Credit cards are great but sometimes we also need to use debit cards for spends. This is where rewarding debit cards like HDFC Bank Millennia debit card are useful. It has annual charges of ₹ 500+GST but is issued free for HDFC Bank Classic, Preferred and Imperia customers. We get 2.5% cashback for online spends and 1% for wallet reloads. Additionally, HDFC Bank Millennia debit card is also eligible for SmartBuy benefits and gets 5% to 10% cashback on SmartBuy spends.

Overview

- Joining Fee: ₹ 500+GST

- Annual Fee: ₹ 500+GST

- Issued free (zero annual fee) for Classic, Preferred and Imperia customers

- Payment Network: Visa, Mastercard, Diners Club

If you are a Classic, Preferred or Imperia customer then you can apply for Millennia debit card without any charges even if you hold any other debit card.

How To Apply for HDFC Bank Millennia Debit Card

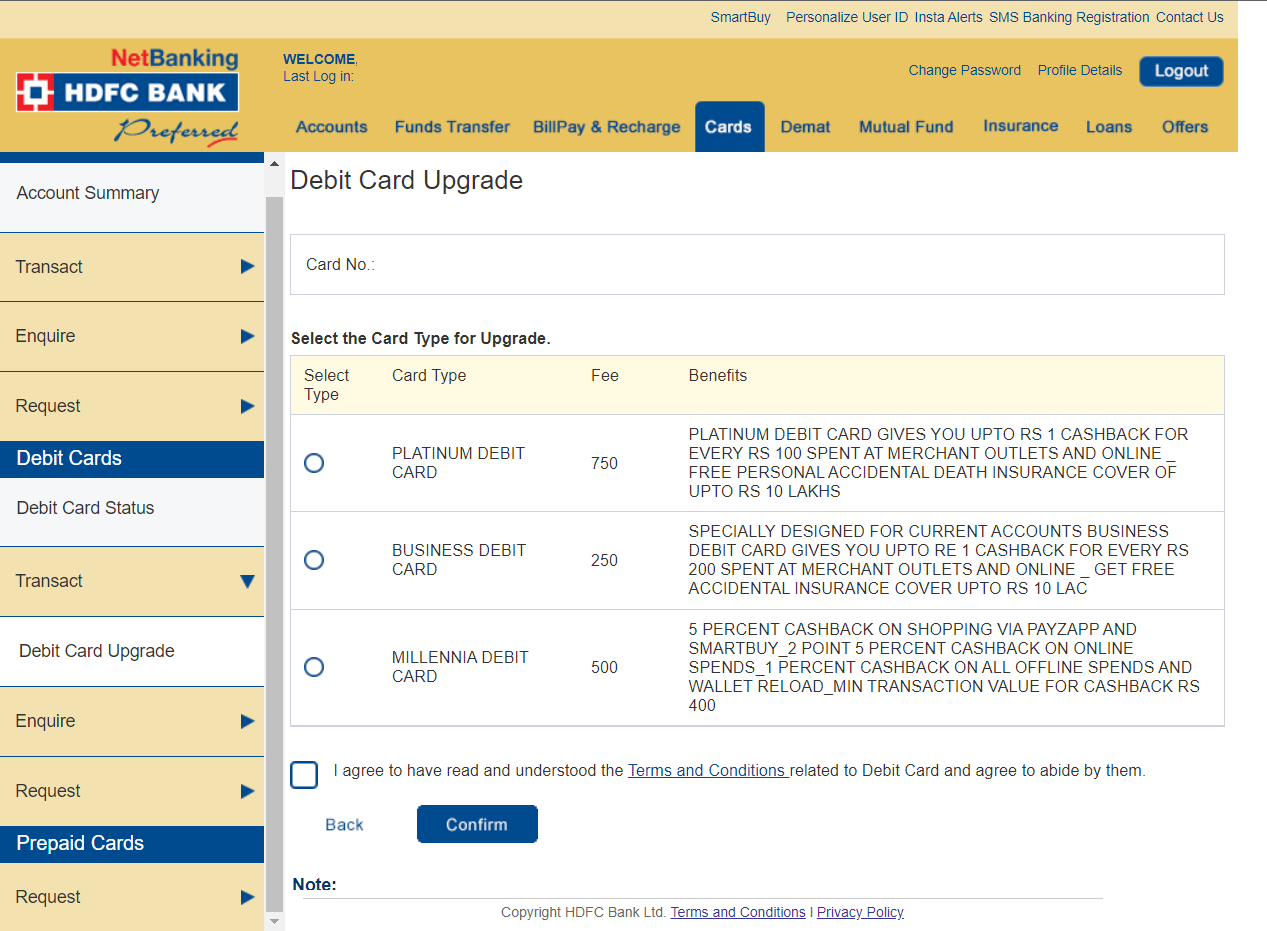

We can apply for Millennia debit card from HDFC Bank Netbanking. The navigation is Cards –> Debit Cards –> Transact –> Debit Card Upgrade.

Cashback on Transactions

| Spend Category | Cashback |

|---|---|

| Shopping via PayZapp or SmartBuy | 5% |

| Online Spends | 2.5% |

| Offline Spends and Wallet Reloads | 1% |

- Maximum cap on SmartBuy cashback is ₹ 1000/calendar month

- Maximum cashback per month for other spends is ₹ 400/calendar month

Below transactions will not get cashback on the Millennia debit card:

