While digital transactions have picked up in India in recent times, people still think twice before using their debit cards/credit cards at a retail shop and more so in online transactions. What happens when a transaction fails but there is a debit on your account?

I was in a similar issue recently – I did a transaction online with Cred for paying my credit card bills using an HDFC Bank debit card. HDFC Bank deducted the amount while CRED did not get the transaction success message for some reason.

I had to go into loops with CRED to check the transaction status. In the end, when CRED confirmed not receiving the amount, I decided to go ahead with raising a debit card transaction dispute with HDFC Bank.

How to raise a transaction dispute with HDFC Bank?

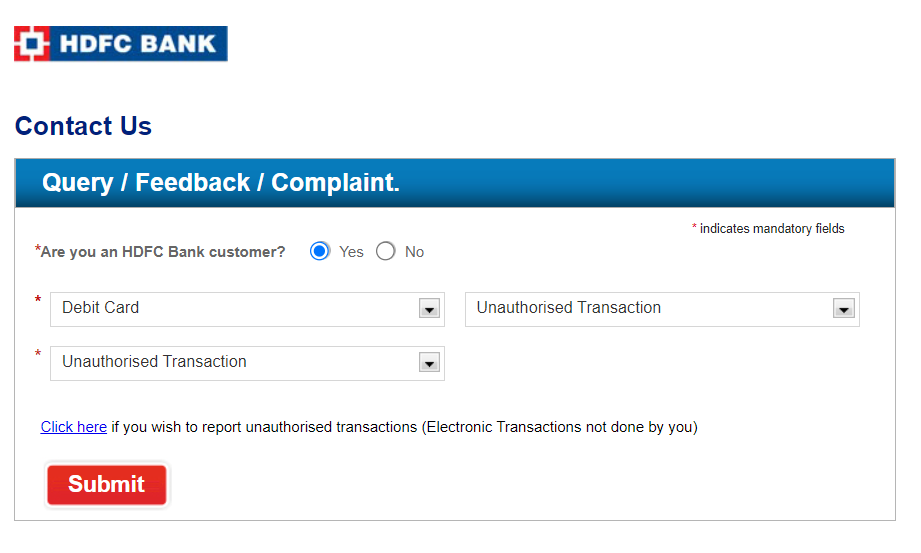

- Raise a complaint through the online complaint portal of HDFC Bank.

- Choose Product/Service as ‘Debit Card’.

- Choose ‘Unauthorised Transaction’ as the query.

- Enter the details in the form – savings account number, date of transaction, and the amount and submit the form.

What happens after your raise the transaction dispute with HDFC Bank?

- HDFC Bank sends an automated email with a unique complaint id in the format HBL=XXX-XXX-XXX.

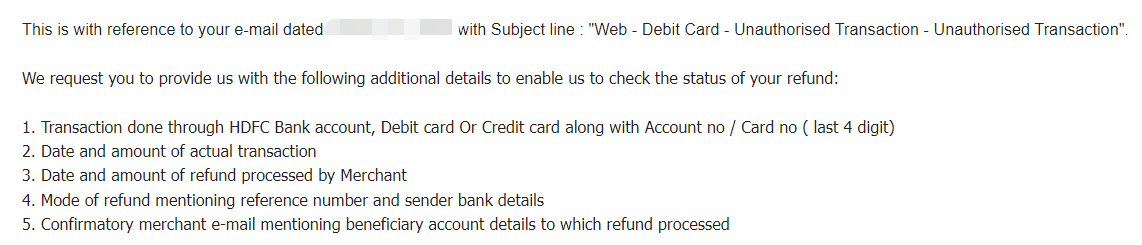

- HDFC Bank might also call or send an email asking to provide some additional details on the transaction.

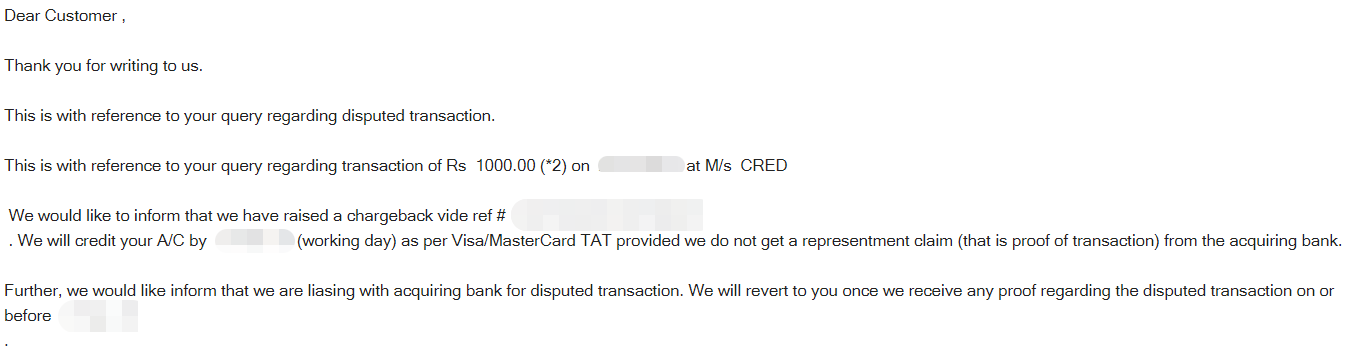

- That’s it. Then HDFC Bank will follow up with the merchant for the disputed transaction to verify if they acknowledge the transaction or else process a refund to the source account. No, follow-up is required from our end.

- I also received some calls from CRED on what is the issue as they were asked for information on the disputed transaction.

My experience with HDFC Bank for a disputed transaction

In my case, it took some calls between CRED and me to make them understand the issue. I sent them copies of my savings account statement from the time the transactions were done. They compared it to their history of payments received and credited to the credit card. Eventually, they found that one transaction was unaccounted for.

Finally, after around 45 days the merchant CRED issued me a refund for the transaction to my linked savings account. Overall, I am satisfied with how HDFC Bank followed up and got the job done!