What are the chances that two leading credit card issuers use the same name for their cards? Here we have a brand name that both HDFC and Axis use, Diners Club Privilege and Axis Bank Privilege credit card. Axis Bank Privilege credit card is a mid-segment offering that comes at an annual fee of Rs 1500. The benefits on the Privilege credit card include complimentary domestic airport lounge access and a fuel surcharge waiver.

Fees

| Joining Fee | Rs 1500+GST ~Rs 1770 NIL for Priority customers |

| Welcome Benefit | 12500 EDGE RP ~Rs 2500 Value 6250 EDGE RP for Priority customers ~Rs 1250 Value |

| Annual Fee | Rs 1500+GST ~Rs 1770 |

| Renewal Benefit | 3000 EDGE Reward Points if fee is paid ~Rs 600 Value |

| Annual Fee Waiver | On spends of Rs 5 Lakh in a membership year excluding spends done on government services, utilities, gold/jewellery, rent, wallet, insurance, fuel and educational services |

Axis Bank has started excluding multiple categories like government services, utilities etc. from spends eligible to be included for annual fee waiver. This makes it a lot more difficult to get annual fee waiver.

Axis Bank Privilege Credit Card Rewards

| Spend Category | Rewards |

|---|---|

| Retail Spends | 10 EDGE RP/Rs 200 ~1% return |

| Rent, Wallet, Fuel, Insurance, Govt. Services, Utilities, Fuel, Education, Gold/Jewellery | No Rewards |

- 10 EDGE Reward Points for every Rs 200 spend ~1% to 2% return

While the base reward rate is low, we have Axis Bank Grab Deals to get a higher return on spending. The portal offers up extra cashback or bonus EDGE RP depending on the partner.

Milestone Benefit

Axis Bank has introduced a new milestone benefit on the Privilege credit card. This will be effective from 20th April 2024.

- Get 10,000 EDGE RP on spends of Rs 2.5 Lakh in a card anniversary year

- Value: Rs 2000 when redeemed for Amazon Pay or Flipkart GV

- Bonus Return: 0.8%

- Spends done on government services, utilities, gold/jewellery, rent, wallet, insurance, fuel and educational services will not be eligible for milestone benefit.