- Fuel Spends

- Jewellery

- Business services like credit card bill and insurance premium payment

Cashback Redemption

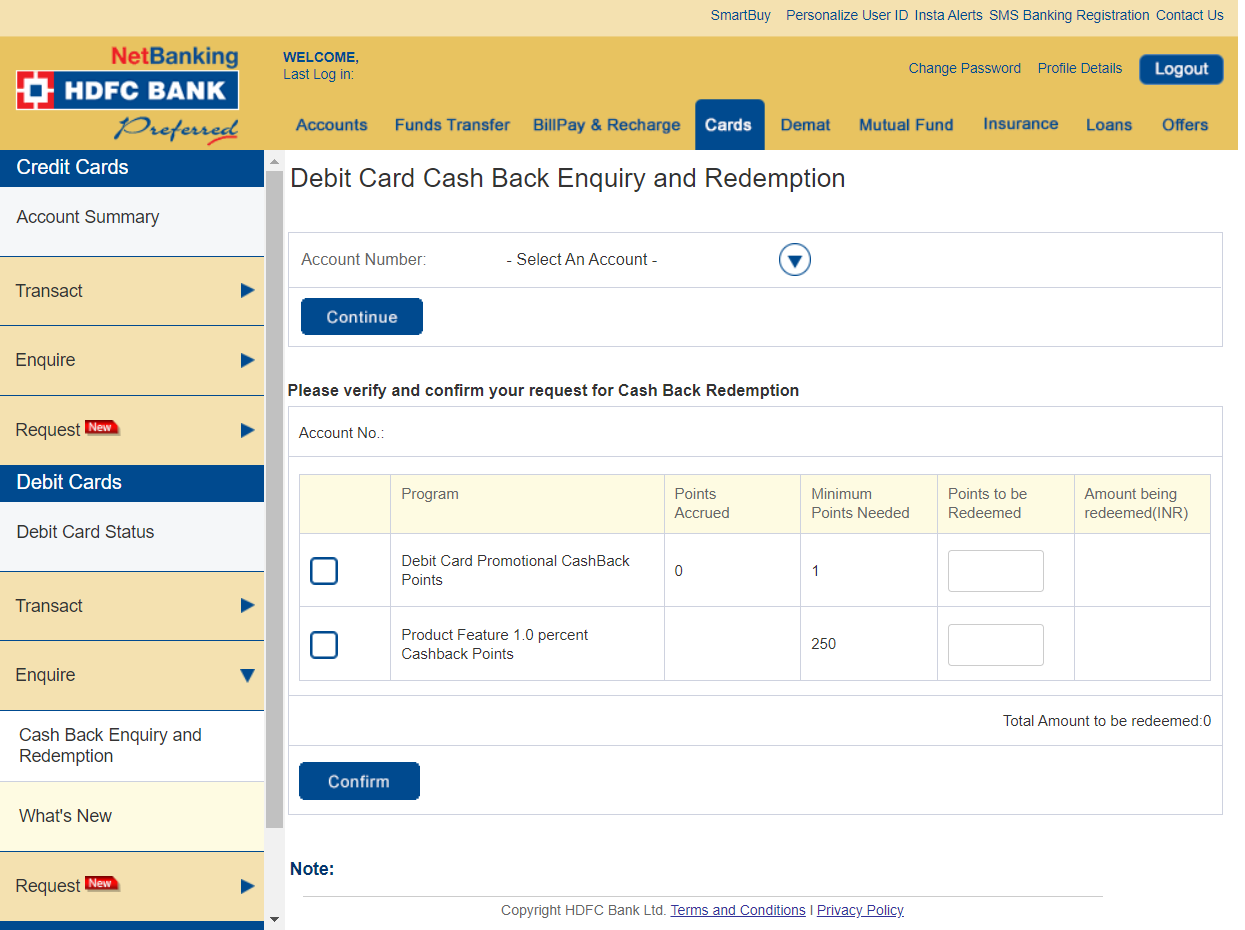

Cashback is valid for 12 months from date of credit. The cashback for transactions is credited within 90 days from end of the calendar month. Cashback can be redeemed from HDFC Bank NetBanking in multiples of ₹ 400. Accumulated cashback can be redeemed from Cards -> Debit Cards -> Enquire -> Cash Back Enquiry and Redemption.

Millennia Debit Card Limits

Millennia enjoys higher limits on shopping and withdrawals over the regular debit cards that are issued by HDFC Bank.

- Daily Domestic ATM withdrawal limits: ₹ 50,000

- Daily Domestic Shopping limits: ₹ 3.5 Lakh

- Daily International Shopping limits: ₹ 1 Lakh

SmartBuy Cashback

SmartBuy has always been a key advantage for HDFC Bank credit cards. SmartBuy also supports accelerated cashback for debit cards like Millennia. The cap for SmartBuy cashback is ₹ 1000 per calendar month for Millennia debit cards.

| Shopping Category | Cashback on Millennia Debit Card |

|---|---|

| IGP.com | 10% |

| Flights | 5% |

| Hotels | 5% |

| IRCTC | 5% |

| RedBus | 5% |

| Instant Vouchers | 5% |

| Apple Tresor | 5% |

| Zoom Car | 5% |

| Nykaa | 5% |

| Jockey | 10% |

| MMT Holiday Packages | 5% |

Complimentary Airport Lounge Access

- Domestic Airport Lounge Access: 4 visits/year capped to 1 visit/quarter

- Spend Requirements for Airport Lounge Access: Spend at least ₹ 5000 in the previous calendar quarter to get complimentary visits in the current calendar quarter.

Check this list of eligible airport lounges to get complimentary access on HDFC Bank Millennia debit card.

