rewards. This ensures that commercial spends on this card are limited. The caps apply on the spends that earn 2% NeuCoins on Tata Partner brands and transactions.

| Brand | Max Monthly Spends eligible for 2% NeuCoins | Max Annual Spends eligible for 2% NeuCoins |

|---|---|---|

| Croma | Rs 3 Lakhs | Rs 9 Lakhs |

| Tata CLiQ, Westside | Rs 2 Lakhs | Rs 12 Lakhs |

| IHCL, Qmin, Air Asia | Rs 4 Lakhs | Rs 15 Lakhs |

| 1MG, Cult, Tata Play | Rs 1 Lakh | Rs 7.5 Lakhs |

| Bill Payments – Tata Pay | Rs 50000 | Rs 6 Lakhs |

| Big Basket | Rs 50000 | Rs 6 Lakhs |

| Titan, Tanishq | Rs 3 Lakhs | Rs 9 Lakhs |

HDFC Bank SmartBuy Offers for Tata Neu Plus Credit Card

The Tata Neu Plus HDFC Bank credit card does not get the 5% cashback or 5X rewards benefits on SmartBuy like other HDFC Bank credit cards. Instead, we get bonus NeuCoins for SmartBuy transactions at a much lower rate. We can earn a maximum of 1000 bonus NeuCoins per calendar month through SmartBuy.

| Category | Tata Neu Plus HDFC Bank Credit Card (NeuCoins) |

|---|---|

| IGP.com | 4% |

| Flights | 1% |

| Hotels | 4% |

| IRCTC | 1% |

| RedBus | 1% |

| Instant Vouchers | 1% |

| Apple Imagine Tresor | 1% |

| Flipkart | 1% |

Rewards Redemption

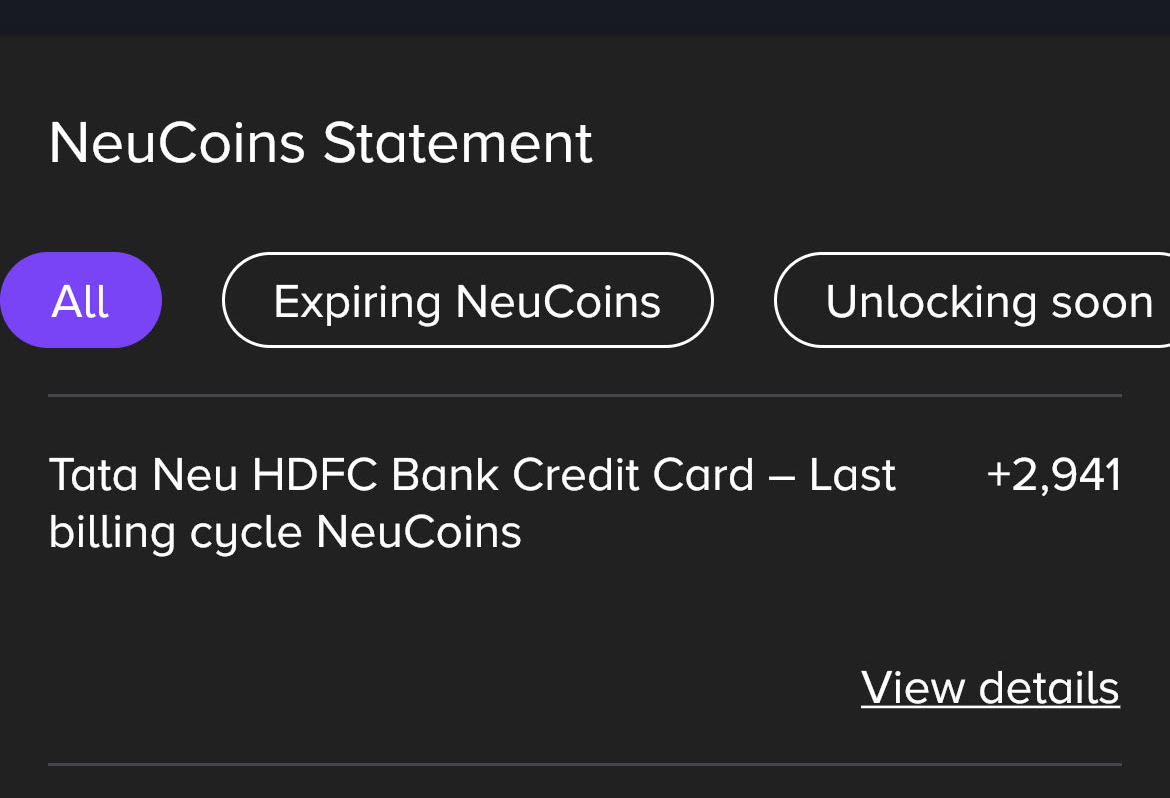

The Tata Neu HDFC Bank credit card statements show the NeuCoins earned per transaction. Earned NeuCoins are automatically transferred to the Tata Neu app within 7 days of statement generation. They can be used on any of the partner brands for purchases. 1 NeuCoin = Rs 1 for all brands.

Complimentary Airport Lounge Access

| Airport Lounge Access in India | 1 visit/quarter |

| Airport Lounge Access outside India | Not Available |

- Airport lounge access in India will be with Visa or Rupay based on card variant. The service is provided by DreamFolks.

- Check this link for the list of eligible airport lounges in India for Tata Neu HDFC Bank credit cards

Key Benefits

- Fuel Surcharge Waiver: 1% waiver for transactions between Rs 400 and Rs 5000. Maximum waiver of Rs 250 per statement.

- Foreign Currency Markup: 3.5%+GST

Final Thoughts

The Tata Neu Plus variant is not an exciting credit card. Rather than 2% rewards on Tata Neu, we would be better off using other cashback credit cards. Even Amex MRCC and Flipkart Axis Bank credit cards are better choices.

So, we would not suggest getting the Tata Neu Plus credit card even for Tata Neu spends. The Tata Neu Infinity variant is a much better choice instead of this.

Frequently Asked Questions

NeuCoins expire 365 days after the last transaction where you earned or redeemed NeuCoins.

Tata Neu Infinity HDFC Bank credit card is the better option for rewards and benefits.

Tata Neu Plus HDFC Bank Credit Card

Card Maven

1 thought on “Tata Neu Plus HDFC Bank Credit Card”

Ok