The Standard Chartered Rewards credit card is the most recent launch from Stan Chart India. It shares the name with the existing Platinum Rewards credit card but offers relatively better benefits than it does. We get it free for the first year with a Rs 1000 annual fee from the second year onwards. The SC Rewards credit card offers up to 8 reward points per Rs 150 on spending. We also get complimentary domestic airport lounge access in the benefits. Here’s a detailed review of the Standard Chartered Rewards credit card.

Fees & Charges

| Joining Fee | Zero – First Year Free |

| Welcome Benefit | None |

| Annual Fee | Rs 1000+GST |

| Annual Fee Waiver | Spend Rs 3 Lakhs in a membership year |

| Renewal Benefit | None |

Rewards

| Spend Category | Rewards | Return |

|---|---|---|

| Government and Insurance | 1 RP per Rs 150 | 0.17% |

| Fuel | No rewards | NIL |

| All other retail spends | 4 RP per Rs 150 | 0.67% |

| Bonus Rewards (Not applicable on Govt., Insurance and Fuel spends) | 4 RP per Rs 150 | 1.33% (incl. regular RP) |

The return rate inclusive of bonus rewards is around 1.3%. This is decent but still less than what many cashback credit cards offer today. Also, we get this reward rate only for monthly retail spending above Rs 20000. The bonus reward points are capped at 2000 RP per statement cycle.

Complimentary Airport Lounge Access

The Standard Chartered Rewards credit card only offers complimentary domestic airport lounge access.

- Domestic Airport Lounge Access: 1 visit per calendar quarter with Visa card

- International Airport Lounge Access: Not Available

Rewards Redemption

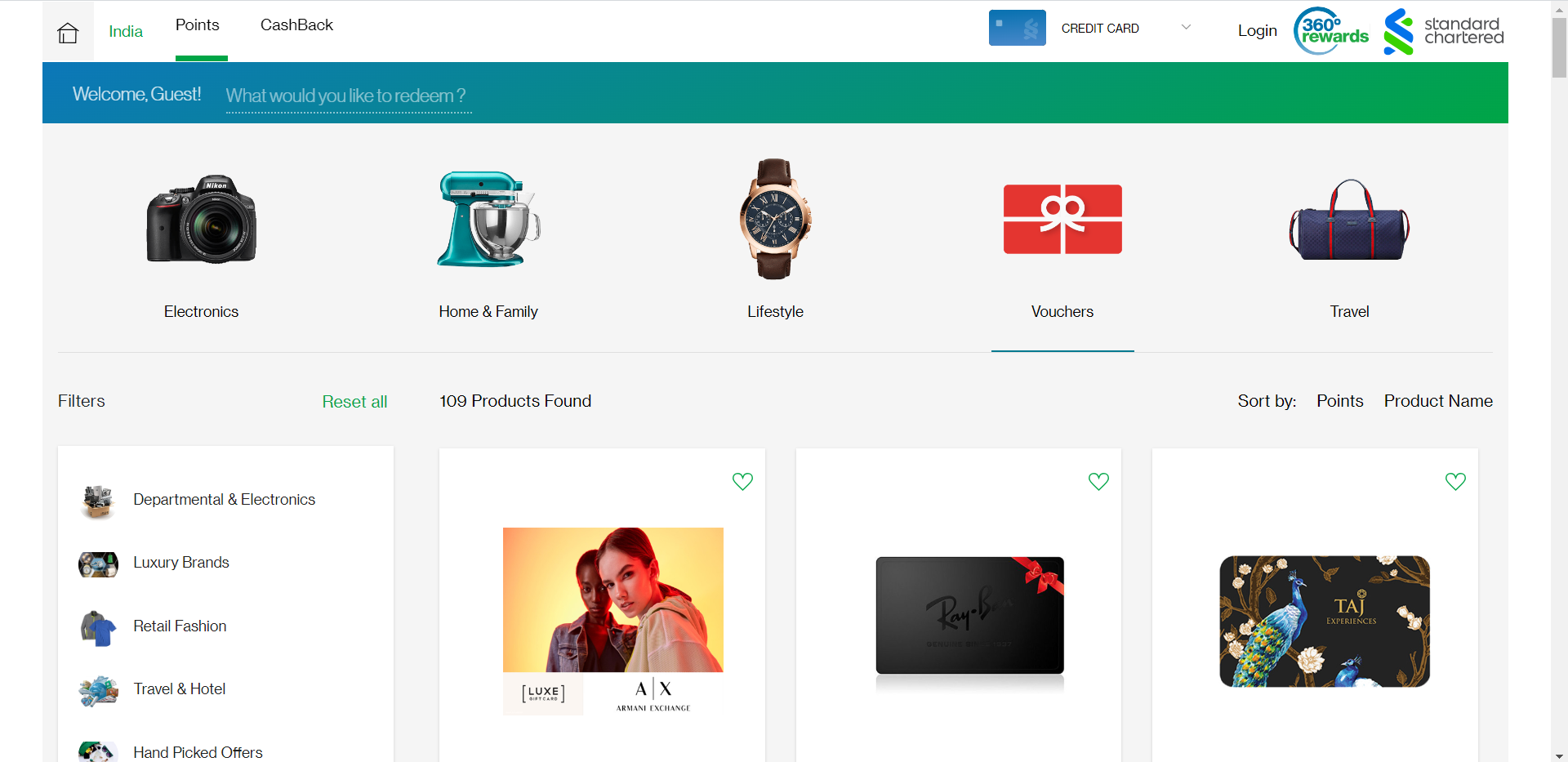

The cashback and reward points can be redeemed from Standard Chartered 360 rewards portal. Each reward point is worth 25 paise. While there are products for redemption, the best option is to redeem them from the available gift vouchers.

There is a charge of Rs 99+GST per redemption request for the Standard Chartered Rewards credit card. This is not justified for an entry-level credit card with an annual fee.

Other Benefits and Charges

- Fuel Surcharge Waiver: 1% waiver on transactions between Rs 400 and Rs 2000. Maximum fuel surcharge waiver of Rs 400 per month.

- Foreign Currency Transaction Charges: 3.5%+GST

- Finance Charges: 3.49% per month / 41.88% annually

Final Thoughts

The Standard Chartered Rewards credit card is a primary entry-level offering. Even though it is a new offering, it loses out on the rewards offered by existing credit cards. For an annual fee of Rs 1000, we should have seen a minimum reward rate of 2% with other benefits. But, the Rewards credit gets at most 1.3%.

Comparing this to the Flipkart Axis credit card, we get 1.5% cashback on all spends and 5% cashback on Flipkart. So for someone who already has better cashback cards, the Rewards credit card does not make for a good case.

Frequently Asked Questions

No, we do not get a welcome benefit on this card. We currently have an FYF offer to get it for a zero joining fee.

Yes, we get 1 complimentary visit per calendar quarter with the Visa card at eligible lounges.

No, there is no complimentary international airport lounge access on this card.

Yes, we get an annual fee waiver on spending Rs 3 Lakhs in a membership year.

Standard Chartered Rewards Credit Card

Card Maven