Following the success of the co-branded EazyDiner IndusInd Bank credit card, EazyDiner is back with a co-branded LTF credit card. With the new EazyDiner IndusInd Bank Platinum credit card, you won’t have to pay any fees to enjoy EazyDiner benefits. We receive 3 months of EazyDiner Prime membership as a welcome benefit. The EazyDiner IndusInd Bank Platinum credit card will give you 20% off at partner restaurants up to Rs 500 a month. Here is everything you need to know about this new LTF card.

Fees

| Joining Fee | LTF |

| Welcome Benefit | 3 months EazyDiner Prime Membership 500 EazyPoints |

| Annual Fee | LTF |

If you have a credit limit over Rs 30,000, head over to this EazyDiner IndusInd portal to split your card limit and get the EazyDiner card.

Complimentary EazyDiner Prime for 3 months

We get a 3 months membership of EazyDiner Prime as a welcome benefit. This membership gets renewed upon spends of Rs 30,000 in 90 days (calendar quarter). All spends are eligible to get this benefit. EazyDiner Prime comes with the below benefits.

- Get 25% to 50% discount up to Rs 3000 at select bars and restaurants

- 2X EazyPoints on meals

- 500 EazyPoints

EazyDiner IndusInd Bank Platinum Credit Card Rewards

| Spend Category | Rewards |

|---|---|

| Retail Spends | 2 RP/Rs 100 |

| Insurance, Rent, Utility and Government | 0.7 RP/Rs 100 |

| Fuel Spends | No Rewards |

While the rewards might seem low, the USP of this card is in the benefits that you get every time you dine out with EazyDiner.

Milestone Benefits

We get 2000 reward points on spends of Rs 30000 in 90 days. This is not counted as per calendar quarter but on a rolling basis. Spends on dining transactions are not considered for this benefit. We don’t see anyone using this card for non EazyDiner transactions, so this milestone benefit will be of little use.

Savings on dining out with EazyDiner IndusInd Bank Platinum Credit Card

We get an extra 20% discount up to Rs 500 on all PayEazy restaurants. This benefit can be used for maximum 3 times in a calendar month. PayEazy is EazyDiner’s in-app payment for restaurant bills. This 20% discount is over and above the discount that the EazyDiner Prime membership offers you at the restaurant.

Extra 20% off will not be applicable if consecutive transactions are made at the same restaurant within the gap of 120 minutes or less. For dining bills of Rs 2500 or lower, this benefit is better than the 10% offered by DCB and 15% offered by Infinia on DineOut.

What are EazyPoints?

EazyPoints are EazyDiner’s reward currency. We earn EazyPoints for the below eligible activities for the EazyDiner app. With the 2X EazyPoints benefit, we get bonus points per activity.

- Download and Register on the EazyDiner app: 200 points

- Book a table: 50 points (2X EazyPoints with the Prime membership)

