Cashback credit cards are simple. Spend, get cashback and redeem it for statement credit. No need to worry about planning and redeeming miles. That’s why cashback credit cards are quite popular. If you are looking for the best cashback credit cards that give you the best return for spends, here is a list. We have compiled a list of the best cashback credit cards in India across different annual fees and categories.

This list of best cashback credit cards also includes cards that offer reward points that are equivalent to cashback.

Best Cashback Credit Cards: Lifetime Free

Amazon Pay ICICI Bank Credit Card

Amazon Pay ICICI Bank credit card is probably the most underrated option in the Indian credit card market. It provides you 1% rewards on all spends except fuel. But, the USP is the 5% cashback on Amazon purchases for Prime members.

Best Cashback Credit Cards: Less than ₹ 1000 annual fee

SBI Cashback Credit Card

SBI Cashback is the table topper when it comes to cashback on online spends. It gives you 5% cashback on most of the online shopping spends across all merchants like Flipkart, Amazon and Myntra. Out of all cashback credit cards, this is the best for online spends. Just remember not to use it for spends in categories for education, fuel, jewellery, insurance, rent, utilities and wallets. You will not get any cashback on those spends.

HSBC Cashback Credit Card

HSBC Cashback credit card is a hidden gem among cashback credit cards. The USP of the card is the 10% cashback offered on any dining, food delivery or grocery spends. Swiggy, Zomato, BigBasket and more are eligible for this cashback.

Standard Chartered Smart Credit Card

Standard Chartered Smart credit card offers just 1% or 2% cashback on spends. But its USP is that it does not any exclusions except fuel where cashback is not applicable. Be it wallets, insurance or utility payments, you get cashback.

Airtel Axis Bank Credit Card

Airtel Axis Bank credit card is another underrated cashback credit card. It gives you up to 25% cashback on Airtel spends and 10% cashback on utility bill payments. The Airtel Axis Bank credit card will not give you any cashback for spends in categories for education, fuel, jewellery, government payments, insurance, rent and wallets.

Axis Bank Ace Credit Card

Axis Bank Ace credit card is not the cashback master it used to be but is still a good option for offline spends. It gives 2% uncapped cashback on any offline spends. The Axis Bank Ace credit card will not give you any cashback for spends in categories for education, fuel, jewellery, government payments, insurance, rent and wallets.

- Joining Fee: ₹ 499+GST

- Annual Fee: ₹ 499+GST

- Cashback: 2% to 5%

- Best Use: 2% unlimited cashback on offline spends

- Airport Lounge Access: 8 visits/year to airport lounges within India

- Con: You need a Google Pay invite to get this card.

HDFC Bank Millennia Credit Card

HDFC Bank Millennia credit card may appear to be not so rewarding option in this list but SmartBuy changes the game. We can buy multiple gift vouchers on SmartBuy Gyftr at 5% cashback. This brings Millennia closer to what SBI Cashback does – 5% cashback on most spends.

Flipkart Axis Bank Credit Card

Flipkart Axis Bank credit card is the equivalent of Amazon Pay ICICI Bank credit card for Flipkart spends. We get 1.5% cashback on offline spends which makes it the next best option after Axis Ace. The Flipkart Axis Bank credit card will not give you any cashback for spends in categories for education, fuel, jewellery, government payments, insurance, rent and wallets.

Swiggy HDFC Bank Credit Card

Swiggy HDFC Bank credit card is another excellent option that gives you reward points equivalent to cashback. The rewards get accumulated in your Swiggy wallet and can be used for any spends on Swiggy. The Swiggy HDFC Bank credit card will not give you any cashback for spends in categories for fuel, jewellery, government payments, insurance, rent, utilities and wallets.

Best Cashback Credit Cards: More than ₹ 1000 annual fee

Tata Neu Infinity Credit Card

Tata Neu Infinity is not exactly a cashback credit card but with 1 NeuCoin = Rs 1, it is a pretty good option as a cashback equivalent card. This is the best cashback credit card for spends on Tata Neu app like BigBasket, 1Mg etc.

