When it comes to popularity, it is the rewards and cashback credit cards that rule the market. The third type of credit cards for earning and redeeming airmiles continue to be a niche segment. Axis Bank Atlas credit card is a credit card that does just that. It does not offer cashback or rewards. The Axis Bank Atlas credit card earns ‘EDGE Miles’ – a new reward currency. These EDGE Miles can be transferred to an extensive list of airline and hotel partners like EDGE Rewards. It also offers great milestone benefits and rewards as Tiers. At a lesser annual fee, the Atlas can be one of the good options over Magnus to earn miles on spending.

Fees

| Joining Fee | Rs 5000+GST ~Rs 5900 |

| Welcome Benefit | 5000 EDGE miles on 3 transactions within 60 days from card issuance |

| Annual Fee | Rs 5000+GST ~Rs 5900 |

| Renewal Benefit | 2500 to 10000 EDGE Miles (Based on Tier) |

The 5000 EDGE Miles are equal to 10,000 partner miles. Some of the partner programs on Atlas will give you a good value on this, even higher than the joining fee you are paying. For example, you can move them to partners like Club ITC or Accor ALL to get a value of more than Rs 2 per EDGE Mile. Axis Bank Atlas credit card also offers a renewal benefit based on the tier you are in. If you reach the Platinum tier, you get 10000 EDGE Miles for the same annual fee of Rs 5000+GST. So, the more you spend the better value you get on the Atlas.

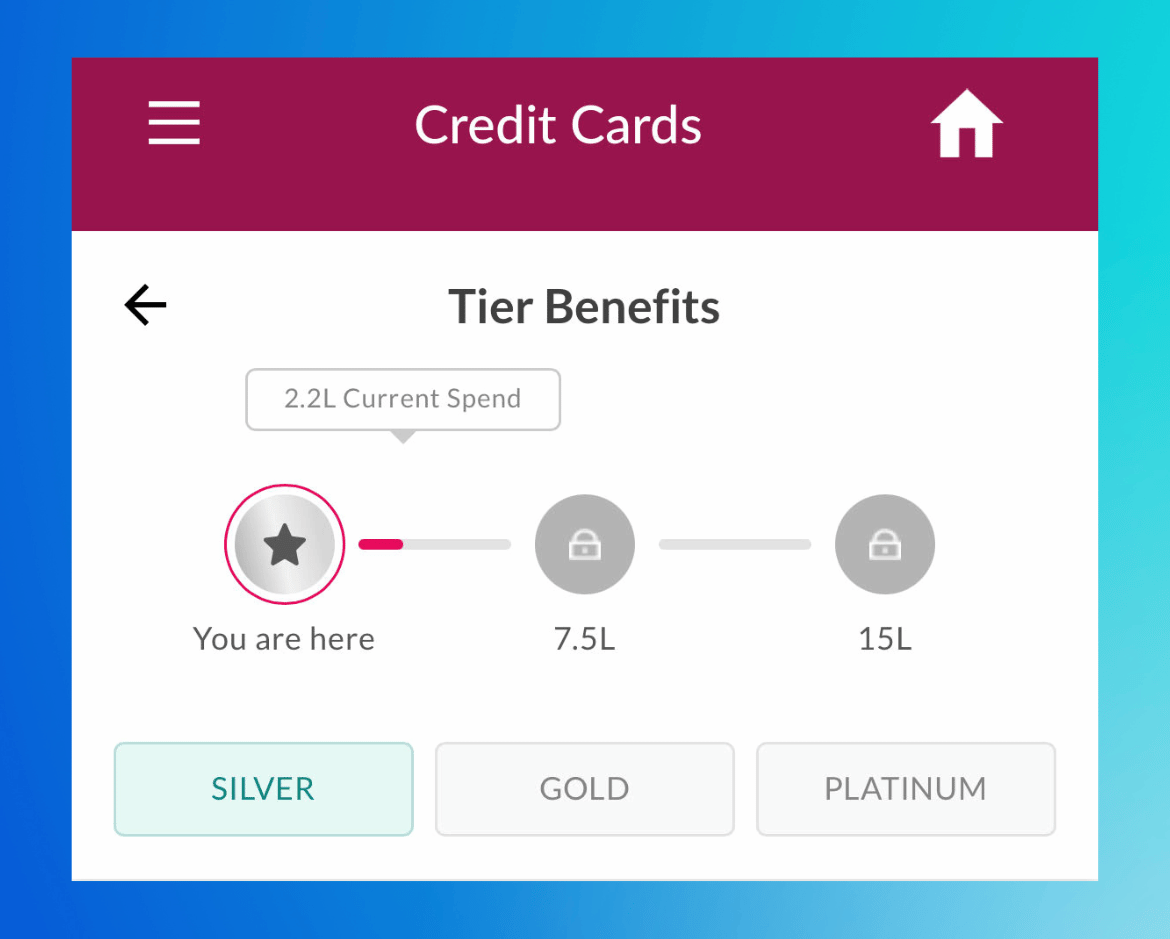

Axis Bank Atlas Credit Card: Tier Benefits

Just like the airlines’ loyalty programs, Axis Bank has created a tier system for the Atlas credit card. The tier is decided based on the aggregate spends in an anniversary year. Each tier gets you bonus rewards and benefits adding to the value you get out of the credit card. The tier changes happen as and when we hit the target spends. So, if you spend Rs 7.5 Lakh in a membership year you immediately get the Gold Tier and also retain it for another membership year when you renew the card.

