The 5:4 transfer ratio on Magnus was a big hit. So much that, it prompted Axis Bank to devalue it and re-launch it on an exclusive Burgundy variant. The Axis Bank Magnus Burgundy credit card is pretty similar to the normal Magnus with a few changes like a better transfer ratio and a higher points transfer cap. This credit card used to be offered as LTF to Burgundy customers but is now offered at an annual fee of Rs 30,000.

Axis Bank Burgundy Relationship Eligibility

To qualify for an Axis Bank Burgundy account, you need one of the below:

- Average Quarterly Balance(AQB) of Rs 10 Lakh in savings account

- Total Relationship Value(TRV) of Rs 30 Lakh including time deposits

- Total Relationship Value(TRV) of Rs 30 Lakh including time deposits and demat holdings

- Salary credit of Rs 3 Lakh per month

Fees

| Joining Fee | Rs 30,000+GST ~Rs 35400 |

| Welcome Benefit | Rs 5000 GV from Luxe, Postcard Hotels or Yatra GV |

| Annual Fee | Rs 30,000+GST ~Rs 35400 |

| Renewal Benefit | None |

| Annual Fee Waiver | Rs 25 Lakh spend excluding rent, wallet, government services, insurance, fuel, gold/jewellery and utilities |

Rewards

| Spend Category | Rewards | Reward Rate |

|---|---|---|

| Spends till Rs 1.5 Lakh in calendar month | 12 EDGE RP/Rs 200 | 1.2% – 4.8% |

| Travel EDGE (Cumulative transactions of up to Rs 2 Lakh in a calendar month) | 60 EDGE RP/Rs 200 | 6% – 24% |

| Incremental spends above Rs 1.5 Lakh in calendar month (AEP Benefit) | 35 EDGE RP/Rs 200 | 3.5% – 14% |

| Utilities, Government Services, Wallet, Insurance, Fuel, Gold/Jewellery | No Rewards | 0% |

- Milestone Benefit: The milestone benefit has been stopped effective 1st September 2023.

- Each EDGE Reward is worth 20 paise when redeemed for vouchers. But, points transfer to airline/hotel partners will yield a better value for your EDGE RP.

