It’s not just super-premium credit cards that offer points and miles. Even an entry-level credit card like the HSBC Visa Platinum helps you earn miles for your dream vacation. With the HSBC Visa Platinum credit card, you can earn 2 reward points for every Rs 150 spent. Additionally, it gets 5X rewards for spending Rs 4 lakhs in a membership year. Benefits of the card include a BOGO BMS offer and a fuel surcharge waiver. Check out our detailed review of the HSBC Visa Platinum credit card.

Eligibility

- Age: Between 18 and 65 years

- Minimum Annual Income for salaried individuals: 4 LPA

- City of Residence: Bangalore, Chennai, Gurgaon, Hyderabad, Mumbai, New Delhi, Noida, or Pune

HSBC does not provide the Visa Platinum card to self-employed individuals. There are some rare exceptions if there is an existing saving account with a high balance but I have not seen this working for some time now. You need a very high NRV for this to work.

Fees and Charges

The HSBC Visa Platinum credit card is Lifetime Free (LTF) with zero joining and annual fee. We get some good welcome benefits on this card. We need to spend a minimum of Rs 2500 or more within 30 days of card issuance to get below benefits.

- Rs 500 Amazon gift voucher

- Rs 250 Swiggy gift voucher

- 3 complimentary airport lounge access or 3 meal vouchers (for airport restaurants in India)

Rewards

The standard earn rate on the HSBC Visa Platinum is little low at 2 RP/Rs 150 but the 5X RP on incremental spends make it a good deal.

- Regular Spends: 2 Reward Points/Rs 150 ~ 1.3% Return

- Monthly Milestone: Rs 250 cashback on Rs 50000 spends in a calendar month ~0.5% Return

- 5X RP on incremental spends above Rs 4 Lakhs in a membership year. Maximum 15000 RP. We hit this cap on incremental spends of Rs 2.25 Lakhs.

We get a total of 20333 RP (5333 regular RPs + 15000 accelerated RPs) on spends of Rs 6.25 Lakhs in a membership year. The best part is the redemption options that we get for these reward points.

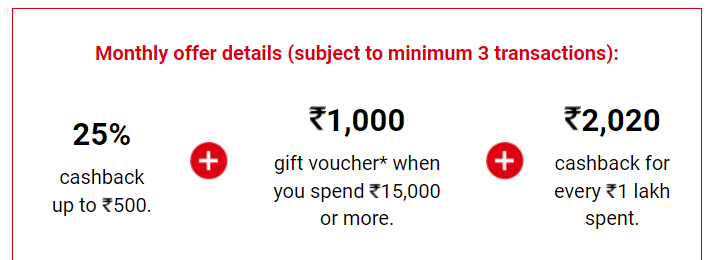

Spend Offers

HSBC also runs good spend offers during Diwali and New Year. Below is one of the cashback offers that was sent out in 2020. Pretty sweet offer to get an extra 3% cashback on spending.

Rewards Redemption

The HSBC Visa Platinum card has multiple redemption options in the reward redemption catalog. We can get Amazon, Flipkart and other gift vouchers as well. But, the value of 1 RP is around 20 paise in these cases. I would not recommend using these redemption options.

The best redemption options are when we opt for one of the transfer partners for airlines or hotels.

| Transfer Partner | Conversion Ratio |

|---|---|

| InterMiles | 2 RP = 1 InterMile |

| Singapore Airlines | 1 RP = 1 Kris Flyer Mile |

| British Airways | 1 RP = 1 Avios Mile |

Except InterMiles, all other transfer partners get a 1:1 transfer ratio. So we get 20333 miles on Rs 6.25 Lakhs spend. This makes it 3.25 Miles/Rs 100, a very good earn rate for an entry-level LTF credit card.

No complimentary Airport Lounge Access

Surprisingly or may be not, the HSBC Visa Platinum credit card does not get complimentary airport lounge access. We have it as a welcome benefit but not from second year onwards.

Other Key Benefits and Charges

- Foreign Currency Markup: 3.5%+GST

- 1% fuel surcharge waiver up to Rs 250 in a calendar month (For transactions between Rs 400 and Rs 4000 and only after 90 days of credit card issuance)

- BookMyShow BOGO up to Rs 250 on the second ticket. Valid once per calendar month and for transactions done on a Saturday.

Final Thoughts

If you are eligible, we would suggest getting the HSBC Visa Platinum credit card. For a LTF card, the earn rate is pretty decent and becomes even better if we get into 5X RP zone. From time to time, HSBC also runs good spend offers that help in getting extra savings. Plus, we get regular offers like the below one for discounts and bonus RP on travel as well.

Frequently Asked Questions

Yes, we do not earn rewards for fuel purchases where the surcharge waiver is applicable.

Yes, the reward points earned are valid for three years from the date of credit.

We get airport lounge access only as a welcome benefit. It is not available from second year onwards.

HSBC Visa Platinum Credit Card

Card Maven

5 thoughts on “HSBC Visa Platinum Credit Card Review”

compare it with HSBC premier.

HSBC Premier needs a banking relationship. So, not directly comparable. But Premier will get you more benefits.

I have crossed 4L annual spend but I didn’t get any 5x reward point. After 1 hr call with customer care they agreed to take a case to credit 5x reward point. But what caught me by surprise was that, I was told the normal reward point of 2points/150 is considered as 2x – the additional reward point we will be getting is 3points/150 (on top of regular 2points/150.

As per this article and as per my previous understanding I thought we will be getting total 10points/150 spend above 4L – but it’s only 5points/150 for spend above 4L. I’m not sure if this is correct or not. can someone clarify.

You got remaining accelerated reward points?

How to get the membership of Taj Inner Circle Point?

Can you write a article for above if possible

Thanks , Appreciate your articles..very informative