Rewards Redemption

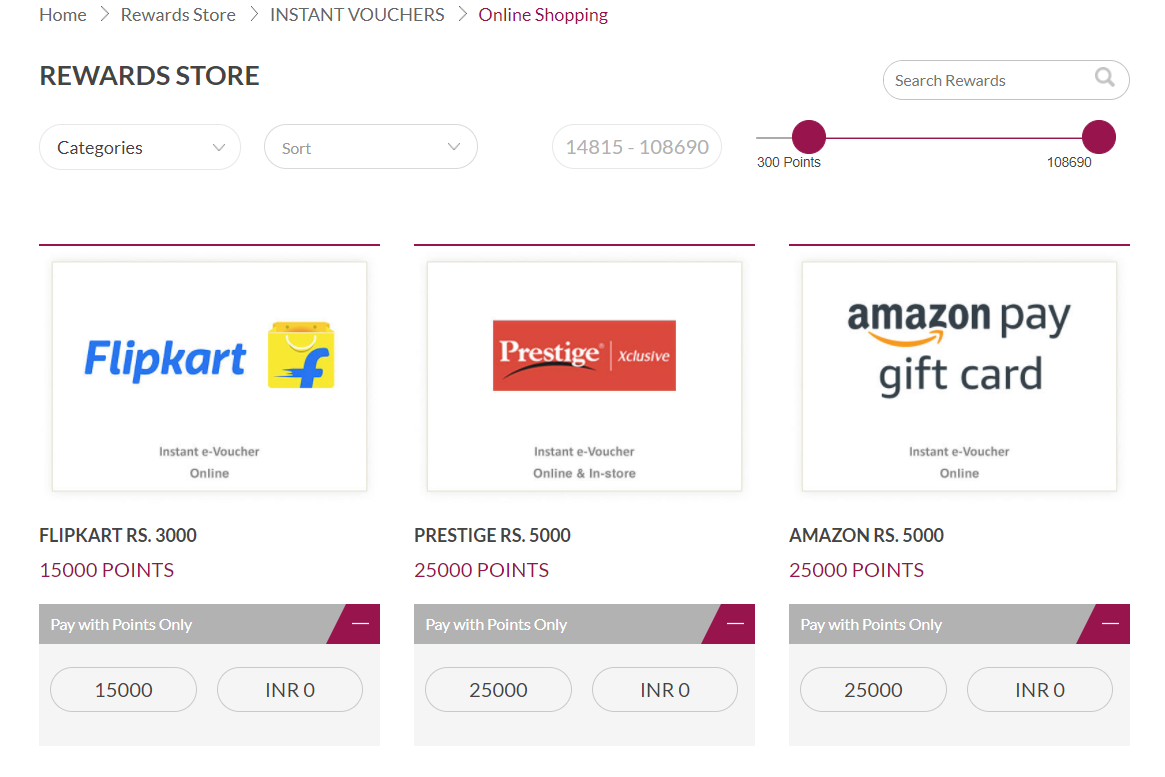

The rewards can be redeemed from the Axis Bank EDGE Rewards Portal. Each EDGE RP is worth Rs 20 paise for these redemption options. We have Amazon and Flipkart gift vouchers for redemption.

Effective 20th April 2024, multi-brand vouchers redemptions will not be available anymore.

Complimentary Airport Lounge Access

- Airport Lounge Access in India: 8 visits/year

- Airport Lounge Access outside India: Not Available

Axis Bank Privilege credit card offers 8 complimentary airport lounge visits in India per calendar year. So, if you are an occasional domestic traveller this card can help you with lounge access. The list of participating lounges is limited to a few cities – Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, and Pune. The details are available over here.

Axis Bank Privilege credit card has a minimum spends requirement to get complimentary airport lounge access. We now need spends of Rs 50,000 over a rolling period of last 3 calendar months to get complimentary airport lounge access. For example, if you need to access the airport lounge on 10th of March, then you should have spent Rs 50,000 in the period from 1st of December to 28th of February.

Other Benefits and Charges

- Fuel Surcharge Waiver: 1% waiver on transactions between Rs 400 and Rs 4000. Maximum fuel surcharge waiver of Rs 400 per statement cycle.

- Foreign Currency Transaction Charges: 3.5%+GST ~4.1%

- Finance Charges: 3.6% per month

Final Thoughts

Axis Bank Privilege credit card used to have an USP of multi-brand voucher redemptions. This option gave a value of 40 paise per EDGE RP giving us a better value for our spends. With the latest update, this benefit will not be available anymore.

The list of exclusions for getting rewards, milestone benefits and annual fee waiver make it a very difficult proposition for most of the customers. At the annual fee of Rs 1500, we would not suggest getting this card but instead go for cashback cards like SBI Cashback or Amazon Pay ICICI.

Frequently Asked Questions

No, spends done on government services, utilities, gold/jewellery, rent, wallet, insurance, fuel and educational services will not be included as eligible spends for calculating milestone spends.

No, spends done on government services, utilities, gold/jewellery, rent, wallet, insurance, fuel and educational services will not be included as eligible spends for annual fee waiver.

Axis Bank Privilege Credit Card

Card Maven

14 thoughts on “Axis Bank Privilege Credit Card”

As we know in miles transfer we got maximum value,

So can I transfer the earned (for New Card 12500 EDGE Reward Points+Other Earnings) EDGE Reward Points to ACCOR?

Yes, we can. You can even get Magnus and take advantage of the 5:4 transfer ratio.

I have Axis My Zone Card Currently and have offered to Upgrade to Axis Bank Privilege Credit Card.

What is the transfer ratio in Privilege Credit Card in ACCOR transfer?

If you are looking for a transfer to Accor, get Magnus. The value you will get will easily compensate the fee.

When it says 5X using grab deals so is this as good as 5% cashback of Flipkart cc ? What will be the end value for edge : money

This is already mentioned in the article under Rewards section.

Hi – Can we also buy Big Basket or Amazon pay gift voucher for redeeming welcome benefit of 12500 Edge RP (5000 rs voucher) for axis privilege?

Only valid on the multi brand vouchers listed in the review

Can you please explain in depth about Multi-Brand Voucher.

If I only wish to redeem for Myntra only from Multi-Brand Voucher list does it allow also what will be the value 20ps or 40ps.

Yes, you can redeem entirely for Myntra. It will be 40 paise per EDGE RP.

can you please confirm as per axis bank website Multi brand vouchers are Milestone Benefit so to earn 40ps for edge rewards points one need to spend 2.5lacs.

This is not mentioned in the above review.

Any EDGE RP earned on the Privilege card can be redeemed for multi-brand vouchers as long as you have enough EDGE RP.

You mentioned that we can combine points we get from Magnus to get higher value vouchers – so, does it mean that we can also move the points obtained from privilege and transfer them to airline miles via magnus?

Yes, it shows up as one account when we go to points transfer.