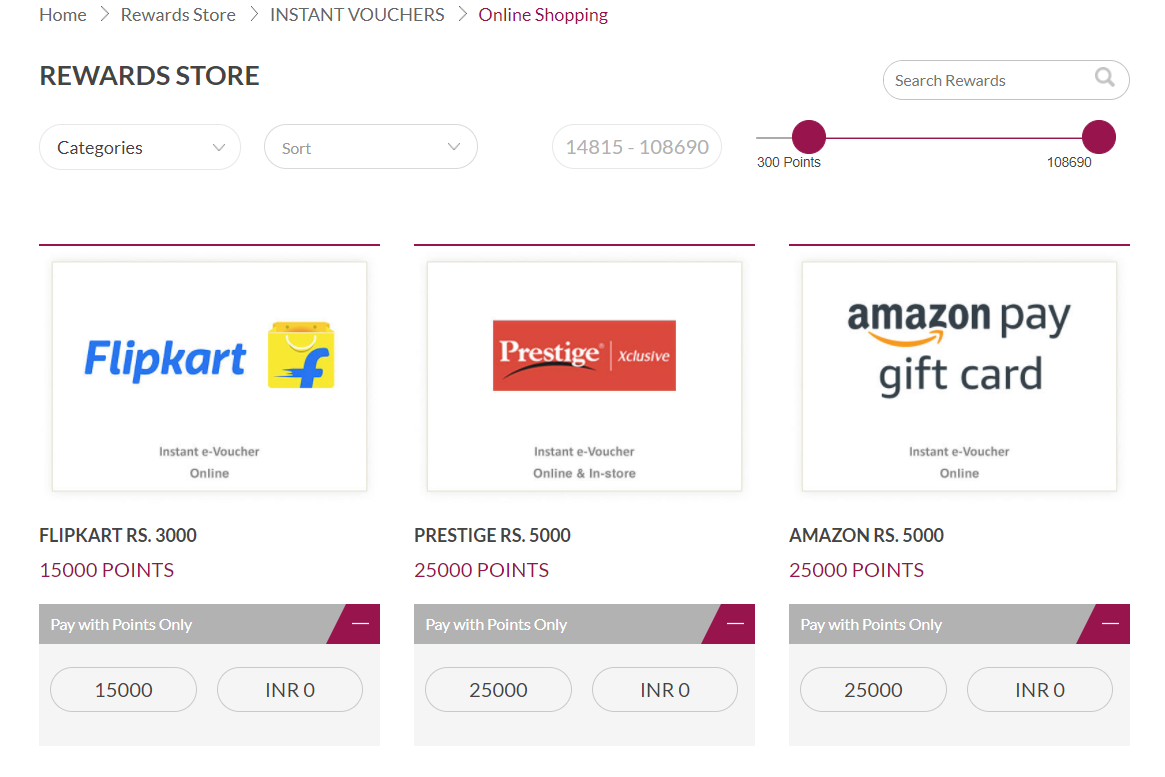

TRAVEL EDGE is Axis Bank’s version of HDFC Bank SmartBuy where we can book flights and hotels. Magnus gets 60 EDGE RP per Rs 200 for TRAVEL EDGE bookings. We also have Grab Deals for earning accelerated EDGE Rewards. Grab Deals is similar to HDFC Bank SmartBuy but comes with more merchants. We have Flipkart, Amazon, and Instant Vouchers where we can get higher rewards on transactions. Bonus EDGE reward points on Grab Deals are capped at 10000 EDGE RP/month.

Accelerated EDGE Reward Points (AEP) Benefit

With the new Magnus reward structure, Axis Bank has introduced a benefit of earning 35 EDGE RP/Rs 200 on incremental spends above Rs 1.5 Lakh in a calendar month. But, not all spends count towards this threshold of Rs 1.5 Lakh and that is what makes it a little bit complicated. To keep it brief, we will just mention the exclusions for this spend target below.

- Travel EDGE spends till Rs 2 Lakh spend in a calendar month are not eligible. Anything above that is eligible and earns 35 EDGE RP/Rs 200.

- Rent payments till Rs 50,000 are eligible

- Utilities, Government Institutions, Wallet, Insurance, Fuel, Gold/Jewellery spends are not eligible for AEP

- Gyftr/Grab Deals spends are not eligible for AEP

So, reaching that Rs 1.5 Lakh spend threshold may not be easy after all.

Axis Bank Magnus Burgundy Credit Card Rewards Redemption

EDGE Rewards can be redeemed from the Axis Bank EDGE REWARDS portal. We have different options including products, gift vouchers, and Airmiles transfers as well. Both Amazon and Flipkart gift vouchers are available. In all cases, the value for each EDGE reward is 20 paise.

- Amazon or Flipkart Gift Vouchers: 1 EDGE RP = 20 paise

Transfer Axis Bank Magnus Burgundy Credit Card EDGE RP to Airlines/Hotel Partners

Out of these transfer partners, Turkish Airlines (for Air India) and Vistara will be useful for domestic travel. At the new transfer ratio, we now earn 4.8% miles on transactions. While this is no where close to how the earlier reward rates were, it is still pretty good. This is even better if you have high spends as we earn 14% airmiles on spends above Rs 1.5 Lakh in a calendar month.

Total EDGE RP that can be transferred to partner points in a calendar year is capped to 10 Lakh per customer ID. There is also a group wise sub-capping. We can transfer a maximum of cumulative 2 Lakh EDGE RP to partners in Group A and a maximum of cumulative 8 Lakh EDGE RP to partners in Group B in a calendar year. You can however hold multiple Axis or HDFC cards and then pool those miles into partner accounts.