- Joining Fee: FYF/LTF/₹ 1499+GST

- Annual Fee: LTF/₹ 1499+GST

- Cashback: 1.5% to 5%

- Best Use: 5% NeuCoins on Tata Neu partner spends

- Airport Lounge Access: 8 visits/year to airport lounges within India and 4 visits/year to airport lounges outside India

- Con: NeuCoins can only be redeemed on Tata Neu app

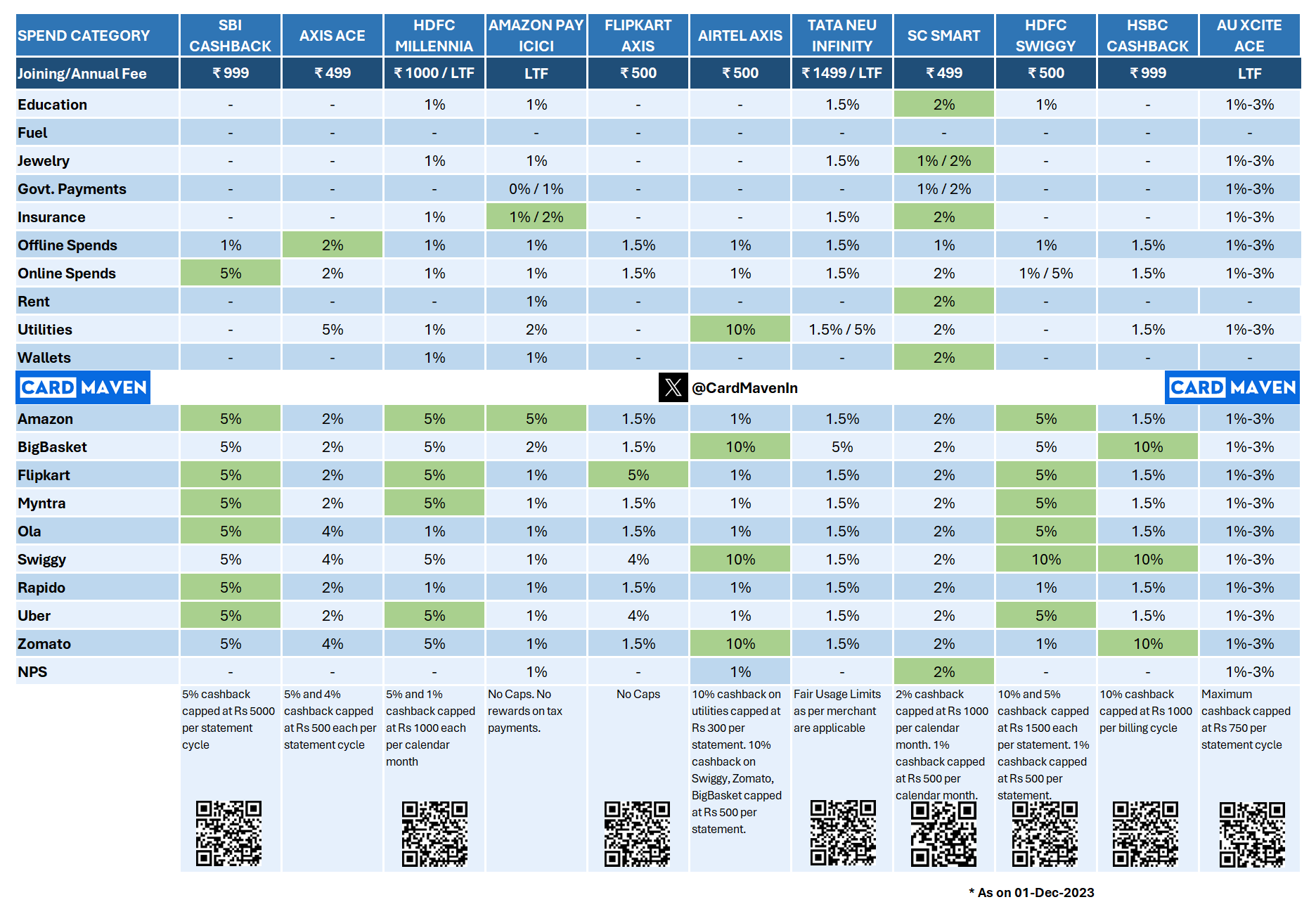

Cashback Credit Card Comparison

If you have multiple cashback credit cards, it can be difficult to identify the best one for a transaction. We have prepared a handy chart to help you identify the best cashback credit cards for each spend category in the below chart.