Airtel Axis Bank credit card is a must-have if you have Airtel connections in your home, be it prepaid, post-paid, broadband or DTH. It comes at a joining and annual fee of Rs 500+GST. The annual fee is waived on Rs 2 Lakh spend. The cashback that Airtel Axis Bank credit card offers for this annual fee is something that no other cashback credit card can match. We get 25% cashback on Airtel recharges and bill payments with Airtel Thanks app. Utility bill payments get us 10% cashback. We also have preferred partners where we can get 10% cashback on spends.

Fees

The fees and annual fee waiver are good enough for an entry-level credit card. Airtel Axis Bank credit card is an invite-only card and we can apply it only from the Airtel Thanks app.

| Joining Fee | Rs 500+GST |

| Welcome Benefit | Rs 500 Amazon Gift Voucher on the first transaction within 30 days |

| Annual Fee | Rs 500+GST |

| Annual Fee Waiver | On Rs 2 Lakh spends in a membership year excluding rent and wallet load transactions |

Cashback

| Spends Category | Cashback | Cap |

|---|---|---|

| Airtel Mobile, DTH, and Broadband Payments on Airtel Thanks app | 25% | Rs 250/statement cycle |

| Utility Bill Payments on Airtel Thanks app | 10% | Rs 250/statement cycle |

| Preferred Merchants (Swiggy, Zomato and BigBasket) | 10% | Rs 500/statement cycle |

| Other Spends (excluding categories below) | 1% | NIL |

The 25% cashback on Airtel recharges/bills and 10% cashback on utility bills are sure to attract a lot of Airtel customers. The caps are good enough for a family of 2-3 people. The 1% cashback on other spending is also good as this card can be used for all kinds of spending. The cashback is redeemed as statement credit.

Below spends will not get any cashback on the Airtel Axis Bank credit card:

- Education

- Fuel

- Wallets

- Jewellery

- Government Payments

- Insurance

- Rent

- Utility Bill payments outside Airtel Thanks app

Complimentary Airport Lounge Access

- Airport Lounge Access in India: 4 visits/year

- Airport Lounge Access outside India: Not Available

Airtel Axis Bank credit card offers 4 complimentary domestic lounge visits in India per calendar year. So, if you are an occasional domestic traveller this card can help you with lounge access. The list of participating lounges is limited to a few cities – Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, and Pune. The details are available over here.

Airtel Axis Bank credit card has a minimum spends requirement to get complimentary airport lounge access. We now need spends of Rs 50,000 over a rolling period of last 3 calendar months to get complimentary airport lounge access. For example, if you need to access the airport lounge on 10th of March, then you should have spent Rs 50,000 in the period from 1st of December to 28th of February.

Other Key Benefits & Charges

- Fuel Surcharge Waiver: 1% fuel surcharge waiver for transactions between Rs 400 to Rs 4000. Maximum waiver is capped at Rs 500/statement.