Final Thoughts

HDFC Bank Millennia debit card gets ₹ 1400 cashback per month including both SmartBuy and regular cashback. This is good enough for a debit card. But, it does have its limitations too. The cashback redemption should have been automatic instead of having to go into Netbanking to redeem it. That would have been useful as customers may forget to redeem the cashback. The other limitation is the capping of airport lounge access to 1 visit/quarter. That capping should be done away with as we already have a cap on annual basis.

Between Platinum debit card and Millennia debit card, we prefer Platinum as it has a higher cashback on utility and telecom spends. But Millennia has its strong points when it comes to general retail spends.

Frequently Asked Questions

The annual charges are ₹ 500. This is waived off for Classic, Preferred and Imperia customers.

Yes, we get domestic airport lounge access. It offers 4 visits per year. To be eligible, you should have spent at least ₹ 5000 in the previous calendar quarter.

Yes, you can use HDFC BillPay and pay other supported credit card bills (except HDFC Bank) to get 1% cashback.

No, Millennia does not have any fuel surcharge waiver anymore.

HDFC Bank Millennia Debit Card

Card Maven

3 thoughts on “HDFC Bank Millennia Debit Card Review”

Hi,

Can someone confirm if we get 2.5% cashback using this Debit card to make Credit Card payments on the CheQ app?

Sadly the cashback is capped at Rs 400 per month.

Can you write a article for Platinum Debit card from HDFC and also do a comparsion between Millenia Debit & Platinum Debit ?

Hi AK. Yes, it is in progress.