Transactions done on Gold/Jewellery, Rent, Wallet, Government Institutions, Insurance, Fuel and Utilities merchants are not eligible for tier calculation.

- Silver: Initial Tier when you get the card

- Gold: Rs 7.5 Lakh spend

- Platinum: Rs 15 Lakh spend

EDGE Miles Earn Rate

| Spend Category | Earn Rate |

|---|---|

| Travel (Airlines, Hotels and Travel EDGE Portal) | 5 EDGE Miles/Rs 100 for spends till Rs 2 Lakh/calendar month 2 EDGE Miles/Rs 100 for spends above Rs 2 Lakh/calendar month |

| Other Spends | 2 EDGE Miles/Rs 100 |

| Fuel Surcharge Waiver Transactions | No EDGE Miles |

| Wallet, Gold, Jewellery, Rent, Insurance, Govt. Institutions, Utilities and Fuel | No EDGE Miles |

The 5 miles per Rs 100 on travel spends is the USP of this card. Only direct spends at airline and hotel websites are eligible for 5 EM/Rs 100. OTA bookings will not be eligible for the accelerated EDGE Miles earn rate. The standard reward rate for other transactions is 2 EDGE Miles/Rs 100. While this is already a good earn rate, it is further complemented by the milestone rewards and benefits.

Axis Bank Atlas Credit Card: Milestone EDGE Miles

Transactions done on Gold/Jewellery, Rent, Wallet, Government Institutions, Insurance, Fuel and Utilities merchants are not eligible for milestone benefits.

- Rs 3 Lakh Spend: 2500 EDGE Miles

- Rs 7.5 Lakh Spend: Additional 2500 EDGE Miles and Gold Tier

- Rs 15 Lakh Spend: Additional 5000 EDGE Miles and Platinum Tier

Renewal Benefit

The Axis Bank Atlas credit card does not have an annual fee waiver criteria but we get EDGE Miles benefits based on the tier during renewal. This is over and above the milestone benefits from above. So, if you spend Rs Rs 15 Lakh in a year you get 7500 EDGE Miles including both milestone and renewal benefits.

- Silver: Not Applicable

- Gold: 2500 EDGE Miles

- Platinum: 5000 EDGE Miles

EDGE Miles Redemption

- 1 EDGE Mile = Rs 1 for booking flights/hotels on Travel EDGE Portal. This can be used for booking revenue flights like IndiGo on Travel EDGE.

- 1 EDGE Mile = 2 Partner Airmiles

Axis Bank Atlas Credit Card Transfer Partners

Axis Atlas gets access to all the transfer partners that Magnus and Reserve get. Total EDGE Miles that can be transferred to partner points in a calendar year is capped to 1.5 Lakh EDGE Miles per customer ID. There is also a group wise sub-capping. We can transfer a maximum of 30,000 EDGE Miles cumulatively to partners in Group A and a maximum of 1.2 Lakh EDGE Miles to partners in Group B in a calendar year. This sub-capping makes it very difficult to plan a booking for more than 1 person. You can however hold multiple Axis or HDFC cards and then pool those miles into partner accounts.

Our favourites in this list would be KrisFlyer, Club ITC, Miles&Smiles, FlyingBlue, MileagePlus and Accor. For Marriott Bonvoy, Amex cards continue to be our preferred option.

| Group | Transfer Partner and Program | Conversion Rate EDGE Miles: Partner Miles |

|---|---|---|

| B | Air India: Flying Returns | 1:2 |

| A | Accor: ALL | 1:2 |

| B | Air Asia: airasia rewards | 1:2 |

| A | Air Canada: Aeroplan | 1:2 |

| B | Air France – KLM: Flying Blue | 1:2 |

| B | Air Vistara: Club Vistara | 1:2 |

| A | Ethiopian Airlines: ShebaMiles | 1:2 |

| A | Etihad Airways: Etihad Guest | 1:2 |

| B | IHG Hotels & Resorts: IHG One Rewards | 1:2 |

| B | ITC: Club ITC | 1:2 |

| A | Japan Airlines: JAL Mileage Bank | 1:2 |

| A | Marriott International: Marriott Bonvoy | 2:1 |

| B | Qantas Airways: Qantas Frequent Flyer | 1:2 |

| A | Singapore Airlines: KrisFlyer | 1:2 |

| B | SpiceJet: SpiceClub | 1:2 |

| A | Turkish Airlines: Miles&Smiles | 1:2 |

| A | Thai Airways: Royal Orchid Plus | 1:2 |

| A | United Airlines: United MileagePlus | 1:2 |

| A | Wyndham Hotels & Resorts: Wyndham Rewards | 1:2 |

If we use EDGE Miles to book on the Travel EDGE portal, the effective reward rate would be between 1% to 2% based on the tier. Hope more partners get added in the future which will make for a better value proposition.

