BoB Premier credit card is one of the popular RuPay credit cards from BoB Financial. While it is not as rewarding as the top most offering Eterna, the Premier credit card has its sweet spots. The BoB Premier credit card comes at a joining and annual fee of Rs 1000 plus GST. BoB also runs LTF offers from time to time for this credit card. The card offers accelerated rewards on dining and international transactions and can also be used for RuPay on UPI spends. Here is a complete review of the BoB Premier credit card with its features and benefits.

Fees

| Joining Fee | Rs 1000+GST ~Rs 1180 |

| Joining Fee Waiver | Spend Rs 10000 within 60 days |

| Annual Fee | Rs 1000+GST ~Rs 1180 |

| Annual Fee Waiver | Spend Rs 1.2 Lakh in a year |

Rewards

| Spend Category | Rewards |

|---|---|

| Travel, Dining, and International Transactions | 10 RP/Rs 100 ~2.5% return |

| Special MCCs | 1 RP/Rs 100 ~0.25% return |

| Other Spends | 2 RP/Rs 100 ~0.5% return |

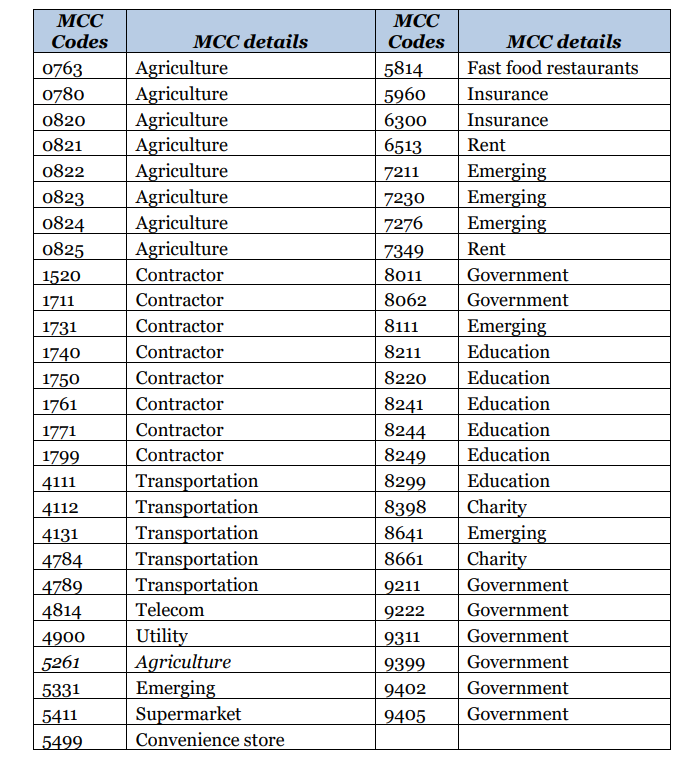

The accelerated reward points for travel, dining, and international transactions are capped at 2000 per month. So, we will hit these with Rs 20000 worth of spending in a calendar month. The special MCCs where we get lesser reward points include some high-spending categories like Rent, Insurance, Utilities, and Government Transactions. The below screenshot has the complete list.

Rewards on UPI Spends

| Spend Category | Rewards |

|---|---|

| Special MCCs | 1 RP/Rs 100 ~0.25% return |

| Other Spends | 2 RP/Rs 100 ~0.5% return |

Complimentary Airport Lounge Access

The Rupay variant of BoB Premier has an edge here. Only the BoB Premier Rupay variant gets complimentary visits to international airport lounges. All thanks to it being on the JCB Rupay platform. So, get the BoB Premier JCB Rupay variant instead of Visa.

| Complimentary Domestic Airport Lounge Visits | 1 per quarter |

| Complimentary International Airport Lounge Visits | 4 per year |

Other Relevant Points

- Foreign Currency Transactions Markup: 3.5% plus GST

- Charges on Rent Payment: 1% of the amount plus GST

- Fuel Surcharge Waiver: 1% on transactions between Rs 400 and Rs 5000 (Max Rs 250 per statement cycle)

Should you get the BoB Premier credit card?

BoB Premier is a good card for the 2.5% value back on travel, dining, and international transactions. But, the 0.5% value on other categories is a bit too less. We have many good entry-level credit cards in the market now. It was a good card to grab with the LTF offer that was going on in 2023. But with the annual fee back on the card, we find it hard to recommend getting this card. But, if the LTF offer comes back at some point in time then go for it.

- It will let you help you in availing the BoB merchant offers online to get 10% instant discount

- BoB Premier RuPay variant will get you international airport lounge access

13 thoughts on “BoB Premier Credit Card”

HI, do the exclusion list for BOB cards to earn reward points apply to UPI payments too?

Just updated the post with UPI reward rates. It is different.

Does it give any rewards on UPI payments?

Yes, it does. The standard reward rates apply.

Is bob premier credit card is life time free or any annual charges are there?

LTF offer is not available as of now.

Hi,

There are no Complimentary International Airport Lounge Visits in this card.

It is available only for the Rupay JCB variant

Is bob still offering Premier card on ltf basis or on spend based?

It is still being offered LTF.

Tried to apply using the link getting message as “INSUFFICIENT_PERMISSIONINSUFFICIENT_PERMISSION”. Please update the correct link. Thank you.

Please try now. I have replaced the link.

Can we switch to Eterna from premier ?

I received the bob premier card today. I wanted to know i can get Eterna instead of Premier. Is there way i can get eterna now , i am eligible as per their income requirement

also do we get 2.5% on wallet load or just 0.5%?