How about a debit card that offers zero forex markup, free international ATM withdrawals, up to 1% rewards on spends and 20% discount on Bigbasket? The feature packed IndusInd Exclusive debit card and savings account are one of the the premium offerings from IndusInd Bank. The best part is you can get IndusInd Exclusive as a zero balance account by holding the Pinnacle or Indulge credit card. This makes it a great deal for those holding either one of these credit cards. Here’s everything you need to know about IndusInd Exclusive debit card account and savings account.

Overview

| Balance Requirement | Zero with Pinnacle or Indulge credit card ~Starting Rs 1 Lakh for others |

| Debit Card | Mastercard World Exclusive Debit Card or Visa Signature Exclusive Debit Card |

| Debit Card Joining Fee | Zero |

| Debit Card Annual Fee | Zero |

IndusInd Exclusive Debit Card Rewards

The companion debit card for IndusInd Exclusive savings account is issued on both Visa and Mastercard payment networks. As long as your savings account is maintained as Exclusive, there are no joining or annual charges for the debit card. IndusInd Exclusive Debit card has a pretty good reward program for spends. We can earn up to 6 reward points per Rs 200 on our monthly spends with the earn rate going up as our spends accumulate. Points redemption is easy too, we can now use the IndusInd mobile app to encash the reward points for statement credit.

- Reward Rate: Up to 0.93%

- Value of 1 reward point: 35 paise

| Monthly Spends | Rewards |

|---|---|

| Up to Rs 5000 | 2 RP/Rs 200 |

| From Rs 5001 to Rs 10,000 | 3 RP/Rs 200 |

| From Rs 10,001 to Rs 20,000 | 4 RP/Rs 200 |

| From Rs 20,001 to Rs 40,000 | 5 RP/Rs 200 |

| Above Rs 40,000 | 6 RP/Rs 200 |

The total reward points you can earn on Exclusive DC is capped at 3000 per calendar month. To hit this cap, you need to spend Rs 1,12,500. Here is how the rewards work out for that amount:

- Up to Rs 5000: 50 points

- From Rs 5001 to Rs 10,000: 75 points

- From Rs 10,001 to Rs 20,000: 200 points

- From Rs 20,001 to Rs 40,000: 500 points

- From Rs 40,000 to Rs 1,12,500: 2175 points

For low spends, the rewards are not great but it is very much worth it if you cross 1L spends. The rewards are valid for all spends except the below categories. If you are disappointed by seeing credit card bill payments in this list, no need to worry. It still works even though things keep changing. Keep a tab on the forum thread to know the latest updates. 🙂

- Mutual Funds & other Investments, Insurance, Fund Transfers, and Payment to Government

- Fuel, credit card bill payments and wallet loads

Zero Forex Markup on International Transactions

The USP of IndusInd Exclusive debit card is the zero forex markup on all international transactions and ATM withdrawals. You also get up to 0.93% rewards along with this zero markup on international transactions. This makes it a worthwhile debit card to have unless you have some other credit/debit card that offers this benefit.

We also get unlimited free ATM withdrawals in and outside India too. Now, you know why we like the Exclusive debit card 🙂

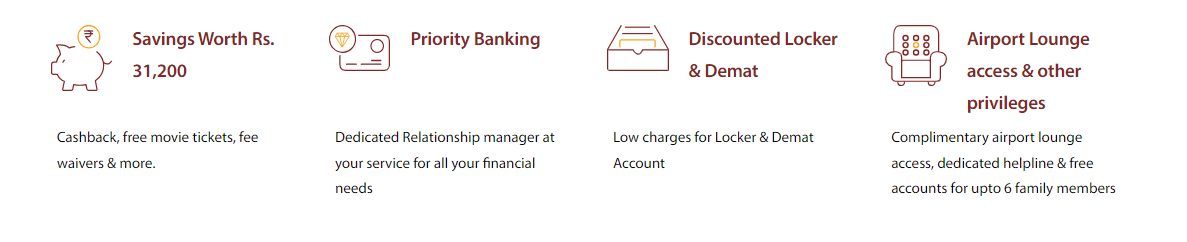

IndusInd Exclusive Savings Account Benefits

Get 6 Free Zero Balance Accounts for Family

We can get up to 6 zero balance accounts and group them as a family account. This is a great benefit as all 6 accounts get access to the same Exclusive account and debit card. If your family members already have an IndusInd savings account, you can also choose to group them under your accounts by signing a grouping form at the branch. Once this is done, their accounts also get converted to Exclusive.

Discounted Locker and Demat Fee Waiver

You get a small/medium locker free for Year 1 and 50% off on locker fee from Year 2 onwards. We also get an AMC waiver on demat accounts for 2 years.

IndusInd Exclusive Debit Card BookMyShow Offer

IndusInd Exclusive debit card also gets one of the best offers on BookMyShow.

- Buy 1 Get 1 Movie ticket offer on BookMyShow

- Get up to 3 tickets free in a calendar quarter, worth up to Rs 500 each

- This is a quota based offer

IndusInd Exclusive Debit Card bigbasket Offer

Another key benefit on the IndusInd Exclusive debit card is its bigbasket offer. We can get 20% off up to Rs 500 from the 1st to 25th of every month. This offer is valid once per card per month. You can double dip this with Tata Neu app Payday sale offers to get bonus NeuCoins too making it an even better deal.

Final Thoughts

If you hold the Pinnacle or Indulge credit card, getting the companion Exclusive savings account is a no-brainer. The debit card is loaded with benefits like the Bigbasket 20% discount offer, zero forex markup and the 6X rewards program.

The only caveat is not many local branches are aware about this benefit. For this, you can show them the Exclusive account schedule of charges which clearly mentions the credit card as one of the criteria to get a zero balance account.

4 thoughts on “IndusInd Exclusive Debit Card & Savings Account”

I have been maintaining a 1lac balance SB account to access this card for the past 4 years? What happens if the AC balance goes below 1lac? Are there are penalties?

Yes, you will be charged non-maintenance charges.

How to get, or upgrade to Pinnacle LTF? I have Legend & Platinum Rupay credit card LTF.

It is possible only if customer care/RM gives you the offer.