Continuing our series on rewarding debit cards, here is the another one in the list – RBL Signature Plus debit card. It is a standalone offering that you can get with any RBL savings account. There is no AMB criteria to be maintained for getting this card either. The RBL Signature Plus debit card has a joining fee of Rs 5000+GST and annual fee of Rs 1500+GST. The renewal fee is waived on spends of Rs 3 lakh in a year. But, why spend so much for a debit card when we have so many rewarding credit cards for the same fee? Let’s check it out!

How to get the RBL Signature+ Debit Card?

You can get the RBL Signature+ debit card with any RBL savings account. If you have one, go to the RBL MoBank mobile banking app and request for an upgrade of debit card. You will see Signature+ as one of the options.

If you do not already have a RBL bank account, then you can open an account online with VKYC. The entire process with Aadhaar authentication takes less than 30 minutes. During the account opening, choose virtual debit card as the option. It has zero charges. After the account is opened, go for a debit card upgrade to Signature+.

Fees

| Joining Fee | Rs 5000+GST ~Rs 5900 |

| Welcome Benefit | Rs 5000 Gift Voucher |

| Annual Fee | Rs 1500+GST ~Rs 1770 |

| Annual Fee Waiver | On Rs 3 Lakh spends in a year |

The joining fee will be immediately debited upon applying for the debit card and you will be able to see the virtual debit card in the MoBank app.

Hands-on Experience: Redeeming the welcome benefit

In our case, we did not receive an email notification to redeem the welcome benefit. But RBL Bank did send a SMS with the redemption link. You can redeem it on Gyftr after around 30 days of getting the debit card. The redemption portal has multiple options including Amazon Pay GV. Considering the welcome benefit, the effective joining fee for RBL Signature+ debit card is Rs 900.

Rewards

| All Spends | 1% value back |

| Maximum Cashback | Rs 1000 per calendar month |

| Minimum Spends for Cashback | Rs 10,000 per calendar month |

| Milestone Benefit | Rs 5000 GV on spending Rs 5 Lakh in a year |

There are no exclusions on the cashback categories. You can spend anywhere including wallet loads and credit card bill payments. So, this is one of the ways you can get rewards for credit card bill payments using platforms like Paytm, CRED or CheQ.

Return on Spends

To get the maximum possible cashback on the RBL Signature Plus debit card, we need to spend Rs 5 Lakh per year. On this spend we get:

- 1% cashback as regular rewards

- 1% cashback as milestone benefit

- Annual fee waiver for the debit card

We can of course spend much more than that but we get only the regular 1% value back on that up to Rs 1 Lakh per calendar month. This is a rather sweet way to get some extra returns on your credit card bill payments which you would have anyways done.

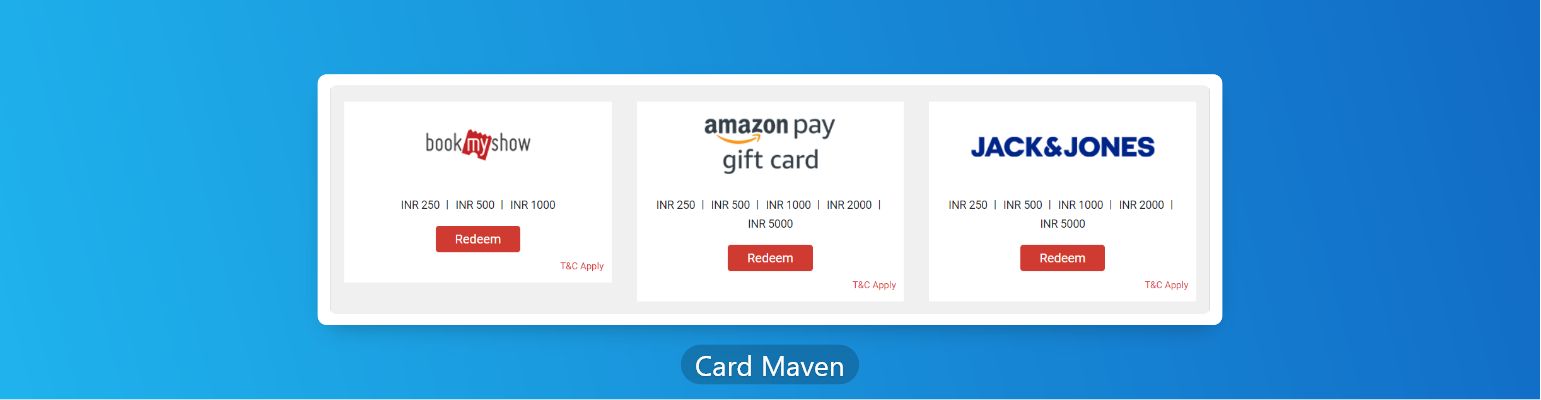

Redemption Options

RBL Bank uses the the Gyftr portal for redeeming debit card rewards. Each point is equal to Rs 1. We get access to most of the brands including Amazon Pay, Flipkart, Croma, Myntra and more.

Complimentary Airport Lounge Access

RBL Signature Plus debit card also offers complimentary airport lounge access in India. There are no minimum spend requirements for getting the access.

- Domestic Airport Lounge Access: 2 complimentary visits/quarter to domestic airport lounges

- International Airport Lounge Access: Not Available

Check out the list of eligible lounges for RBL Signature Plus debit cards issued on Visa and Mastercard.

Zero Forex Markup on RBL Signature Plus Debit Card

While we are impressed by the rewards and airport lounge access, the Signature+ debit card does another USP too. It offers zero forex markup on international transactions!. If you ever need to use a DC for international transaction, this is one of the options.

The zero forex markup is not applicable on international ATM withdrawals. So, do not try it out as you will be charged a 3.5% markup.

Final Thoughts

RBL Signature Plus debit card is one of the most rewarding options today. In the past, we have already covered quite a few debit card including HDFC Platinum, HDFC Millennia and IndusInd Exclusive. While the joining fee is high, it is compensated with the Amazon Pay GV making the effective outgo Rs 900. From second year onwards, the spends will make it a free card with the annual fee waiver.