| Group | Transfer Partner and Program | Conversion Rate EDGE RP: Partner Miles |

|---|---|---|

| B | Air India: Flying Returns | 5:4 |

| A | Accor: ALL | 5:4 |

| B | Air Asia: airasia rewards | 5:4 |

| A | Air Canada: Aeroplan | 5:4 |

| B | Air France – KLM: Flying Blue | 5:4 |

| B | Air Vistara: Club Vistara | 5:4 |

| A | Ethiopian Airlines: ShebaMiles | 5:4 |

| A | Etihad Airways: Etihad Guest | 5:4 |

| B | IHG Hotels & Resorts: IHG One Rewards | 5:4 |

| B | ITC: Club ITC | 5:4 |

| A | Japan Airlines: JAL Mileage Bank | 5:4 |

| A | Marriott International: Marriott Bonvoy | 5:4 |

| B | Qantas Airways: Qantas Frequent Flyer | 5:4 |

| A | Singapore Airlines: KrisFlyer | 5:4 |

| B | SpiceJet: SpiceClub | 5:4 |

| A | Turkish Airlines: Miles&Smiles | 5:4 |

| A | Thai Airways: Royal Orchid Plus | 5:4 |

| A | United Airlines: United MileagePlus | 5:4 |

| A | Wyndham Hotels & Resorts: Wyndham Rewards | 5:4 |

Complimentary Airport Lounge Access

- Airport Lounge Access in India: Unlimited visits

- Airport Lounge Access outside India: Unlimited visits

Axis Bank Magnus Burgundy credit card customers get unlimited international lounge visits with Priority Pass. We also get 4 complimentary guest visits each for domestic and international. But the catch is there is no separate Priority Pass for add-ons like Infinia. The guest access is valid only if the primary card member is accompanying them. Unlimited domestic lounge access (for primary and add-on cardholders) is also available. The access is directly on the Axis Magnus credit card on this list of lounges.

We also have a minimum spends requirement to get complimentary airport lounge access. We now need spends of Rs 50,000 over a rolling period of last 3 calendar months to get complimentary airport lounge access. For example, if you need to access the airport lounge on 10th of March, then you should have spent Rs 50,000 in the period from 1st of December to 28th of February. This is where Axis Bank should have drawn the line. For someone fulfilling Burgundy requirements and a 30K annual fee credit card, airport lounge access has got to be complimentary!

Airport Meet & Greet

The regular Magnus does not get airport meet and greet anymore. But Magnus Burgundy still gets it, although with a reduced cap now.

We will now get 4 complimentary airport meet and greet services per calendar year. This is down from the previously offered 8 complimentary visits.

Complimentary EazyDiner Prime Membership

Axis Bank Magnus Burgundy credit card does not list down EazyDiner Prime membership as a benefit but we get it on this HNI card. EazyDiner Prime is a birthday benefit that was introduced on the Magnus in November 2022. We get the EazyDiner Prime membership automatically on the mobile number that is linked to our credit card around a week before the cardholder’s birthday date. So, if you log into EazyDiner with that mobile number, you will see the Prime membership. No activation code or email required.

EazyDiner Offer on Axis Bank Magnus Burgundy Credit Card

Axis Bank Magnus Burgundy credit card also gets access to the Dining Delights offers with EazyDiner.

- Get 40% off up to Rs 1000 at EazyDiner partner restaurants

- Valid once per card per month

Axis Bank Magnus Burgundy vs Axis Bank Magnus

While the core rewards and benefits stay the same, Magnus Burgundy has three changes over the regular Magnus:

- Points transfer ratio is 5:4 for Burgundy Magnus compared to 5:2 for normal Magnus

- Points transfer is capped at 10 Lakh EDGE RP for Burgundy Magnus compared to 5 Lakh EDGE RP for normal Magnus

- 4 complimentary airport meet and greet services in a calendar year

Final Thoughts

With the new reward rates and Gyftr multiplier devaluations, does the Magnus Burgundy still make sense? On the positive side, we can still earn an above average airmiles reward rate provided we have high spends. But spending more than Rs 1.5 Lakh may be difficult considering the multiple exclusions. Some of our high spend categories like insurance and utilities are now completely excluded.

Earning airmiles on spends has become a lot more difficult now. But considering the caps and restrictions from different issuers, we now need to diversify spends across multiple credit cards to earn airmiles. So, it would have to be a combination of Axis Atlas and Axis Magnus to earn both EDGE Miles and EDGE RP to consolidate and earn airmiles exceeding the caps. Remember that, the caps are separate for EDGE Miles and EDGE RP. With the new changes, not sure why Axis Bank needs to have an annual fee of Rs 30,000 without having a decent welcome or renewal benefit. Yes, the points transfer ratio and cap are higher but it is still not worth the 30K fee.

Axis Bank Magnus Burgundy Credit Card

Card Maven