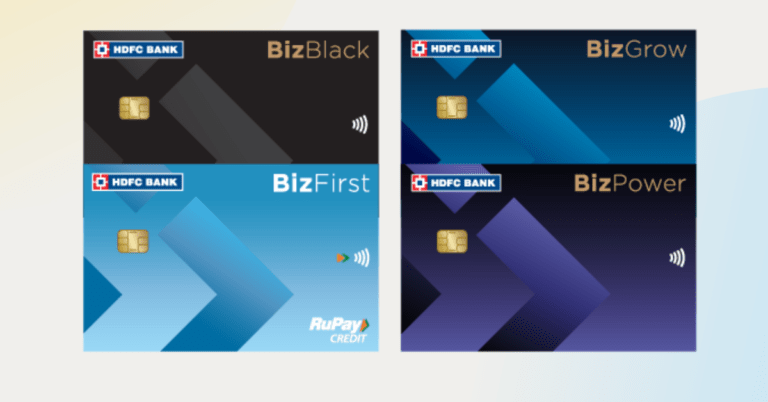

HDFC Bank has launched what are arguably the best business credit cards in India yet. The Biz range has four credit cards named Biz Black, Biz Power, Biz Grow and Biz First for business owners. In these, Biz Black is the super-premium offering with the best rewards and benefits. These are business credit cards and will not be available to salaried individuals. If you are a business owner, then you can get these for your business expenses. Here’s an overview of the new Biz range of HDFC Bank business credit cards.

Biz Black Credit Card

Biz Black is the Infinia equivalent for business spends. It comes in a Metal Edition and offers the top reward rate of 5 reward points per Rs 150.

- Eligibility: Self Employed with annual ITR above Rs 21 Lakh

- Joining and Annual Fee: Rs 10,000 plus GST ~Rs 11,800

- Joining Fee Waiver: On Rs 1.5 Lakh spends in 90 days

- Renewal Fee Waiver: On Rs 7.5 Lakh spends

- Reward Rate: 5 RP per Rs 150 ~3.3%

- Accelerated Rewards: 5X Reward Points on business spends including bill payments, income tax payments, GST and Vendor Payments, AWS, Google, Office 365 and more

- Bonus 4X rewards capped at 7500 RP per statement cycle

- 5K SmartBuy flight/Taj GV on every Rs 5 Lakh spent (excluding rent, petrol) with the card. Maximum 20K worth of GVs in this benefit.

- Unlimited domestic and international airport lounge access

- Redeem reward points at 1:1 for Airmiles and SmartBuy Flights/Hotels

Biz Power Credit Card

Biz Power is the Regalia Gold equivalent for business spends.

- Eligibility: Self Employed with annual ITR above Rs 12 Lakh

- Joining and Annual Fee: Rs 2500 plus GST ~Rs 2950

- Renewal Fee Waiver: On Rs 4 Lakh spends

- Reward Rate: 4 RP per Rs 150 ~1.3%

- Accelerated Rewards: 5X Reward Points on business spends including bill payments, income tax payments, GST and Vendor Payments, AWS, Google, Office 365 and more

- Bonus 4X rewards capped at 5000 RP per statement cycle

- Rs 2500 MakeMyTrip/Reliance Digital GV on Rs 2.5 Lakh quarterly spends

- 16 visits/year to domestic airport lounges and 6 visits/year to international airport lounges

- Redeem reward points at 50p/0.5 for Airmiles and SmartBuy Flights/Hotels

Biz First and Biz Grow Credit Card

Biz First and Biz Grow are entry-level basic credit cards like the Millennia and MoneyBack+ credit cards. But if you are not eligible for the Biz Black and Biz Power credit cards, then may be go for these to use on business spends.

Final Thoughts

Using personal credit cards for business expenses has always been against the T&C. From time to time, we see many personal credit cards getting cancelled for using them for commercial/business purposes. So, it is always good to get a business credit card for business spends. With this new range of Biz credit cards, we finally get good rewards and redemption options just like personal credit cards.

It is also good to see HDFC Bank putting in a lot of thought for these new credit cards. 5X or 16% rewards for tax payments and business spends on Google, Tally and Azure etc. are amazing! We are sure many entrepreneurs and business owners will appreciate that.