- Foreign Currency Markup: 3.5%+GST ~4.1%

- Interest Rates: 3.6% per month

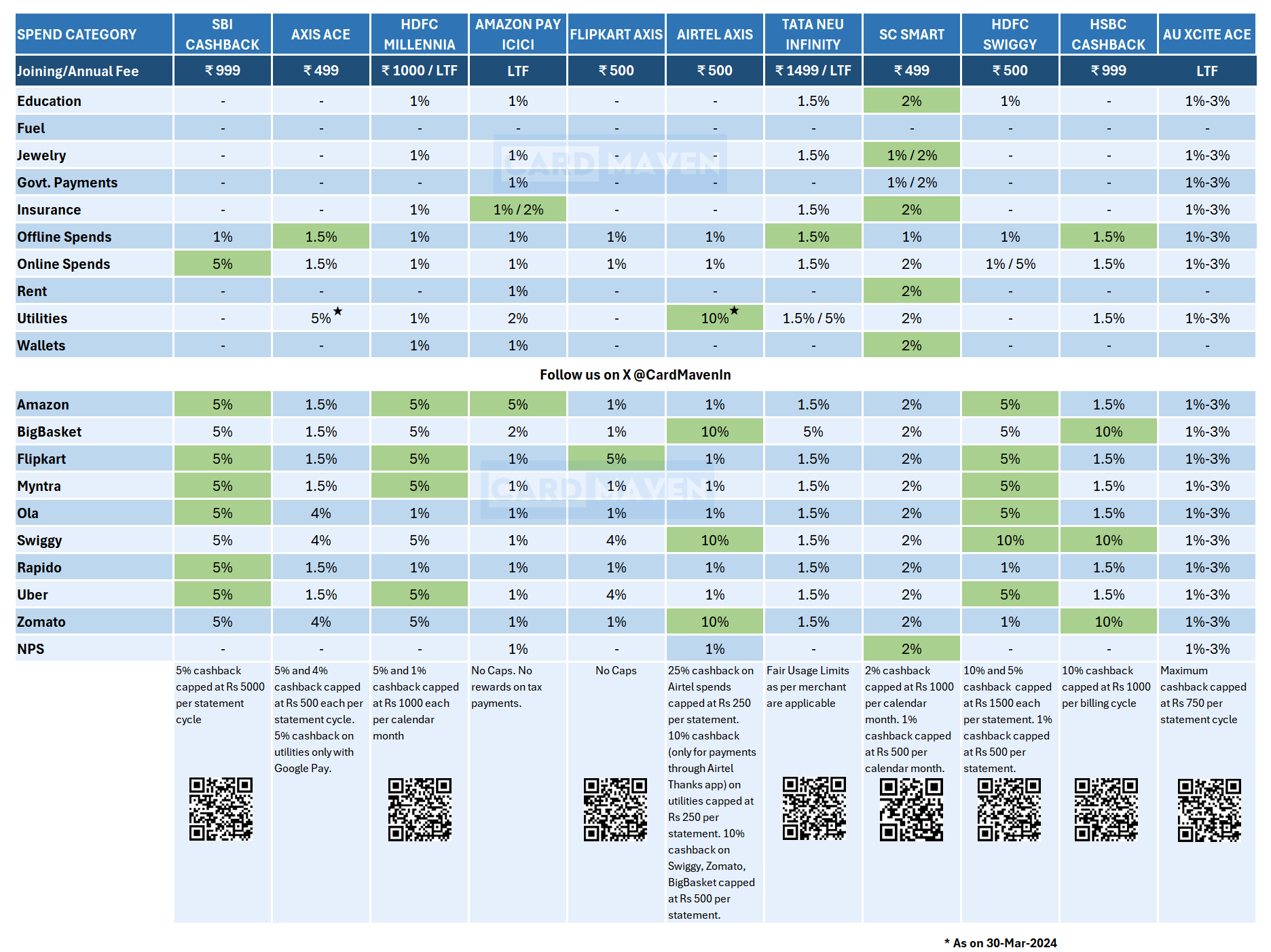

Airtel Axis Bank Credit Card vs Other Cashback Credit Cards

If you have multiple cashback credit cards and want to know which is the best one for your spends, refer to our handy chart below. It has cashback percentage comparisons across multiple cashback credit cards to find the best one for your spends.

Maximizing cashback on Airtel Axis Bank Credit Card

While Airtel Axis Bank credit card annual fee waiver at Rs 2 Lakh spend, it is better to not target it and instead just maximize the cashback in each of the categories.

- Maximize cashback cap for utility spends by spending Rs 2500/statement cycle

- Maximize cashback for Airtel spends by spending Rs 1000/statement cycle

This takes our total spends in a membership year year to Rs 42,000 on these categories. The overall reward rate comes to an amazing 14%. Even if we pay the annual fee from second year onwards, the net reward rate comes to 13% which is still pretty great.

Final Thoughts

Axis Bank has some good entry-level cashback credit cards like the Flipkart Axis and Ace. The Airtel Axis Bank credit card joins that list. This card is ideal for Airtel customers who prefer cashback over reward points and miles.

For some, this might even be a better cashback card than Ace depending on your spending. If you use Airtel services and have up to Rs 2500 worth of utility spends, this card gives you better cashback than Ace. Ace is better in one area, with 1.5% cashback for all spends.

Frequently Asked Questions

We can apply for the Airtel Axis Bank credit card only from the Airtel Thanks app. It is not possible to apply for this card from Axis Bank’s portal.

Yes, we get 4 visits per year but with a spends requirement. We need to have spends of Rs 50,000 in the last 3 months for complimentary airport lounge access.

We do not get any cashback for spends on utility spends other than Airtel Thanks app, education, fuel, wallets, jewellery, government payments, insurance and rent.

Airtel Axis Bank Credit Card

Card Maven

12 thoughts on “Airtel Axis Bank Credit Card”

I applied a few days back through the Airtel Thanks App, but got rejected saying I don’t fit the bank’s criteria. I earn 70K+ a month easily so I am unsure what else is in the criteria. If there is any workaround or any other way that I should apply I’d be glad to know.

No workarounds. This card has always been difficult to get. You may want to try for some other mobile number in the family.

Will I be able to pay friends and family Airtel services bills using it and get 25% cashback. Or services have to be on card holders name

Yes, you can

Insurance payment on Airtel Thanks app will get 10% cashback or not?

It is not applicable on insurance transactions.

Application of mine got rejected.

Is there any possible way to get it approved else way?

By mailing nodal officer? Or get it against FD?

I mailed nodal officer to reconsider and pathetic customer service, they told to get credit card against FD and also to reply back with the application reference number if not eager to do FD.

I have replied with the reference number to reconsider as well as provide airtel CC against FD for which I am ready to book an FD now waiting for the principal nodal officer to reply for my replied mail.

Is there any chance that they’ll approve? Or allow me to get airtel CC against FD?

Can a non-airtel user apply for the card? Thinking of getting one, but only if card is approved then only will port to airtel.

Is there any internal criteria to apply from a airtel sim only for further approval?

Cashback capping is 300₹ per statement period or calendar month?

It is per statement period.

Have they stopped issuing this card? Applied 1 month back, haven’t got the card yet.

good article