Axis Atlas Key Benefits

| Benefit | Silver Tier | Gold Tier | Platinum Tier |

|---|---|---|---|

| Complimentary Airport Lounge Access – Domestic | 8 | 12 | 18 |

| Complimentary Airport Lounge Access – International | 4 | 6 | 12 |

- International Lounge Access on Axis Atlas credit card is via Dreamfolks.

- With the recent devaluation, Axis Atlas no longer gets airport transfers and meet & greet services.

Key Benefits and Charges

- Foreign Currency Markup: 3.5%+GST ~4.1%

- Fuel Surcharge Waiver: 1% waiver for transactions between Rs 400 and Rs 4000

Final Thoughts

Atlas is not a regular rewards card. So, it would not be right to compare it with the likes of Infinia. With the recent devaluation, it has become five times more difficult to accumulate miles. But, this is what used to be the normal miles earn rate before the ‘Axis Magnus era’. So, we can say things are quietly getting back to normal and card rewards are getting reasonable.

Atlas is still one of the best from Axis Bank’s credit card offerings especially if you are into airmiles. If you have the spends, you can still hold Atlas and other Axis/HDFC Bank credit cards to accumulate miles.

Frequently Asked Questions

No, transactions done on Gold/Jewellery, Rent, Wallet, Government Institutions, Insurance, Fuel and Utilities merchants are not eligible for milestone benefits.

Axis Bank Atlas Credit Card

Card Maven

35 thoughts on “Axis Bank Atlas Credit Card”

whole axis cards need an update due to huge devaluation, kindly update accordingly.

The review for Atlas is now updated. Others are in progress.

can I use atlas add-on to access lounge on domestic airport !

You can generate a QR code from Axis Bank app and use that.

Do fuel expenses contribute to milestone spends?

Yes

What is the reward rate on foreign currency transactions, is it same 2 EM per 100 or in case of foreign transactions it is 4 EM per 100

Same 2 EM/100

Do we get Atlas Edge miles for payment made on the Adda app towards Apartment maintenance changes. Adda charges a 2.7% charge on credit card payment and it doesn’t support Diner/Amex, so only option is VISA/Master and I don’t want to give it 2.7% unless I can get 2% back from the card and also move towards spend based benefits

Yes it should but is a hit or miss. If you don’t get it then it is a long follow up with customer care.

Is the reward structure same for Axis Atlas LTF variant as well?

As of now, yes from what others have reported

Hi. I have the atlas card with me. But I did not receive any card from dreamfolks for international lounge access. Do I need to talk to the customer service team to get one? I thought international lounge access was through the same card.

Atlas gets lounge access through QR codes that can be generated on the mobile app.

Are even Business and First Class Lounges accessible? For eg at DXB Ahlan Business and First Class Lounges are shown in the app? Do we get access to these or are there chances that the lounge staff may decline if you are traveling on economy tickets?

No, those are restricted to people travelling in business/first class.

Do we get rewards and milestone benefits for utility payments as well???

Yes, we do

Hi.

Does the card give reward points on government transactions like paying electricity bill through government website ?

And which card according to you is the best for such a transaction.

Thanks

Yes, it does.

Atlas also provides Edge miles while paying directly to HOTEL or booking HOTEL which is 5 miles per Rs 100. This needs an update.

Thank you Ashis. This is updated now. It was missed.

I am looking for a card to pay utility bill payments. My spend is more than 1lk rupees per month, if i get reward points on electric bill payments then using this card means 4% reward rate by far the best among all other cards. I just want to reconfirm that electric bill payments yield 2 points per 100 or not? I can achieve platinum tier also, does that mean 10k points for milestone and 10k for renewal?

Yes

Hi,

Can you elaborate on direct airlines/hotel spending. Does booking via OTA count as direct spending for Airlines and hotels?

No, only on the airline/hotel website.

I think this page needs a relook. The edge mile is actually 2%. That means with partner transfer, one can get 4% value back. Why its written that its 1% for other spends?

We missed that during the update. It is fixed now.

Hi

On Government spends like paying of Income Tax, are we eligible for 2 Edge Miles pe Rs. 100?

Yes, we do as of today.

Hi. I just received this card. I wanted to recheck if the miles earned on other spends are 2 miles per 100 Rs or 1 mile per 100 Rs. Also, will I receive miles if I pay rent with this card? I am not bothered about the milestone benefits for now.

2 miles per Rs 100

Yes, you should get it on rent too as there is no exclusion right now.

Hi Sachin

Did you get rewards for rent?

I tried applying for this card, but this card doesn’t show up. Is it gone live or not?

Launched but applications not open yet. It should be available in March 1st week for applying.