Bank of Baroda issues credit cards through its wholly-owned NBFC arm – BoB Financial. While the rewards offered by most of its cards are on the lower side, Eterna is a little different. It is a premium credit card that offers good rewards for its segment. Below is a review of the Bank of Baroda Eterna credit card and its features/benefits.

Fees and Charges

| Joining Fee | Rs 2499+GST |

| Annual Fee | Rs 2499+GST |

| Joining Fee Waiver | Spend Rs 25000 within 60 days |

| Welcome Benefit | 10000 Bonus RP on Rs 50000 spends in first 60 days ~Rs 2500 Value 6 months FitPass Pro membership |

| Annual Fee Waiver | Spend Rs 2.5 Lakhs in a membership year |

If we spend Rs 50000 on BoB Eterna in the first 60 days, we get a joining fee waiver plus another Rs 2500 in reward points. Good welcome benefit!

Rewards

| Category | Reward Points | Value |

|---|---|---|

| Online Shopping, Dining, Travel and International | 5X Rewards i.e. 15 RP / Rs 100 *Max 5000 bonus RP per month * 3 RP/Rs 100 post the cap | 3.75% |

| Special MCCs | 1.5 RP / Rs 100 | 0.375% |

| All other spends | 3 RP / Rs 100 | 0.75% |

| Fuel | No Rewards |

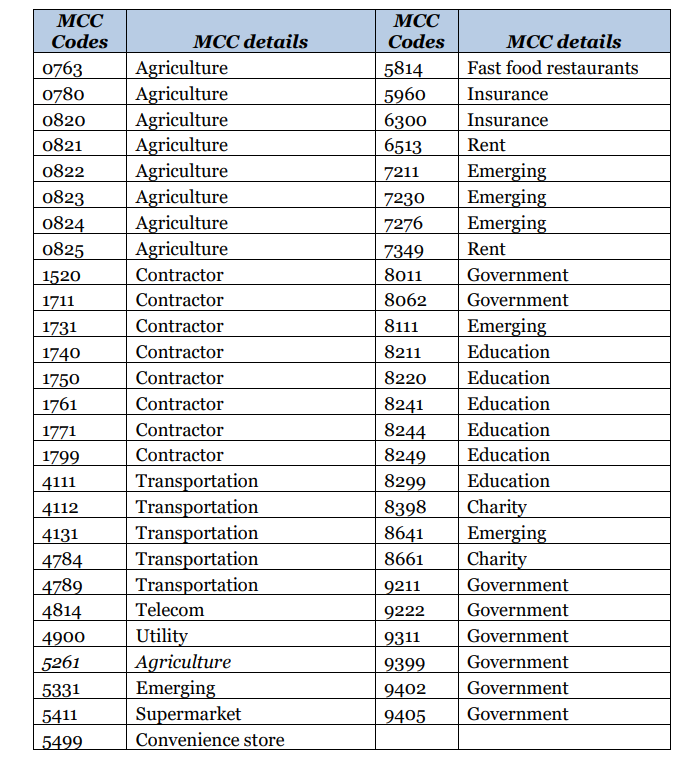

The special MCCs where we get lesser reward points include some high-spending categories like Rent, Insurance, Utilities, and Government Transactions. The below screenshot has the complete list. We used to get 3.75% on all online transactions earlier but this will not be the case going forward.

Milestone Rewards

- 10000 Bonus RP on spending Rs 50000 within the first 60 days ~ Rs 2500 Value

- 20000 Bonus RP on spending Rs 5 Lakhs in a year ~1% Return

With milestone rewards, the reward rate on online shopping comes to 4.75%.

Rewards Redemption

Each reward point is worth 25 paise. The reward points can be redeemed for cash back (statement credit). This is why the rewards have a higher value as it is all redeemable as cashback.

Complimentary Airport Lounge Access

Unlimited airport domestic lounge access stands out as one of the attractive benefits of the BoB Eterna credit card.

- Airport Lounge Access: Unlimited complimentary domestic lounge access ( Visa || Mastercard ).

- The complimentary airport lounge access is also valid for add-on cards.

Key Benefits

- Paytm Movies: Buy one and get one free up to Rs 250 once per month

- Fuel Surcharge Waiver: 1% fuel surcharge waiver on transactions between Rs 400 and Rs 5000 (Max. Rs. 250 per statement cycle)

- Forex Markup: Reduced forex markup at 2% for international transactions

Pros and Cons

Pros

- 3.75% cashback on online shopping, dining, travel, and international transactions

- Unlimited domestic lounge access at airports

- Reduced forex markup at 2% means we get effective 1.39% rewards on international transactions

Cons

- Special MCCs and other categories get a low return

- Customer support is not that good

Maximizing Rewards on Eterna Credit Card

This is where we find out how to get the maximum rewards possible on the Eterna. The ‘sweet’ spot is to spend Rs 41667 every month on eligible online transactions. By doing this we get:

- Maximum cap of bonus 4X rewards at 5000 RPs per month.