- Buy a QSR deal: 10 points

- Order food online: 25 points

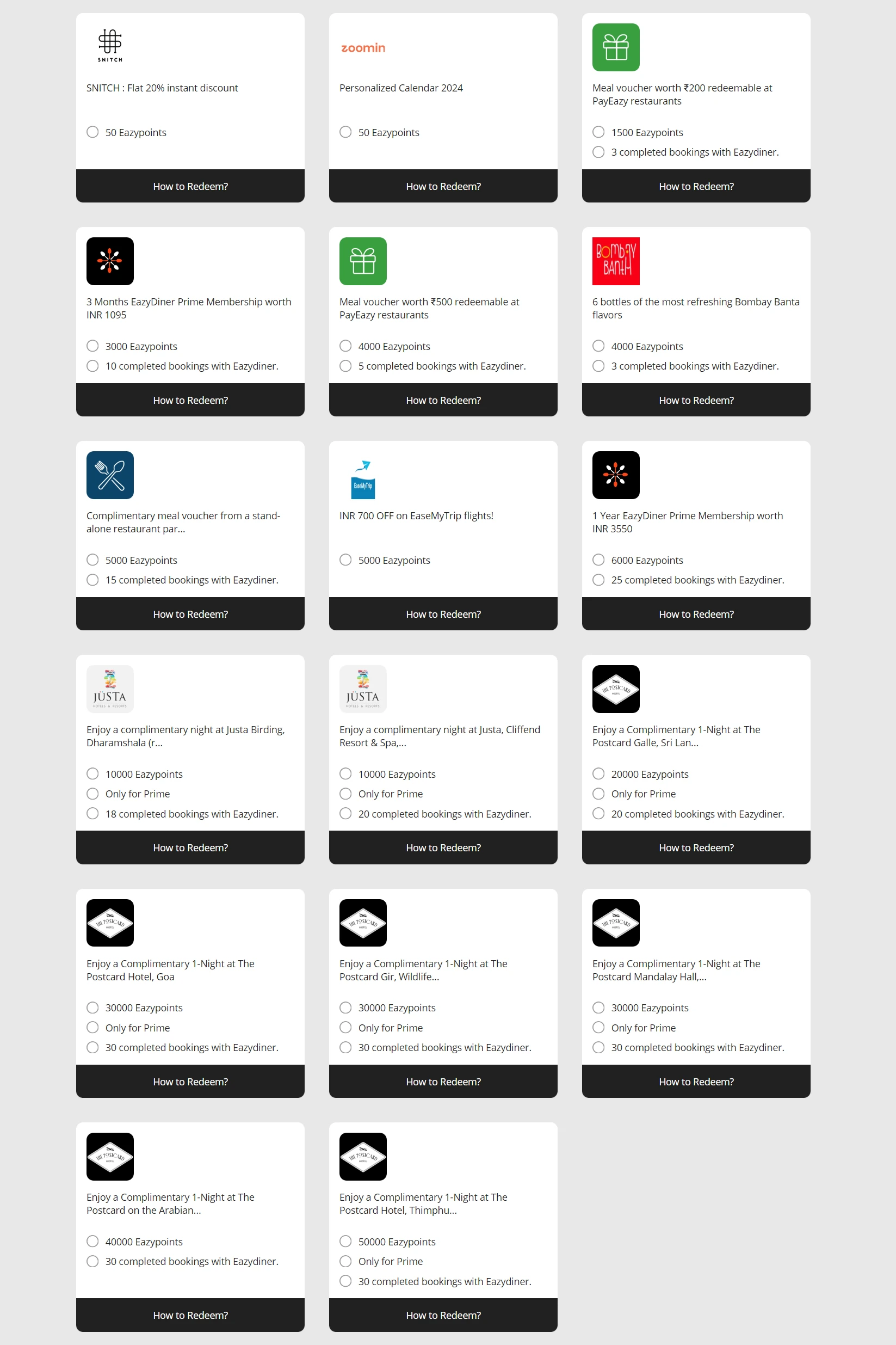

Earning EazyPoints is quite tough with these earn rates. The redemption options include meal vouchers, complimentary meals or Postcard hotel stays. But, these redemptions will not be easy considering the required EazyPoints. For example, a 1 year EazyDiner Prime membership costs 6000 EazyPoints. To earn 6000 EazyPoints, you need to make 120 bookings on EazyDiner app! Also, EazyPoints cannot be used for dining payments.

Rewards Redemption

Reward points earned on transactions can only be used against dining bills. There is no cash redemption. The accumulated reward points expire at the end of each anniversary year. The value of each reward point is 20 paise.

Complimentary Airport Lounge Access

- Domestic Airport Lounge Access: Not Available

- International Airport Lounge Access: Not Available

Other Key Benefits & Charges

- Fuel Surcharge Waiver: Get 1% waiver for transactions between Rs 400 to Rs 4000

Should you get the EazyDiner IndusInd Bank Platinum credit card?

While the card benefits are good, it will not be a good fit for everyone. EazyDiner has restaurant partners in very few cities. So, do some kind of checks at the restaurants you plan to dine in to see if the EazyDiner card is going to help you.

If the annual fee option of the EazyDiner Signature card was holding you back, then this is an ideal option as you will get it LTF. For an LTF card, the 20% savings on dining are pretty good too! We can get EazyDiner Prime membership benefit on few other credit cards too, so the 3 months EazyDiner Prime membership is not an issue.

EazyDiner IndusInd Bank Platinum Credit Card

Card Maven