- 1250 RPs as 1X rewards.

- 20000 Bonus RPs for spending Rs 5 Lakh in a membership year.

- Total Return: 4.75% as cashback

Key Benefits

- Paytm Movies: Buy one and get one free up to Rs 250 once per month

- Fuel Surcharge Waiver: 1% fuel surcharge waiver on transactions between Rs.400 and Rs.5,000 (Max. Rs. 250 per statement cycle)

- Forex Markup: Reduced forex markup at 2% for international transactions

My Take

I tend to avoid credit card offerings from PSU banks as the rewards are not that great. But, Eterna is a decent offering. 4.75% cashback with milestone rewards is pretty good on online shopping. However, the low reward rate on other categories is far from ideal. And, now we have SBI Cashback which gets us 5% cashback on all online merchants with a higher cap as well. Considering a lower annual fee on SBI Cashback, Eterna seems to not have an edge in rewards anymore. But, Eterna has an advantage in unlimited complimentary domestic airport lounge access unlike SBI Cashback.

The other missing thing is customer support. It can be frustrating to deal with Eterna’s customer support.

FAQs

Email [email protected]. You will receive a response asking for income documents.

Bank of Baroda Eterna Credit Card

Card Maven

27 thoughts on “Bank of Baroda Eterna Credit Card”

What is is rewards you get on rent payment from BOB Eterna card? Need updated info.

Will EMI transactions be counted for milestone benefits?

Also, if I have a high ITR, do you think it will help to mail them asking to convert the card to LTF ?

Yes, the EMI transactions that fall within the membership year should still count for milestone benefits. But, better to reconfirm this with customer care.

Right now, there is no option to get it LTF based on ITR.

How do I specifically apply for the MasterCard variant of Eterna?

Not sure if they do that now. All new issuances are on Visa Infinite. But, you can try by emailing their customer care.

Do they issue Eterna LTF ?

I have BoB Premium which is issued LTF, if I ask for conversion to Eterna, will that be LTF as well ?

No, Eterna will be chargeable when you upgrade.

For getting Eterna as LTF, you need to have either a Rs 30 Lakhs ITR or be a BoB Radiance customer.

I got eterna Ltf. condition is You need Bob account, Itr of 12L+ and need to go to branch, do the tedious procedure by their lazy staff and get it as LTF.

You do have to wait for almost a month with multiple calls to their staff after which you will get it, but have to visit branch again to activate it.

Will the accelerated rewards at 3.75% be applicable for rent or property payments done online? Or is it applicable strictly for online shopping?

Accelerated rewards work fine for rent/property payments till now as reported by many readers.

That’s great!

do we get reward point on wallet load like paytm wallet load using Eterna CC ?

Do the add on card holders also enjoy unlimited domestic lounge access on eterna ?

Yes, they do! 🙂

So can i use the lounge access together on the same day same time with my family member/s if they have an add on card?

if yes how many add on members can avail this together??

Regarding the support you rightly said its almost non-existent.

Yes, add on cards have a different number.

We can get up to 3 add-on cards.

I mean if we have 2 addon

And we go to use the lounge, all 3 members can get acces with their cards?

Yes, we do

Hey, if possible could you let me know the validity of reward points? Welcome booklet mentioned “eternal (no expiry)”, customer support saying “financial year end”.

Don’t think it expires at end of FY. Customer support sometimes does not give the right info.

Anyways, better to accumulate as and when you have the points. It is cashback and there is no point of accumulating those.

Good to know. I asked them to re-check the same and still waiting for their reply.

This is mentioned in product official webpage

“Shop for more luxuries in life with Lifelong validity of reward points on your

Bank of Baroda ETERNA Credit Card”, anyway will confirm once I got the reply. Thanks

Can we switch to Eterna from premier ?

I received the bob premier card today. I wanted to know i can get Eterna instead of Premier.

I am not able to apply for eterna as I already hold premier

Is there way i can get eterna now , i am eligible as per their income requirement

also on side note do we get 2.5% on wallet load or just 0.5% on premier ?

Try emailing [email protected]

one more thing

Also can you please confirm if all the addon cards have a seperate limit of 5000 RP /month for 5x or it is combined to 5000/month across all cards (primary+ add on ) ?

Add-on cards do not have a separate limit for accelerated rewards.

I want to ask a question…. The 5x points… Those are credited in the same month or next month…. I did transaction on oyo… Which comes under travel… But only got normal points….

Yes, they are mostly posted only in the next month.